Protect your spending & savings with precious metals

What our customers are saying

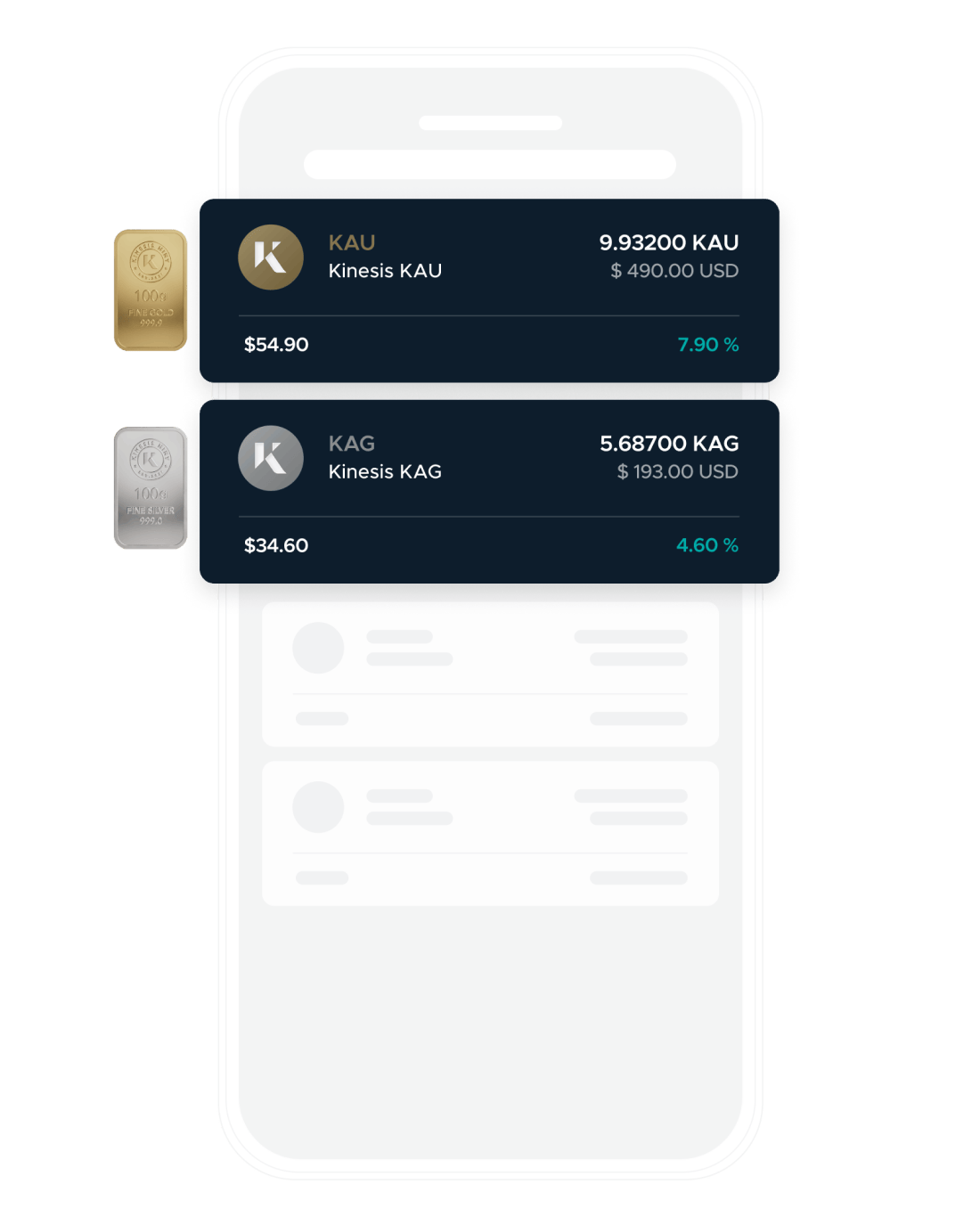

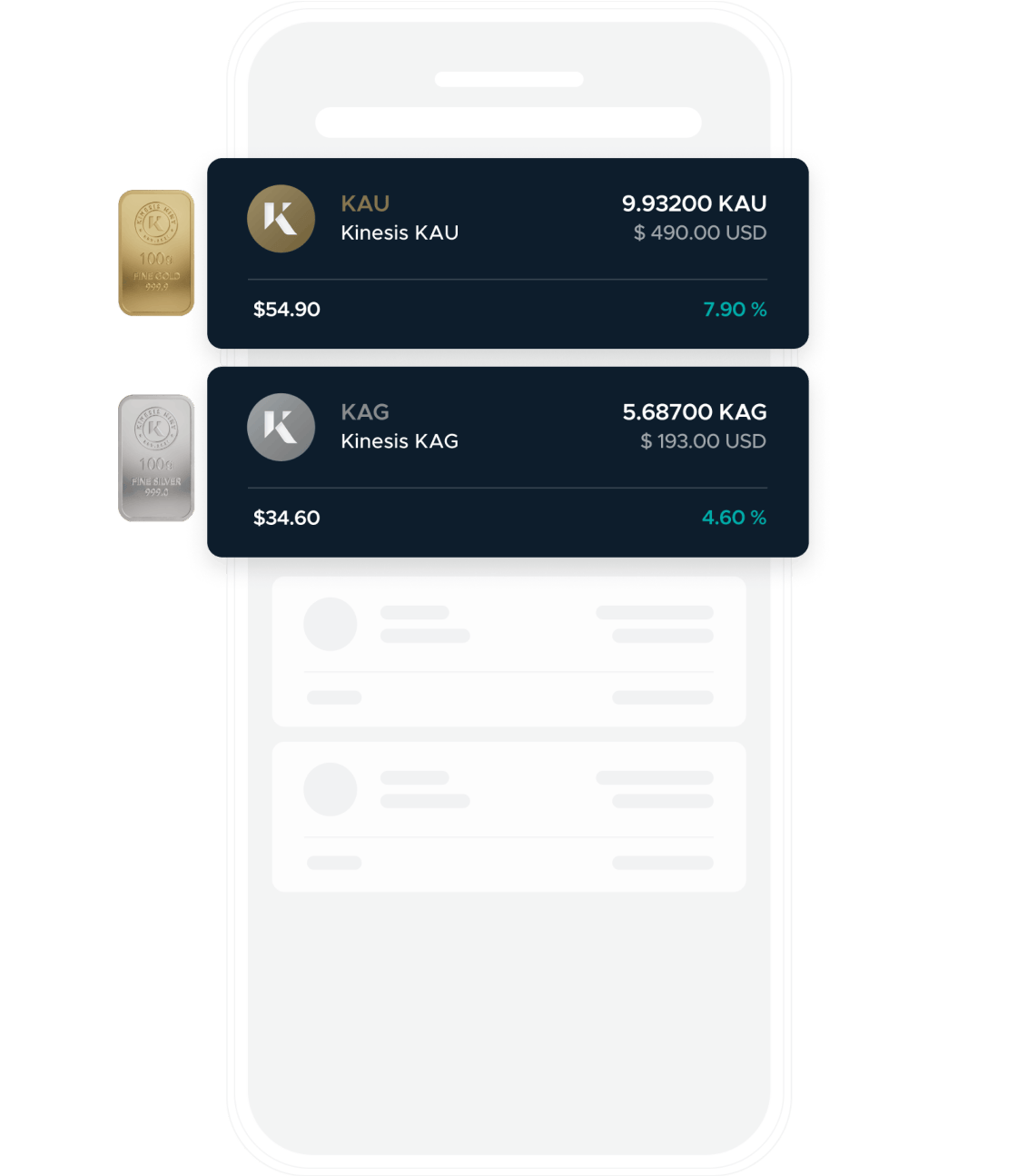

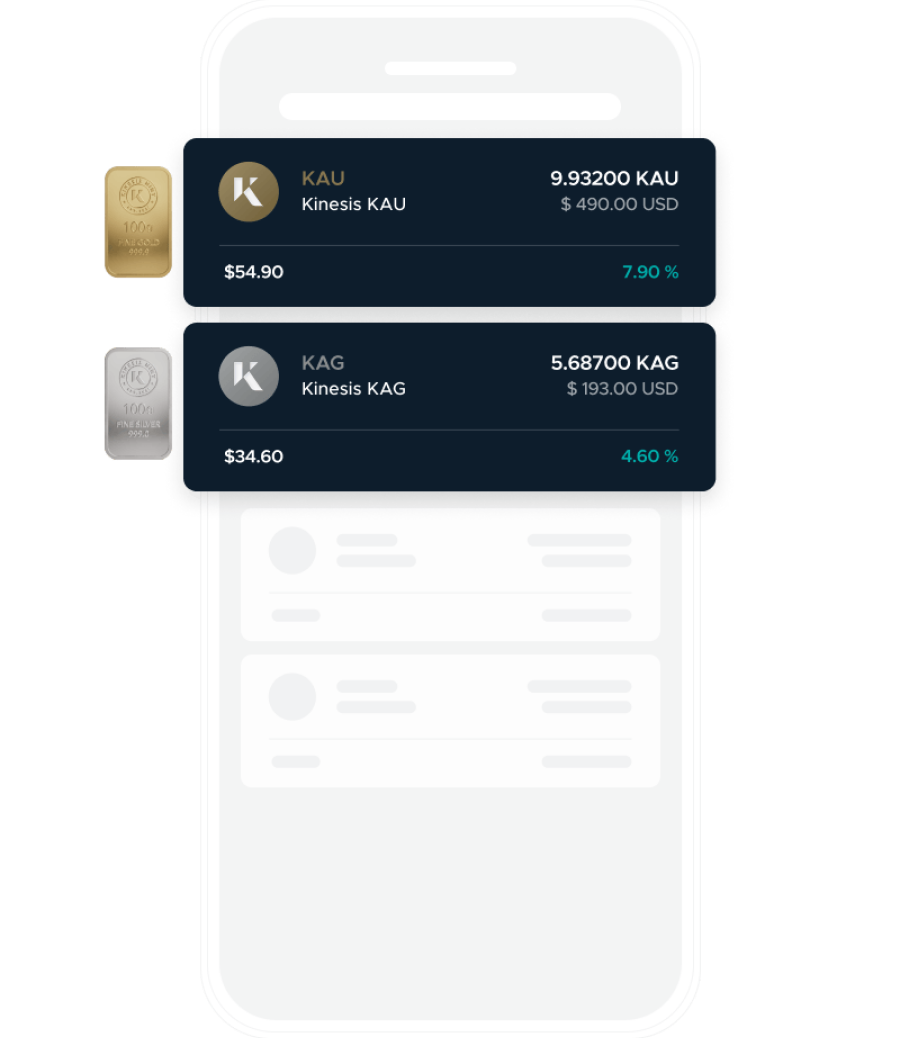

