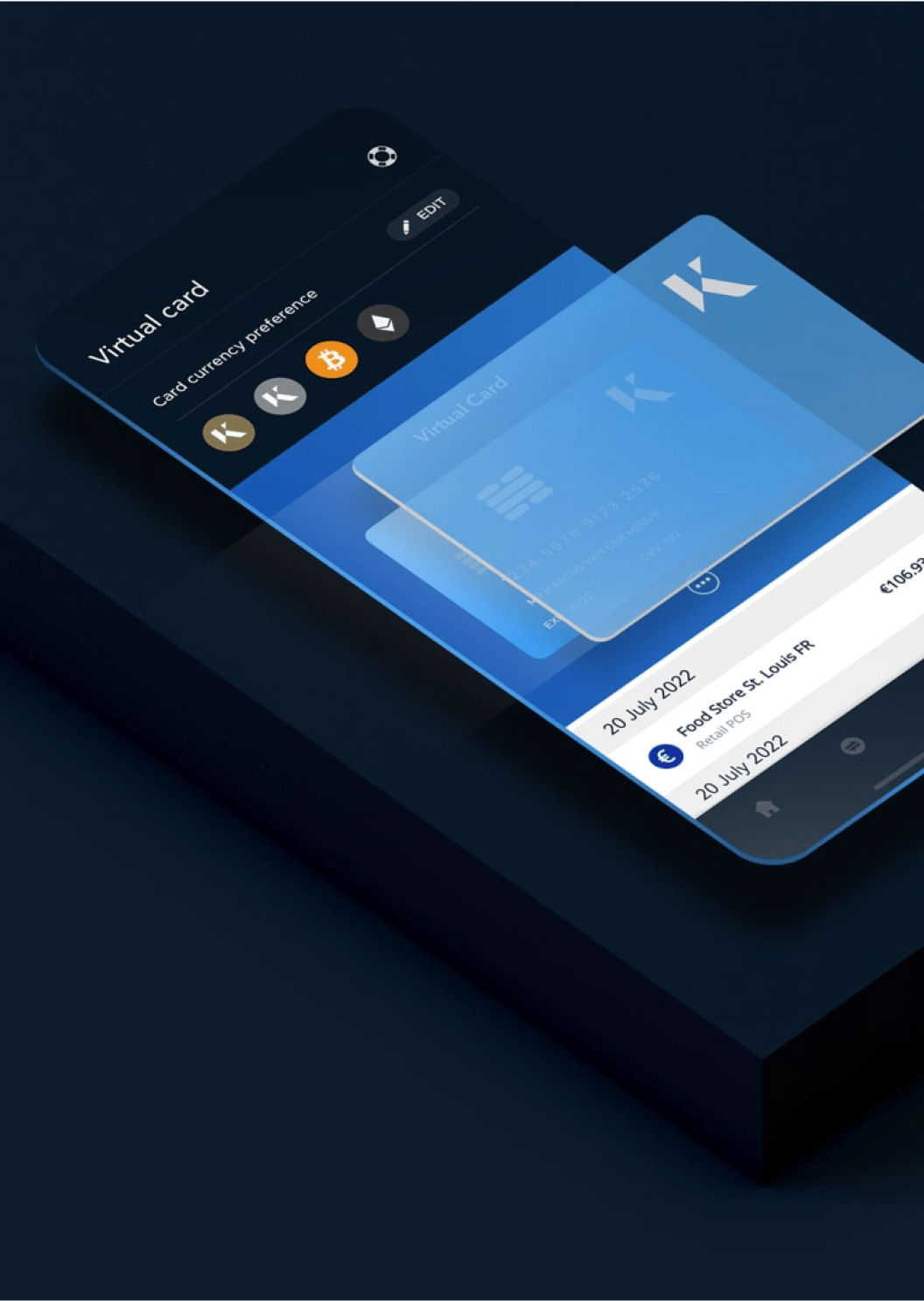

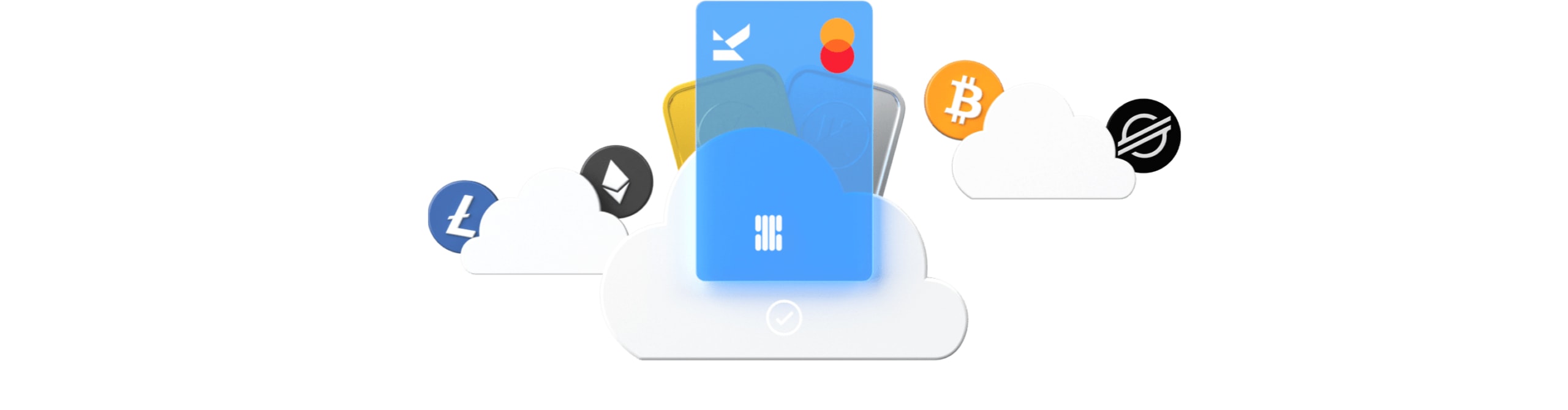

The Kinesis Virtual Card

Spend your gold, silver and crypto in real-time with instant fiat conversion, anywhere in the world.

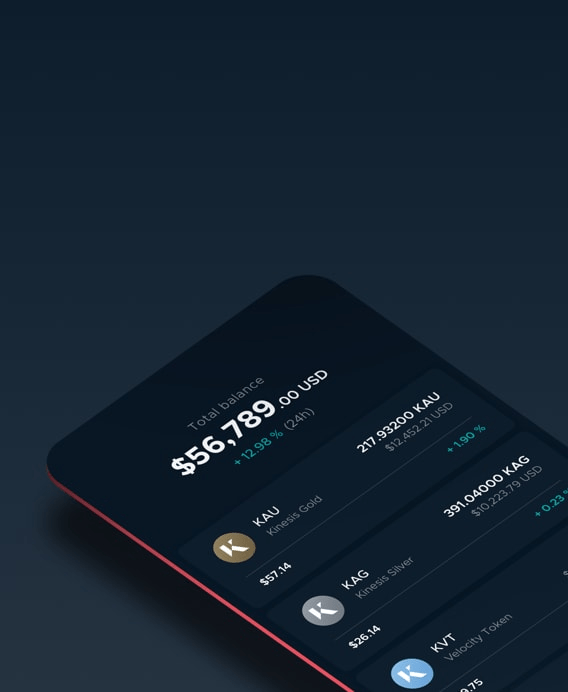

Everything Money Should Be

Spend your gold, silver & crypto instantly

Spend your gold, silver & crypto instantly

Protect your wealth in gold and silver – or hold crypto – with split-second conversion at the moment of purchase.

Go borderless

Spend your assets anywhere in the world Mastercard is accepted.

Sky-high daily limits

Spend up to €15,000 each day – over €400,000 every single month.

