Silver is thought to be the world’s oldest form of money and is formed from sulfur compounds beneath the earth’s crust. As far back as ancient Athens, silver was a crucial element in trade and commerce. Silver is found deposited in the crust by volcanic or hydrothermal activity, where it often mixes with other metals to form metal alloys.

As well as having been a form of currency, silver is an industrial metal. It’s used in a wide range of products, primarily because it’s an efficient conductor of electricity. Many sectors use silver nitrate, one of the silver salts, as a disinfecting agent. Even if it weren’t a precious metal, it’s clear that it would be in high and constant demand.

Keep reading to discover more about where silver is found across the globe, where the world’s silver mines are located, and how it fares as an investment metal.

Where is silver found in the world?

Silver is made through a complex process that takes millions of years. Silver came into being in stars, scattered around the universe by supernovae. Eventually, it becomes part of planets like earth.

On earth, silver compounds, including silver sulfide and silver chloride, play an important role. These compounds form in regions with a lot of volcanic or hydrothermal activity. Over time, some silver combines with other metals to form different alloys.

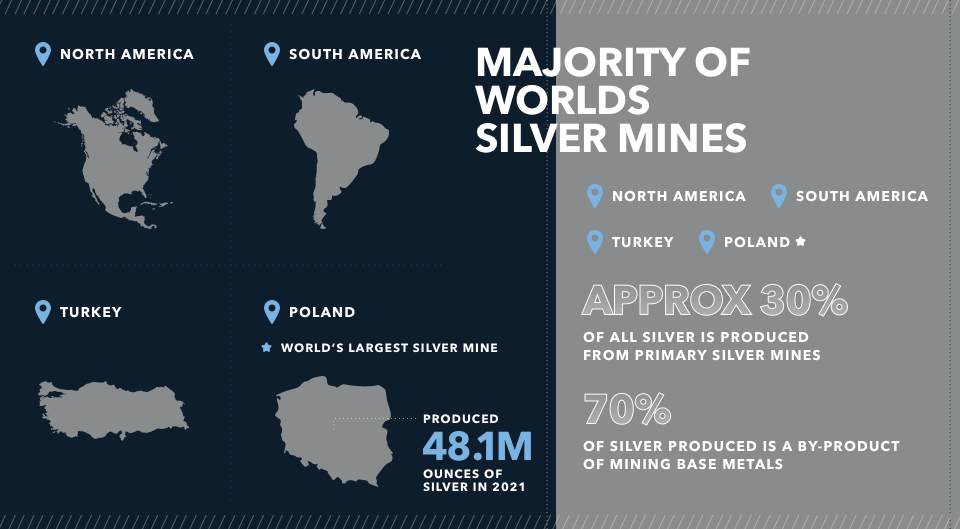

30% of all extracted silver we use today comes from primary silver mines. This indicates that silver mineralization comprises most of the ore in these mines. 70% of the silver produced is a by-product of mining base metals like copper, lead and zinc.

Many investors view most mining companies as either “primary silver miners”. This is even though firms like Hecla, Coeur Mining and Pan American Silver derive only 20-30% of their revenues from the metal.

Who discovered silver?

Silver’s use as money dates back to at least the ancient Egyptian and Greek civilizations.

The origins of silver are steeped in history, leading many to ask: when was silver discovered, and who discovered it? While these details remain elusive, archaeological findings, such as slag dumps in Asia Minor and the Aegean Sea islands dating back to 3000 BC, provide evidence of early silver extraction.

Other archaeological evidence shows that silver may have been in use for at least 5,000 years.

How much silver is produced?

Most of the world’s silver mines are in North and South America, but there are also significant deposits in Poland, Turkey, and Australia. The world’s largest silver mine is KGHM’s copper mine in Poland, which produced 42.3 million ounces of silver in 2021. Mexico has four of the top ten silver-producing mines globally.

According to the Silver Institute, miners extracted 822.4 million ounces of silver in 2022. Recycling added another 173 million ounces supplied in the same year.

They expected that, in 2023, global mined silver production would fall to 820 Moz. This is despite a forecast demand of 1.14 billion ounces for the same year, up 10% in 2022.

Commercial uses (industrial, jewellery, photography and silverware) comprise 77% of demand.

