Gold Price Per Ounce

View the live gold price on the chart below, populated with data from the Kinesis Exchange. Our bespoke charts allow you to view live data on the gold price per gram, with multiple time frames available.

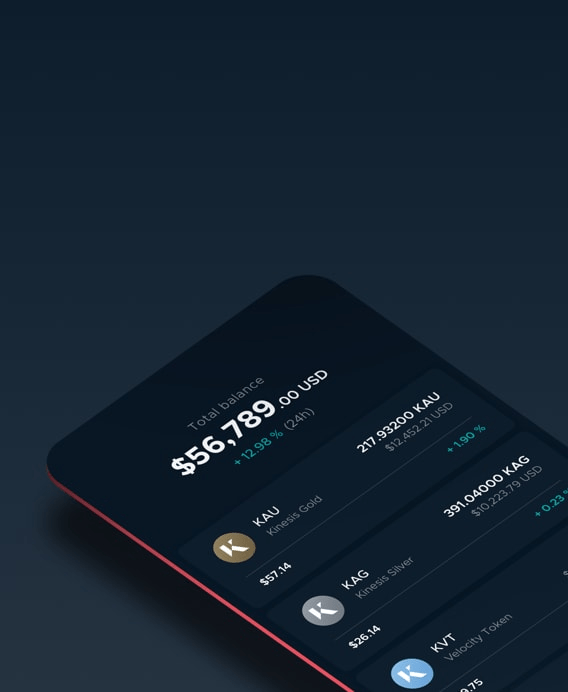

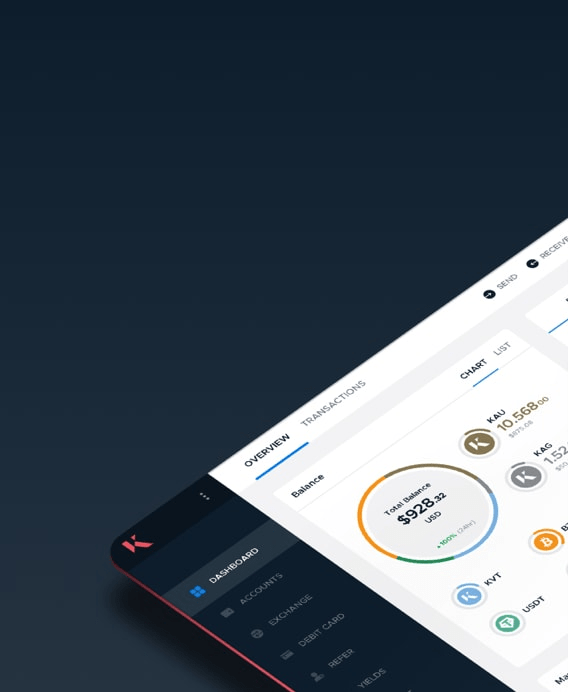

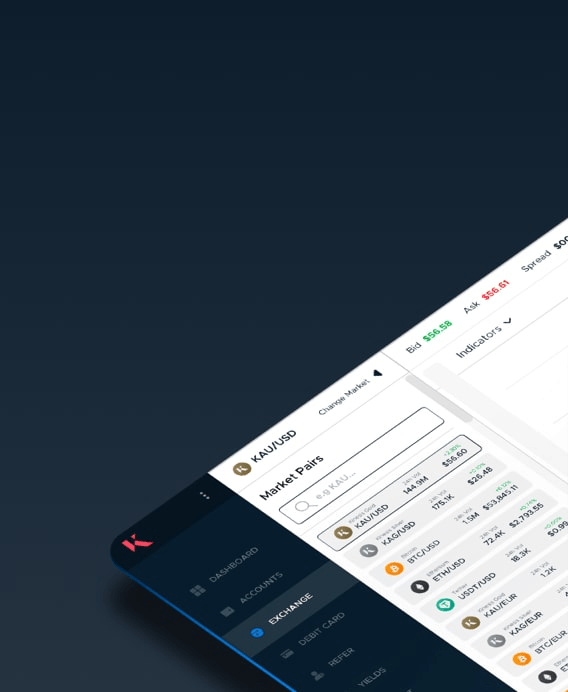

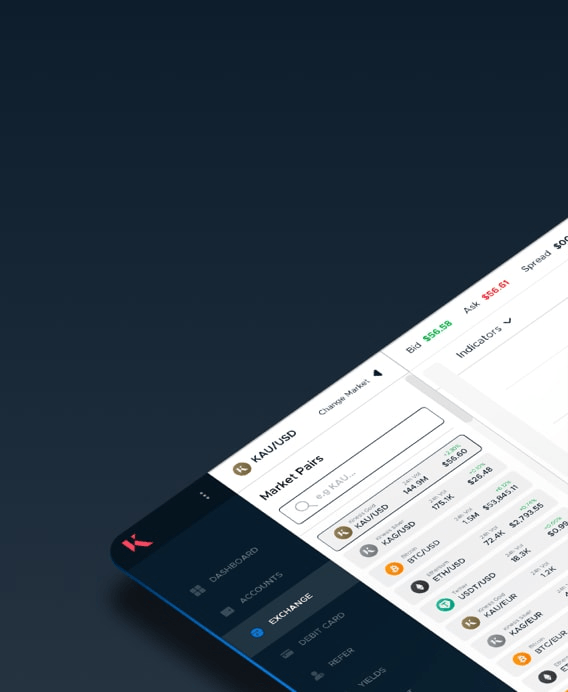

With Kinesis, you can purchase physical gold bullion at these live prices on our online platform and app.

Historic Gold Price

| Yesterday | Last Week | Last Year | |

| Gold Price (Ounce) |

Updated with live market data from the Kinesis Exchange

Live gold prices are aggregated across our physical vaulting hubs in London, New York, Brisbane, Sydney, Toronto, Hong Kong, Dubai, Istanbul, Vaduz, Panama City, Zurich, Batam and Singapore.

What is a Troy Ounce of Gold?

A troy ounce of gold is a standard system of weight measurement that dates to medieval times and is based on pounds and ounces. One troy ounce is equivalent to 32.151 grams in the metric system of grams and kilograms.

In the UK, there is another system of pounds and ounce measurement called the avoirdupois system whereby one avoirdupois ounce is 28.35 grams. In Anglo-Norman French avoirdupois means ‘goods of weight’. Other systems exist around the world.

For precious metals, the troy ounce, though a little heavier than avoirdupois, is the standard measurement in the US and UK, and is still used in modern times.

Gold Price per Ounce FAQ

When was gold worth $35 an ounce?