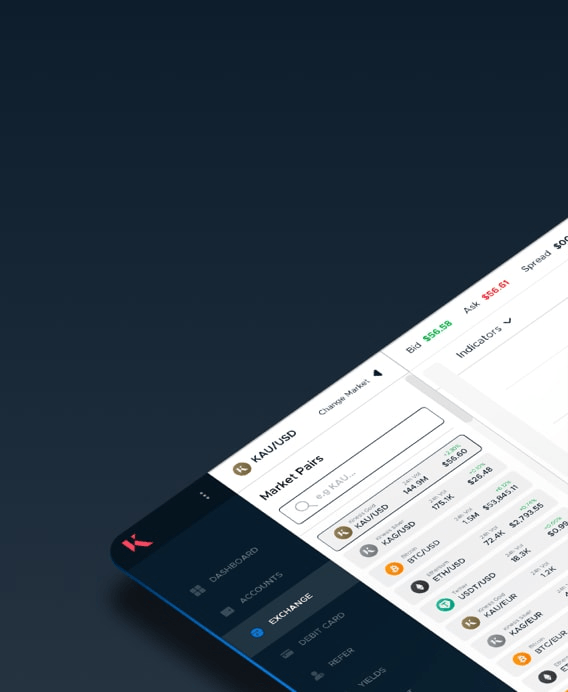

Your global crypto card

Use your crypto as currency at 80 million locations around the globe.

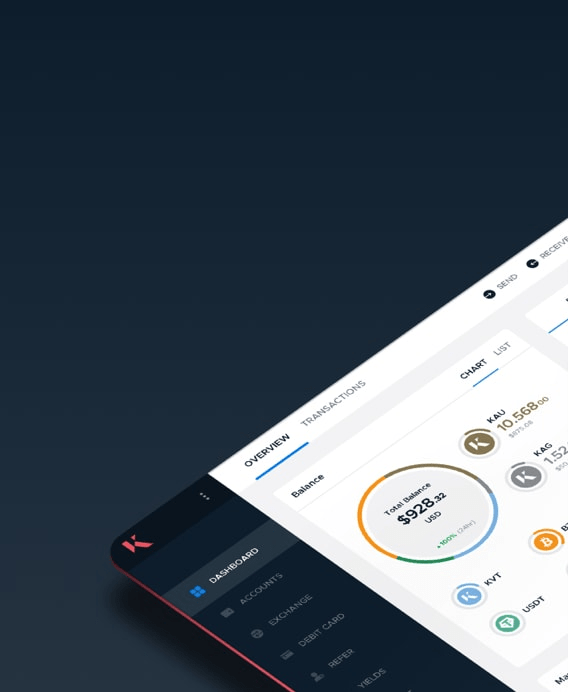

Earn gold and silver as you spend

Earn gold and silver as you spend

Get paid gold and silver

The more precious metals you spend, the more gold and silver you earn.

You share in our growth

We share 10% of our global earnings with our gold and silver spenders.

We share our fees

Unlike other cards, Kinesis’ transaction fees are collected and paid out monthly as yields.

