Key Takeaways

- Gold and stocks should not be viewed as mutually exclusive. Instead, they complement each other within a diversified portfolio.

- Diversification is crucial. Spreading your investments across different asset classes, such as gold and stocks, can help manage risk and improve potential returns.

- Both gold and stocks can potentially deliver positive returns over the long term, making them valuable components of any investment strategy.

In an ever-changing financial landscape, making the right investment decisions is crucial for achieving your long-term goals, whether saving for retirement, buying a home, or planning for your children’s education.

This article will explore the advantages and risks associated with both, helping you make informed decisions that align with your financial objectives.

Understanding Gold as an Investment

Gold has long been regarded as a key asset for diversifying a financial portfolio and protecting against economic uncertainties and market volatility. It is particularly valuable during periods of high inflation, as it tends to hold its value better than other assets.

When investing in gold, you have several options:

- Physical Gold: This includes gold bars, coins, and jewellery. While owning physical gold can offer a sense of security, it comes with higher costs, such as storage and insurance, and often has a wider bid-ask spread, meaning you might pay more to buy it and receive less when selling.

- Gold Investment Online: You can invest in gold through financial products like exchange-traded Funds (ETFs), which track the price of gold without the need to own the physical asset. Digital gold is another option, allowing you to own gold while accessing all the benefits of a spendable, tradeable asset, with lower costs and greater liquidity.

- Gold Mining Stocks: Investing in companies that mine and produce gold is another way to gain exposure to the metal. However, it is essential to note that these stocks can be more volatile and may only sometimes move in line with the price of gold itself.

What About Stock Investment?

Stocks are a popular investment choice. They represent ownership in publicly traded companies. When you buy stocks, you become a shareholder, and your return depends on the company’s performance. Investors will have a positive return (a profit) if the price of the stocks in the portfolio increases, while they lose money if they sell stocks for a lower price.

There are a few ways to invest in stocks:

- Individual Stocks: After researching a company’s financial health and market conditions, you can buy shares of that company. This approach offers the potential for high returns but comes with the risk of significant losses if the company underperforms.

- ETFs: Exchange-traded funds allow you to invest in a basket of stocks, providing instant diversification. You can choose ETFs that track major indices like the UK’s FTSE 100 or the US’s S&P 500 or more specialised ETFs that focus on technology or renewable energy sectors.

What are the risks of investing in gold?

While gold tends to appreciate in the long term and is often seen as a haven asset, it is not without risks. The price of gold can be relatively volatile, influenced by unpredictable factors like geopolitical events, central banks’ decisions about interest rates, and macroeconomic data.

Additionally, physical gold requires secure storage, which can be costly. Unlike stocks, gold does not generate interest or dividends, so the only way to profit from it is to sell it at a higher price.

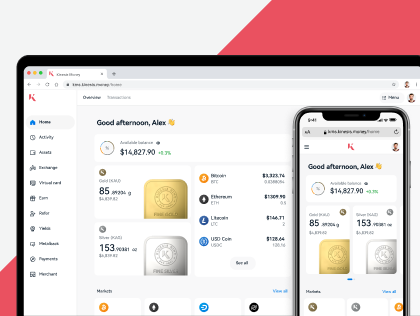

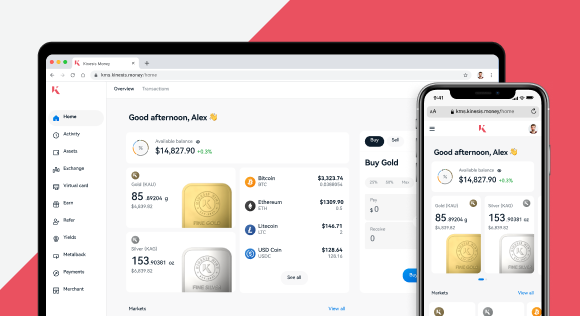

The advantages of digital gold

Digital gold offers a modern way to invest in gold with additional benefits. Kinesis has developed an innovative monetary system based on precious metals. What sets Kinesis apart is that these digital assets can provide monthly yields to the owner of Kinesis gold (KAU). Each KAU is backed by 1 gram of fully allocated physical gold bullion.

Kinesis’ offering combines the stability of gold with the potential returns typically associated with bonds. These precious metal assets can be redeemed for physical precious metals at any time, with the owner always the legal title owner.

What are the risks of investing in stocks?

Investing in stocks also carries risks. While many stocks have delivered substantial returns, others have seen their value plummet. A long list of stocks have posted triple-digit gains in the last few years. At the same time, others declined by 50%, and some of them even by more than 90%.

Economic downturns, natural disasters, and other unforeseen events can cause broad market declines, leading to increased volatility and reduced liquidity.

Company-specific risks, such as poor management or declining revenues, can trigger significant losses in individual stocks. To mitigate these risks and protect the value of a portfolio in volatile situations, it is essential to diversify investments. You can reduce your portfolio’s overall volatility by holding a mix of assets, including stocks and gold.

It’s also worth noting that rising interest rates can negatively impact stock prices, particularly for companies with high levels of debt or those in the early stages of growth.

Which offers potential returns: gold or stocks?

So, which offers better returns: gold or stocks? The truth is that both have a place in a well-rounded portfolio. Gold plays a key role as a haven that mitigates volatility in market turmoil. During market crashes, when stock prices and bond yields are collapsing, gold tends to appreciate.

When we compare gold’s performance to stocks over the past three years, we see that gold increased by around 40%, clearly surpassing the S&P 500’s return of around 20%. Over the past twenty years, gold has risen by nearly 500% (from $400 to $2,450), compared to less than 400% for the S&P 500 (from around 1,115 to 5,330 points).

However, over more extended periods, stocks have historically outperformed gold. For instance, over the last 40 years, stocks have delivered higher returns than gold. A 10-year analysis would have a similar outcome. It is important to note that past performance is not necessarily indicative of future results. However, this underlines the significance of diversifying a financial portfolio.

By carefully considering the unique characteristics and risks of both gold and stocks, you can make informed decisions that align with your financial goals. Whether you choose to invest in physical gold, digital gold through Kinesis, individual stocks, or ETFs, a balanced approach will help you navigate the complexities of the financial markets in 2024 and beyond.

Frank’s experience covering the commodities markets spans 22 years, with a particular specialism in metals, carbon and energy markets. He has worked as a senior editor for S&P Global Commodity Insights (formerly Platts) and before this, at ICIS-LOR, a part of Reed Business Information (Reed Elsevier), where he covered the petrochemicals markets from 2003 to 2005.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.