Preserving the use of cash at first seems like a project doomed to fail, and one that exists in opposition to the progressive, accelerating use of digital currencies, such as crypto.

So, who is it that’s seeking to prevent the supposed “death” of cash?

You would be surprised to know that it’s not just traditionalists or technological Luddites, but there are many with diverse agendas determined to keep their cash firmly in hand.

In this article, we explore the beginnings of money, its evolution and whether cash will survive in the wake of fintech, and digitised monetary solutions.

The Beginning of Money

Before the existence of money, the bartering system was firmly in place. This system of trade worked if both parties were interested in exchanging for what the other had to offer. While this clearly functioned well when individuals were trading like for like (i.e apples for oranges), this didn’t work if one party clearly benefited more than the other.

Replacing the bartering system, came with the intention to overcome this issue. As a result, the idea of commodity money was born, in which the valuation of money was determined by the commodity it was made from.

Commodities like precious metals, acted as the monetary solution for a time, being an effective store of value and unit of account. However, the numerous qualities of physical gold or silver, for example, were greatly outweighed by a major quality inherent to money: its portability.

As a physical bar or coin, it was not practical nor logical to trade gold in this way, especially when making frequent daily trades. This signalled the need for an alternative – although, as we will uncover, one which carries significant flaws.

Paper Money Was Born

The normative system of money that currently operates today is known as representative money, in which money is just that: a representation of value that is universally accepted by all who use it. It began with certification issued by a central authority, which enabled the exchange of a ‘note’ for commodities, such as gold or silver.

China was the first known country to begin issuing IOU certificates on paper for trading on a global scale. This category of money is also known as “fiat currency”, which would set the tone for the current banking model.

Banking became mainstream in the 19th century, and more specifically fractional reserve banking – a protocol on which most developed nations operate. This protocol dictated that banks only need to keep a small portion of the money they issued, and the rest could be issued via loans, for example.

However, the major pitfalls of the fiat system came to light most recently during the 2007-8 financial crisis, which created shockwaves still felt today. After excessive lending, governments had to borrow billions of taxpayers’ money to bail out the banks, which increased the total supply of fiat money, and led to their overall depreciation in value.

What’s more, this crisis was enabled by the fact that the dollar, at the heart of the crisis, was not tied to any commodity, and hence, held no intrinsic value. Prior to the crash, Nixon saw an end to the gold standard in 1973, which meant that American citizens could no longer trade their dollars for gold bullion.

From this moment onwards, the world continued trading in dollars (USD), British pounds (GBP), and other fiat currencies, but without the backing of anything with intrinsic value or being pegged to any commodity.

Today, countries such as America and the UK, are now seeing the devastating effects caused by a reliance on fiat currency, and the cataclysmic issue with the current economic model as a whole. As of the latest inflation data, the CPI index currently rests at 7% in the US, which is the highest level of inflation America has seen in the last 40 years.

The very fact that money, or cash, can be manipulated and injected into the economy, means that fiat currencies are losing value day by day, especially when they are kept in the bank. Another point worth mentioning is simply the belief people still have in the value of these currencies, even when the only differentiator between the banknote you hold and any other paper is trust!

Evolution of Money

In most developed countries, traders are happy to accept card payments, while in uncertain times, people tend to hold cash more often. As a result of the pandemic, many retailers globally shifted their sales online, with one study showing that around US$5 trillion had shifted to online purchases.

In the United Kingdom, according to a major report in 2019 on access to cash, only about 30% of the population used cash. However, due to safety and convenience, many people are switching to other payment methods.

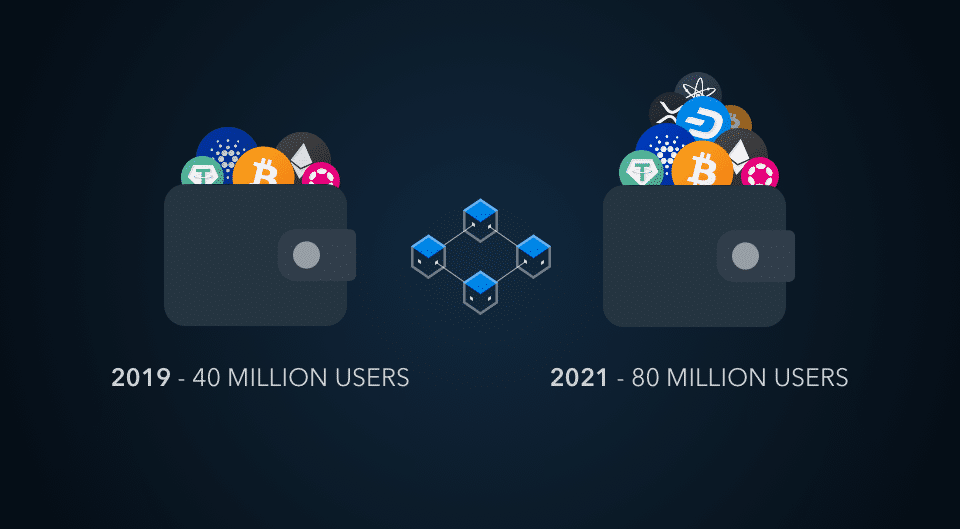

We’re now seeing significant growth in the blockchain industry and digital wallets. At the end of 2019, there were 40 million wallet users, while that number almost doubled to 80 million in 2021.

Since blockchain payments don’t require centralised authority, as cash does, there now exist many partnerships between blockchain companies and big enterprises like Circle, Visa, and MicroStrategy. Facebook (now Meta) making huge steps towards adoption in the crypto space. Not to mention, Bitcoin is now officially legal tender in El Salvador.

While this is occurring in developed nations, cash is still a primary form of money in developing countries, despite various technological advancements. This is partly due to bank fees and taxes, which are often too high for citizens to pay.

A Question of Privacy

Privacy is another key reason why people are still using cash. When two people meet in person and make a cash transaction, nobody knows about that besides them.

This is a major reason why governments have an interest in eliminating cash payments, as a way to seriously combat criminal activity. Although it would be naive to suggest that the abolition of cash would equate to the complete eradication of crime – it could simply lead to further creativity in that department.

Aside from this, it seems the new generation of consumers is now already swapping out privacy for convenience, which is creating a greater demand for cashless payment systems that prioritise efficiency. After all, a cashless payment system can be more time-efficient, whereas physical cash is less so and can be lost or stolen.

Future of Money

Today coins and cash have been partially forgotten, seeing a massive decline in transactions, especially during the pandemic. Nowadays, most transactions are completed via card and e-banking, and due to that, we can now send money globally in a matter of seconds.

However the issue with cash, and more widely fiat currency remains. They are wrapped up in the same overarching problem, whether in physical form or digitised, cash money is still vulnerable to the economic fallacy of the system as a whole. In a monetary sense, it successfully functioned as a medium of exchange but has failed to store value effectively over time, leading investors to seek more efficient stores for wealth.

Many are now turning back to the original commodities that stored wealth, that being gold and silver, as well as cryptocurrencies such as Bitcoin. Commodities like gold, when digitised, can be spent as digital currency. What’s more, gold-backed digital currency could now have all the prerequisite qualities vital to being effective, sustainable and secure money.

While the outlook for money is yet unclear, what we can be sure of: the future is not fiat.

Thinking about gold investment?

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.