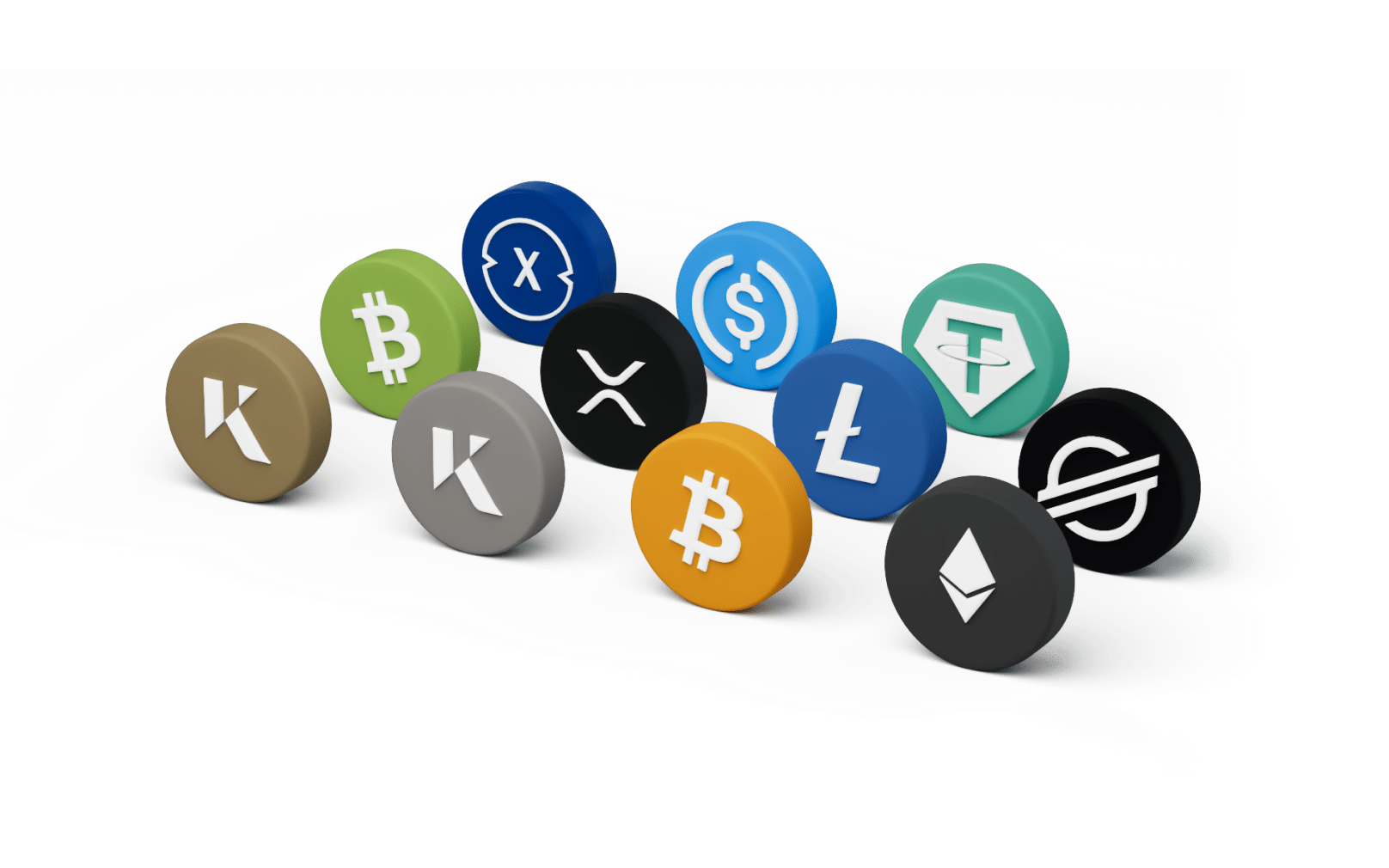

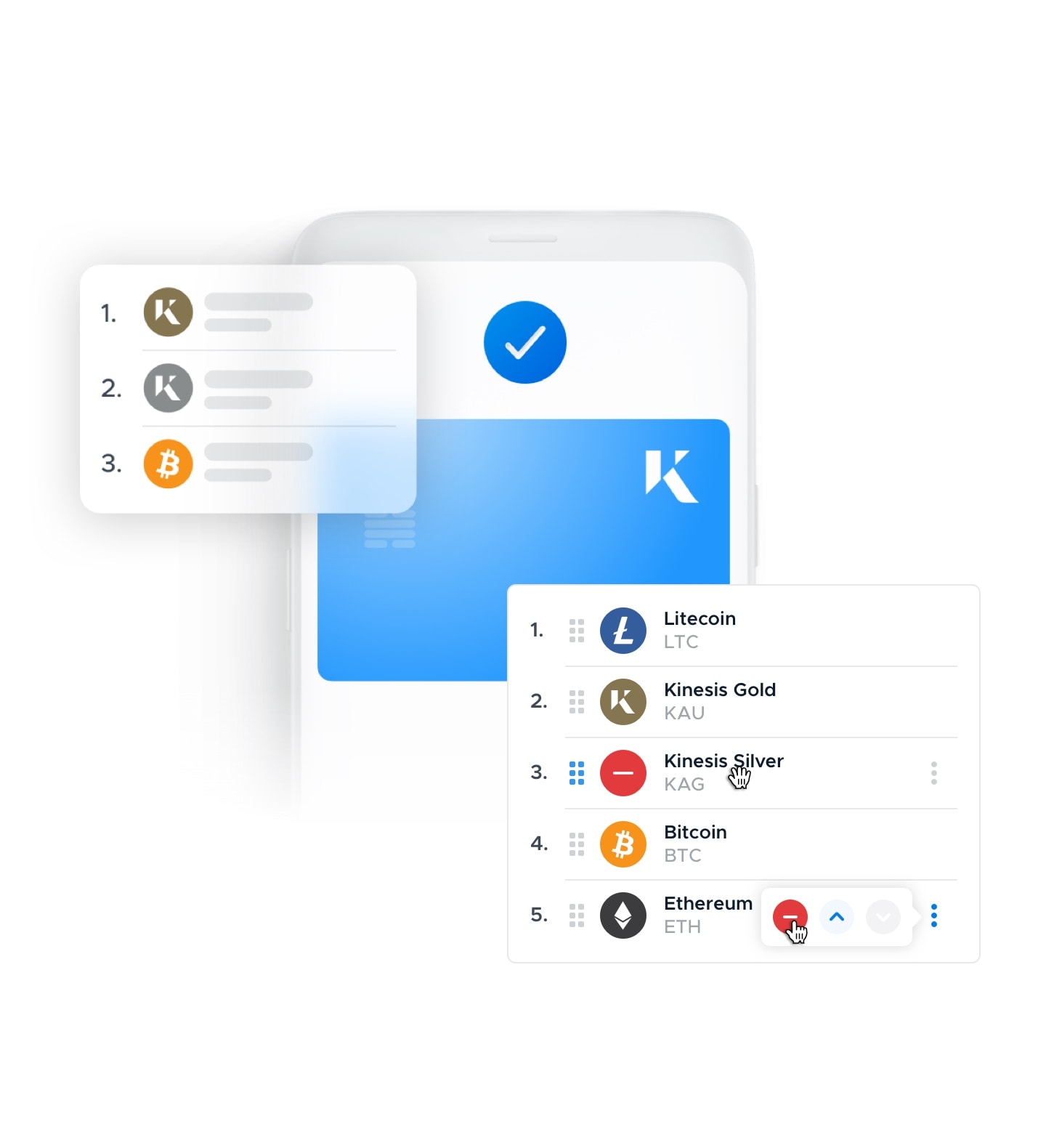

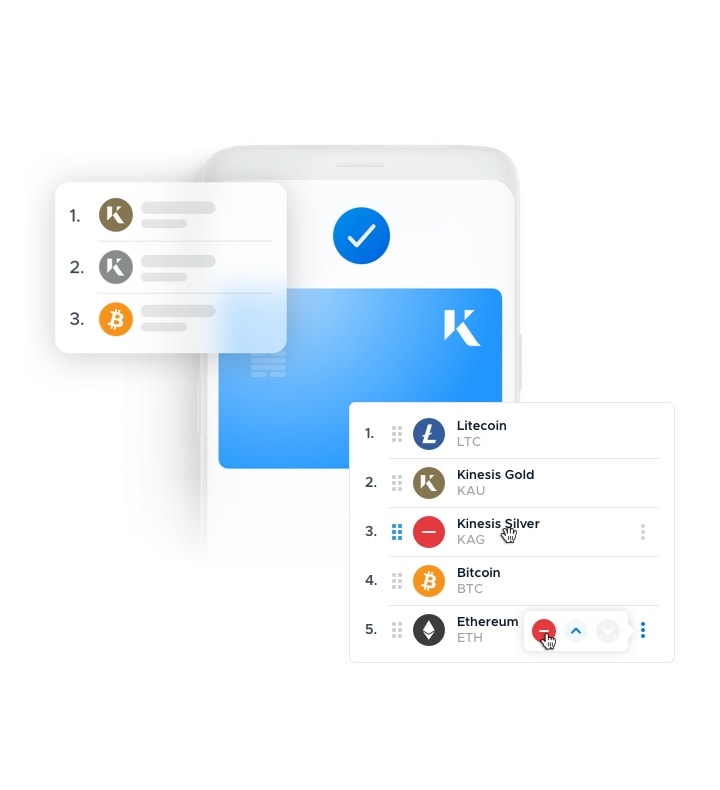

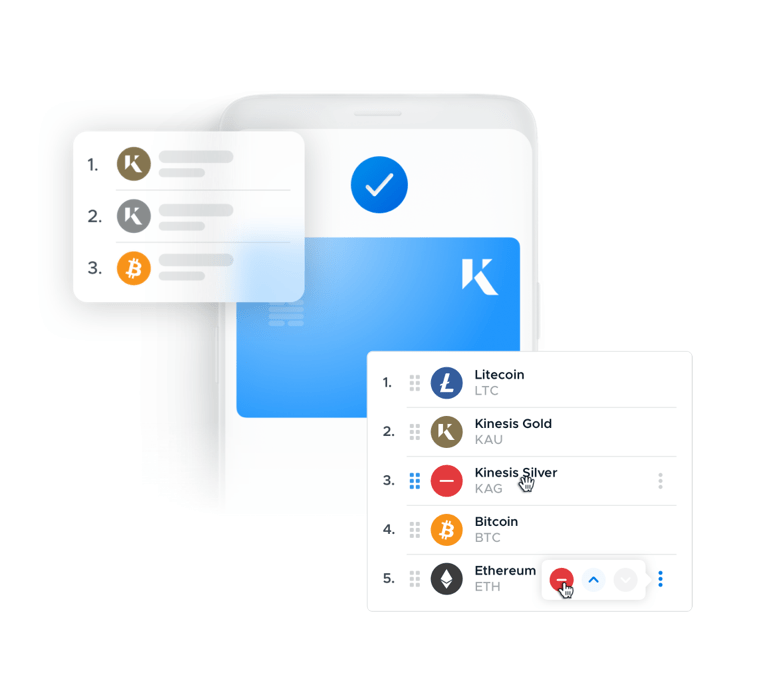

Choose your money

Choose your money

Easily switch between spending your precious metals and crypto – and even preselect the order you spend your currencies in.

