Silver dollars are the some of the most collectable and liquid in the coin market today. They’re also among the most valuable coins in the world.

One recently became the most expensive coin in the world at auction and others regularly sell for millions of dollars. Not bad for a coin that, on the face of it, is worth just $1.00!

What is a silver dollar?

US silver dollars are coins made by the United States Mint. They minted the first of these coins back in 1794.

Each coin had a 90% silver content with the remaining 10% made from copper. They were redeemable for $1.00.

The history of US silver coins is interesting, with the coins coming about after the country adopted a silver standard based on the Spanish dollar in 1785. According to Precious Metals Analyst Dave Kranzler:

“This silver standard was legally mandated by the 1782 Mint and Coinage Act. This established the silver United States dollar as the official unit of currency.

“The U.S. fixed the dollar at par with the Spanish dollar and divided it into 100 cents. The Coinage Act authorised the minting of coins denominated in cents and dollars.”

It wasn’t all plain sailing for the silver dollar, though. The first major disruption the coins faced was The Coinage Act of 1873. This ended the turning of silver into coins that the state had mandated over 100 years before.

Production resumed five years later following the passing of the Bland-Allison Act. This law compelled the Treasury to buy a minimum amount of silver each month that they would then turn into dollar coins.

However, just a few years later the Sherman Silver Purchase Act of 1890 led to a surplus in the supply of dollar coins. Volumes tailed off over the subsequent years until 1904 when the U.S. suspended production of the silver dollar.

The end of World War I saw the passing of the Pittman Act which led to the minting of the Peace Silver Dollars in 1921.

This coin enjoyed a short production run before war once again intervened. The Mint struck no further silver coins for about 30 years until the creation of the Eisenhower Dollar in the 1970s.

Following this resumption in production, the Mint struck coins with a variety of designs until 2011.

Coins produced from 2012 are no longer for general circulation. They are purely commemorative and made specifically for collectors. The range of designs and the history behind each different coin is fascinating. It’s a key factor in why silver dollars are one of the most collectable coins.

Why is a silver dollar called the silver eagle?

The silver eagle refers to the American Silver Eagle, which is the official investment-grade, silver bullion coin. Part of its investment appeal is that it weighs exactly one troy-ounce coin and is made from .999 pure silver.

Approved by the 1985 Liberty Coin Act, the coin first appeared in 1986.

This one-ounce coin is pure silver and has the Walking Liberty design on the obverse and the Bald Eagle, the national bird of the USA, on the reverse.

The US government backs its weight, purity and content, helping to make it the most widely traded silver coin in the world.

All Eagles minted before 2012 have a face value of $1. However, the standard coins trade for a small premium over the spot price value of the physical silver contained in the coins.

As ever with collectable items, more unusual or proof versions of the coins can sell for considerably more. However, as they are newer coins, they’re more prone to fluctuating values as the price of silver moves in the open market.

The most valuable silver dollars today

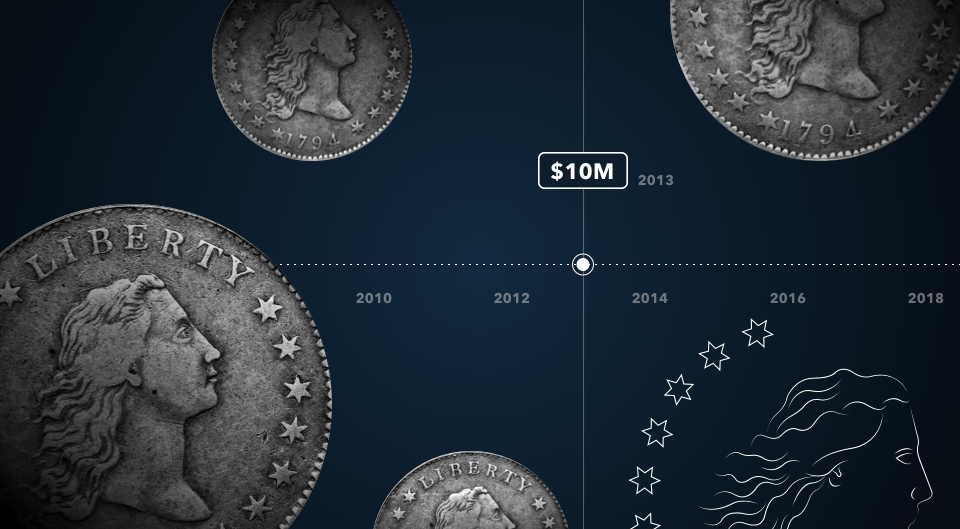

The 1794 “Flowing Hair” specimen was potentially the first silver dollar that the US Mint in Philadelphia struck. The coin derives its name from the appearance of Lady Liberty on one side.

