This article will explore the investment potential of gold, the types of gold investments that exist and outline how you can get started.

Gold has been a sought-after commodity for centuries and is one of the main investment tools used to combat the turbulence of financial markets. Owning gold, and precious metals more widely, can offer investors the ability to reduce volatility in their portfolio and maintain their wealth in uncertain times.

Why Invest in Gold?

Safe haven for investors

Gold is a commodity, widely favoured in times of volatility – the like that many are witnessing today. It is well-known as a safe haven for investors since the price of gold has historically maintained a positive relationship with other market influencing factors, such as inflation. In fact, as Di Martino points out, gold is the least correlated asset in existence, against inflation.

Gold is a finite precious metal, the value of which has increased over time. For many, gold has acted as an insurance policy during economic crises, as the value of gold is not directly impacted by factors like interest rates or the performance on the stock market. Rather, when traditional investment assets struggle to perform, such as dividend-yielding stocks or bonds, people return to gold as a stable investment choice.

Inflation hedge

For many years, gold investment has offered a capacity for wealth preservation and, as mentioned, the ability to act as a hedge against inflation. Not only is gold an asset that finds strength in its appreciating value, but investors can also earn a passive, monthly yield on all gold stored within the Kinesis ecosystem.

Inflation occurs when there is a reduction in the purchasing power of money (indicated by the Consumer Price Index), while simultaneously, the prices of goods and services increase in the economy. One of the most notable examples of inflation, and its devastating impact, was seen in the instance of Zimbabwe, where hyperinflation caused the annual inflation rate to reach 737% by July 2020.

Investing in gold can preserve the purchasing power of one’s money, therefore making it an effective way to store and grow wealth.

Portfolio diversification

Keen investors know the importance of having a well-diversified investment portfolio. In brief, diversification means holding assets that are not all affected the same way by political and economic events.

For many, including gold is a common diversification tool as gold is usually negatively correlated with stock market fluctuations. This means that while other assets experience volatility, holding gold can counteract a certain level of risk presented by other investments.

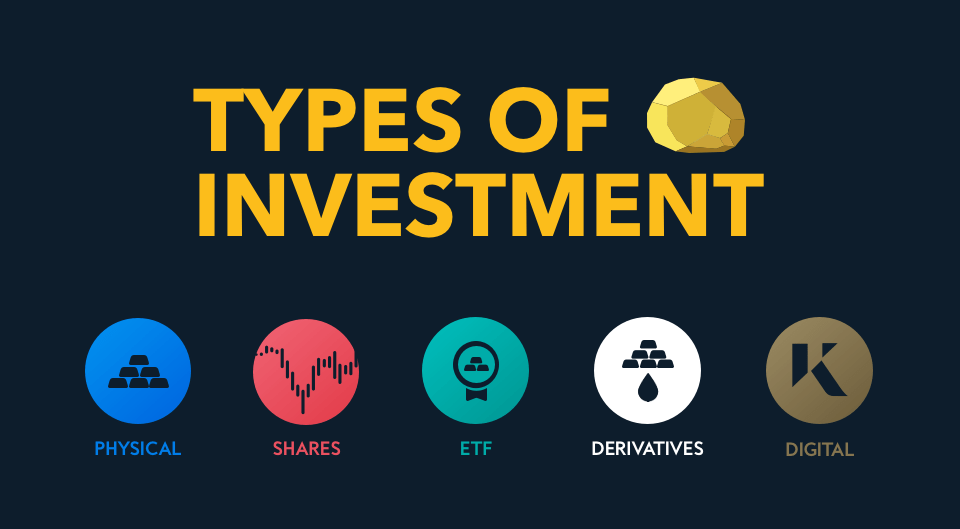

Types of Gold Investment

Gold investment comes in many forms. Depending on your specific needs as an investor, one form may be better suited for your investment strategy than another.

Here we’ll cover some of the most common ways to invest in gold.

Gold bullion and physical gold

Buying physical gold bullion has been a popular investment in recent years. The metal can be traded in recognised formats, such as gold bars, ingots, or coins. These forms of gold can be bought from reputable dealers, banks, or brokerages, both online and offline.

It is important to note that when it comes to physical gold coins or bullion, safe and secure storage is a must. This may involve paying a broker, bank, or another firm a fee. Alternatively, Kinesis offers investors the ability to store physical gold bullion, for life, and free of charge.

To find out more about how to access free bullion storage, click here

Shares in gold mining companies

Another option for investors is investment in gold stocks, also known as gold mining shares. Gold mining shares can be a little riskier than physical gold as you are investing in a business rather than the physical metal.

However, certain investors like to buy shares in gold companies as returns can be greater than physical gold. But like any share, they are prone to volatility, the price of the stock reflecting the company’s financial success and market position more than the price of gold itself.

When assessing shares in gold mining companies as an investment strategy, it is important to remember that this method may not be the optimal hedge against market risk.

Gold exchange traded funds (gold ETFs)

Gold or Silver ETFs, or an exchange-traded fund, are trusts that own physical gold or silver and sell shares that track and reflect the price of gold or silver. Also known as the “paper markets”, investors may decide to invest in ETFs so as to avoid navigating costly storage options for their bullion.

However, the main issue with ETFs is that the investors own none of the physical bullion that they are trading, in their name, and hence, can never redeem it as their own.

Gold derivatives

Gold derivatives are financial instruments in which prices are derived from physical gold. These derivatives include Futures and Forwards. Trading gold or other precious metal derivatives should only be undertaken by seasoned commodities traders, who have the necessary know-how and skill.

Again, derivatives are a mere representation of the asset, and in no way shape or form mean that the investor owns the asset. Nowadays, it is becoming increasingly preferable to hold, and own physical assets, that possess the kind of intrinsic value that gold has displayed for thousands of years.

Digital gold

The innovation of blockchain and other digital technologies have created new investment options for gold, with the main one being digital gold.

Through digitalisation, digital gold enables the asset to possess an added liquidity, the ease of instant buying and selling, and offers investors easy access to gold investment, without the hassle of physical storage.

With Kinesis, investors can utilise the – once impractical – asset of gold, as currency in their everyday transactional life. Kinesis gold (KAU) and Kinesis silver (KAG) currencies are native to Kinesis, based 1:1 on physical gold and silver, that enable investors to spend gold and silver on their virtual debit card, all while earning a yield.

Is Gold a Good Investment Now?

In a time of financial uncertainty, Kinesis provides investors with the option to take advantage of precious metals, as a debt and risk-free instrument that fundamentally protects wealth.

Against the volatility of high-risk investment assets, and their large scale returns, precious metals investment allows for a portion of your financial portfolio to be stored in a safe haven asset.

In addition to this, gold – and silver – stored in the Kinesis ecosystem maintains, and continues to build wealth, since the monetary system instils precious metals with vital yielding potential.

The Kinesis yield model supports and incentivises a return through participant usage of the monetary system. Whether minting Kinesis gold (KAU) and silver (KAG) currencies, spending, or storing precious metals in the system, Kinesis provides a cost-effective, liquid, and efficient investment option, against other traditional avenues on the market.

To find out more about investing in gold, start with Kinesis here.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.