Multi-currency transactions

Spend gold, silver & crypto in the same transaction.

Supports 10+ currencies

Gold, Silver, Bitcoin, Ethereum, XRP & more.

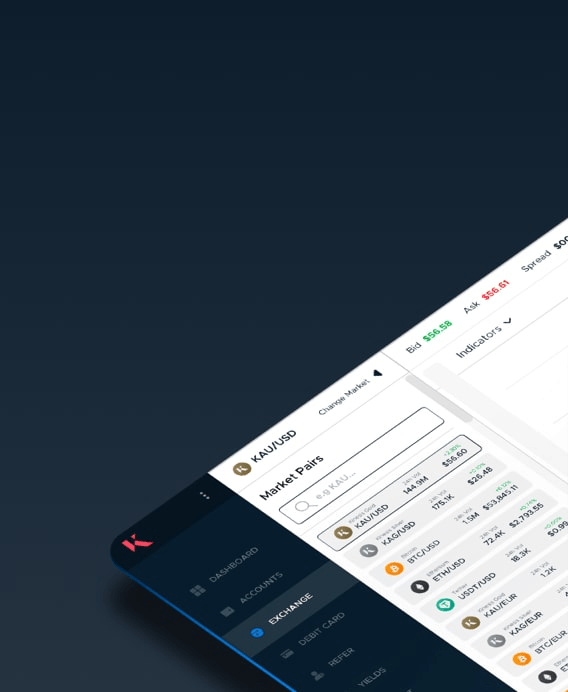

Our plan

Spend your gold, silver, or crypto in real-time with instant conversion to fiat

€15,000 daily spend limit

No monthly fee

No sign-up fee

Spend currencies in your preferred order

Google Pay & Apple Pay compatible

Available in the UK, Europe, Canada, Australia, Oceania and Latin America.

Available in 60+ countries. See full country list here.