A 1794 “Flowing Hair” dollar sold at auction for $10,016,875 in 2013, reflecting its status as the rarest coin ever in the silver dollar range.

Coin collector Bruce Morelan, who made the record-breaking purchase, later sold the coin for $12 million in 2022. The firm GreatCollections bought it at that price for one of their clients.

The Mint only struck 1,758 silver dollars in its opening run. Any coins from that year still around today are highly sought after by collectors.

Collectors estimate that there are between 120 and 130 remaining 1794 “Flowing Hair” coins. Each one would likely attract a multi-million dollar price tag should they ever come to market.

The 1787 Brasher Doubloon, a celebrated silver coin, went to auction in January 2021. It fetched an amazing $9.36m reflecting its elite-level rarity and collectibility.

The next most collectable silver dollars are the Morgan Dollars and the Peace Dollars. Two of the key coin features of the Morgan dollar that make it so collectable are its distinct mint marketing and intricate designs.

Morgan Dollars have sold for impressive amounts, with one 1889-CC Morgan Silver Dollar coin selling for $881,250 in 2013. On the other hand, one of the highest-selling Peace Dollars, a 1922 Pattern Peace Dollar, sold for $325,000 in 2014.

Collectors often seek out mint-marked versions of these coins. The mark indicates which specific US mint struck the coin.

The various Mints struck the George T. Morgan-designed Morgan Dollars between 1878 to 1904 and then again briefly in 1921. Collectors value them for their comparative rarity and their beauty. In mint condition, they can sell for between $100,000 to $550,00.

The short 1921-1935 run of the Peace Dollar makes this coin popular with collectors due to its relative scarcity. The Peace Dollar made a brief but welcome return in 1965.

Other coins to attract a high price include the 1885 Proof Trade Dollar. There are only five known examples of this circulating coin which the US Mint has no record of ever producing. One of the 1885 Proof Trade Dollar coins sold at auction for $1.32 million in 2020.

Seated Liberty dollars from the late 1860s and 1870s are also sought after. An 1866 version missing the “In God We Trust” inscription sold for over $1 million.

The 1866 version lacks the “In God We Trust” inscription and one coin from this series sold at auction for $1,207,500 in 2005.

Such is the interest in silver dollars that you can easily trade them at bullion dealers and pawnbrokers. You should store the dollars in air-tight containers or packets to reduce the risk of them becoming tarnished.

Almost all silver dollars gain in value but not always by much. For example, for a standard 1923 silver dollar, the value of it over 100 years later is between $30 and $40. In pristine condition, uncirculated dollars from that year can fetch up to $3,750.

You might be asking which is the most expensive coin ever sold. It’s a gold coin – the Saint-Gaudens Double Eagle which sold for $18,900,000 in 2021.

How to avoid buying fraudulent coins

Coin collecting is a popular hobby and can be a lucrative investment. As with most valuable goods, you must be cautious and watch out for fakes and replicas.

There is a lot of misinformation about coins circulating online, so you must do your due diligence before making a bid. Scammers have taken common coins and marketed them as rare, valuable coins at online auctions.

To avoid buying fraudulent coins, start by being aware of the traditional size of the coin you’re buying. Check the diameter, thickness, and weight of the coin. A counterfeit coin will likely be the wrong size or weight.

If you’re interested in buying a valuable or rare coin, look for certified coins. Experienced third parties will verify the authenticity of individual coins for you. They can easily spot fake coins and can warn you if needed.

You should only buy from reputable dealers, and remember: if a deal sounds too good to be true, there’s a good chance it is.

Warren Zivi is the head numismatist and president of the American Rarities coin dealers in Colorado.

He recommends a book for collectors to read before buying coins. The book, A Guide Book of United States Coins by Jeff Garrett, helps people understand how rare their coins are and how much they may be worth.

With entry prices as low as $20, silver dollars offer an attractive entry point into coin collecting. The possibility of unearthing a rare silver coin in mint condition keeps collectors dreaming of making a fortune.

Kinesis now offers its very own signature bullion collection available at the Kinesis Bullion store. They are independently produced at the Kinesis Mint for your peace of mind.

Collectors can find a selection of premium coins and bars at competitive prices, suitable for every level of investment.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwashing while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.