Gold prices were at $35 per troy ounce from 1940 until the 1970s. In 1944, the Bretton Woods Agreement tied the gold price to the US dollar, as a legislative measure that aimed to facilitate international trade. This agreement was lifted in 1971 by President Nixon.

Has the price of gold increased?

In March 2023, gold prices traded at around $1,913 per troy ounce, which is equivalent to an increase of more than 5000% from the levels seen in the 1940-70s when they were circa $35 per troy ounce.

Is the gold price up or down?

The gold price experiences a certain level of fluctuation day-to-day, as well as year-on-year.

It can rise and fall depending on a variety of factors, such as increased inflation and the relative strength of the US dollar. In its current state, many analysts have argued that gold could be considered undervalued at present.

Will gold prices fall?

In the long-term, gold has been steadily appreciating in value, which is why investors often turn to the precious metals as an inflation hedge, rather than fiat currency. In the short-term, the gold price may fall, but the longer term, the gold market value is considered to be relatively stable.

Latest Gold Articles

Keep up to date with the latest news in gold.

Latest Gold Articles

Keep up to date with the latest news in gold.

Gold Hits Record Highs Rising with the…

Over the last six weeks, gold and the US dollar…

How Do Central Banks Impact Precious Metal…

Central bank buying has been an important factor behind the…

Why are gold and silver soaring?

Several people have asked me my thoughts on what is…