There is light at the end of the tunnel.

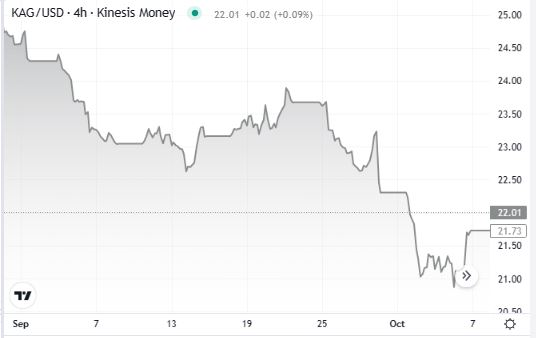

The silver price closed last week posting a significant rebound to $21.6 an ounce. This positive impulse has been confirmed in the early trading today, with the precious metal extending its recovery to $21.85.

At the moment, silver is trading over one dollar per ounce above the low reached twice last week, with the price trying to come back to the former support zones of 22.2 and 22.5 (which have now become resistance levels).

The current rebound can be seen as the result of different factors. The slowdown of the greenback seen on Friday on the Forex Market reduced the bearish pressure on silver, while growing tensions are forcing investors to focus their attention on precious metals (as safe-haven assets). Moreover, the recent decline seemed too quick, with silver losing 15% in just 5 weeks, generating – from a graphical point of view – an oversold situation.

We should point out that the current rebound does not yet necessarily represent a long-term inversion. Moreover, it seems relatively easy to predict that silver could return under pressure until investors do not understand clearly that the Fed funds peak has been reached. Some help, in this direction, could come from the next macroeconomic data. Particularly, the FOMC Meeting Minutes (released Wednesday evening) will be announced this week and the CPI figures for September (Thursday).

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.