Digital currencies fully backed by physical gold and silver

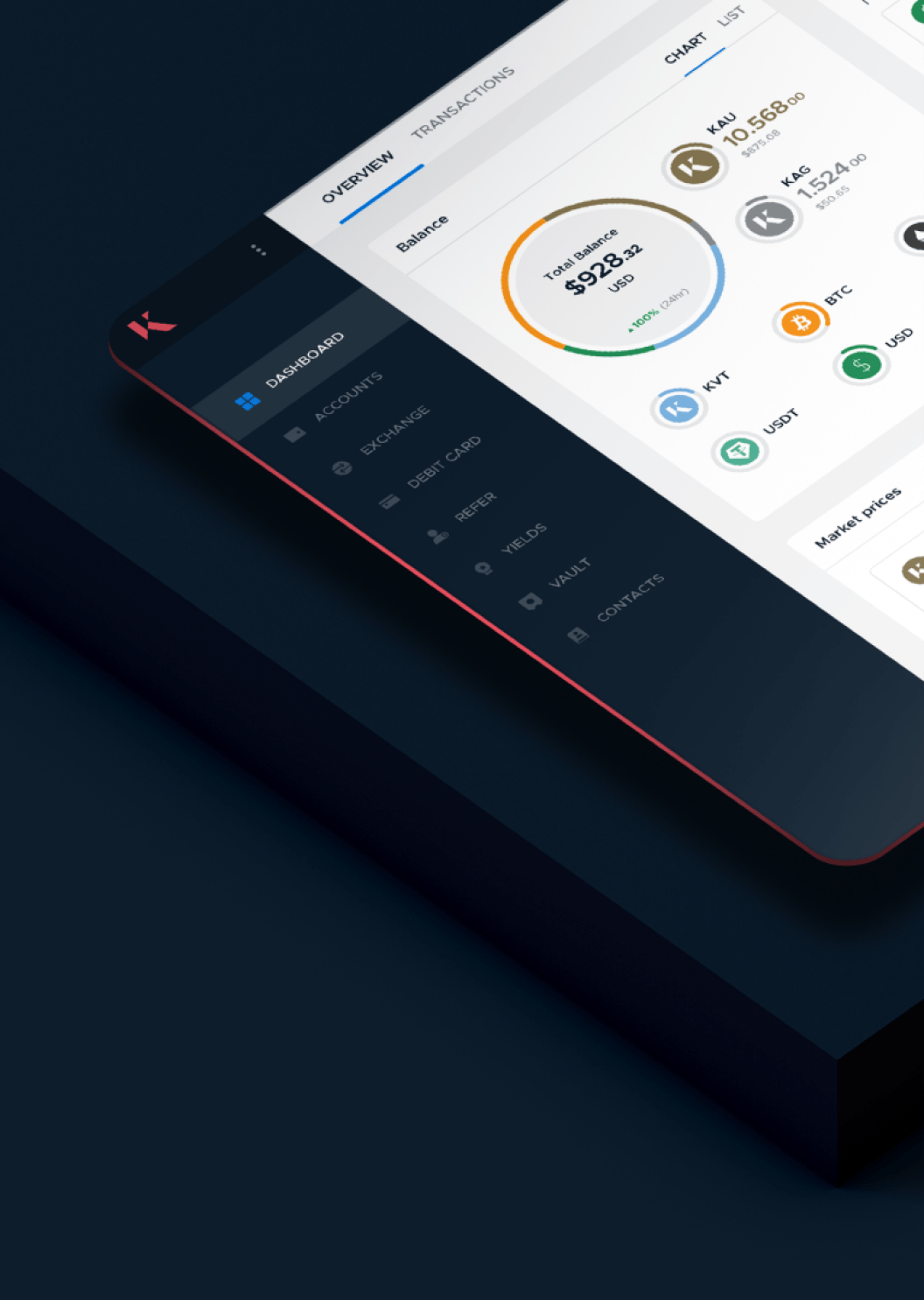

Spend your gold & silver with a tap

Instantly spend your gold, silver & digital assets – anywhere.

Earn yields just for using your account

- Holder’s

- Velocity

- Referrer’s

- Minter’s

- KVT

Hold and earn

Spend and earn

Refer and earn

Mint and earn

- Holder’s

- Velocity

- Referrer’s

- Minter’s

- KVT