The low melting point of silver also makes it ideal for processing into other raw materials. Its low melting point is ideal for creating sterling silver. This type of silver is pure, durable, and a popular choice in jewellery production.

The move towards becoming more environmentally friendly will likely increase the supply and demand gap. That’s because solar energy panels and batteries in electric vehicles rely on silver.

Additionally, silver is very good at killing bacteria. That has led to an increased use in medical applications, another significant demand vector.

Many analysts believe that the price of silver highlights it’s ‘undervalued’ at present and has significant potential upside, with the metal offering a good balance of risk and return, especially compared to the stock market.

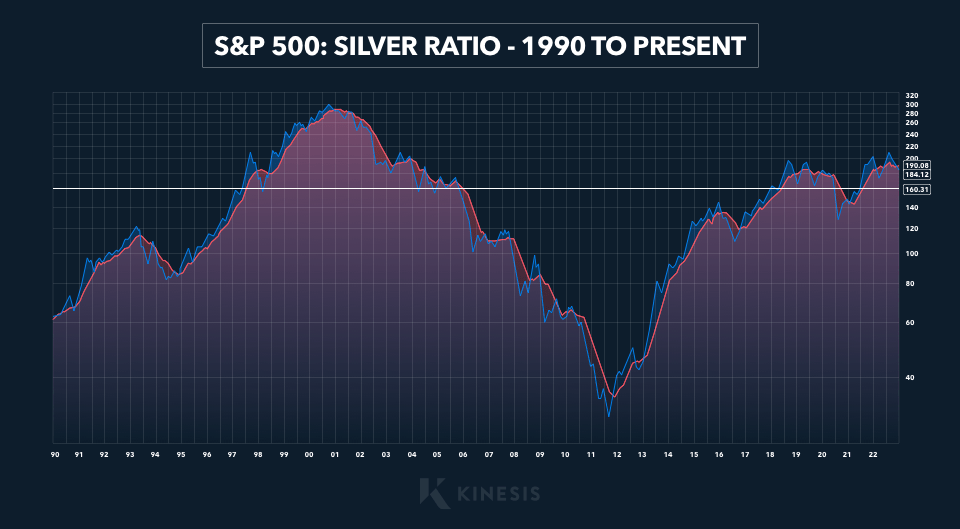

The chart above shows the S&P 500 vs. silver ratio from 1990 to the present. For the majority of that period (60%), the balance has been substantially below the current ratio of 160.

This means that silver is historically undervalued compared to the general stock market. The SPX: silver ratio bottomed out at 26 in 2011.

This suggests that silver has the potential to outperform the stock market by up to a factor of 6.15 if the SPX/silver ratio reverts to the previous low.

Silver as an Investment

Central banks historically held large amounts of silver as part of their reserves.

However, in the late 1800s, silver became “de-monetized” as central banks started removing silver as a reserve asset. The 19th century marked a pivotal shift in how governments and businesses perceived the role of silver in the global economy. The era of the Silver Standard was over.

The Bretton Woods Agreement finalised this process. That’s when gold and the United States dollar began to provide the structure for the global economy.

Central banks hold gold as part of their Tier 1 reserves despite the later effective end of the Gold Standard in 1971. Many investors believe silver will eventually become an integral part of the monetary and banking systems.

Silver and Gold

The value of silver is a fraction of the value of gold per ounce. This means its often silver easier to exchange silver like for like and offers its more practical use as a currency.

The same holds for the value of silver relative to gold. Over the same 32 years shown in the chart above, the gold: silver ratio is currently higher than it has been for over 60% of the time between 1990 and the present.

Let’s assume that the current rising trend in the precious metals sector is at the beginning of a sustainable, extended bull cycle. This could mean that the gold: silver ratio will revert minimally to 30, where it bottomed in 2011.

Holding the price of gold constant would imply that silver has the potential for at least a 250% upside relative to the price of gold.

To round up, the supply/demand fundamentals alone suggest that silver has tremendous upside potential. That’s regardless of the statistical analysis applied to silver as an investment.

First and foremost, buying and self-safekeeping physical silver in its physical form. This could be, for example, sovereign-minted bullion coins, easily recognisable as a form of currency.

You can buy sovereign mint bullion products like U.S. gold or silver eagles via silver bullion investment services. The Kinesis Bullion store also offers a full range of rounds and bars available for delivery across the United States.

In addition, Kinesis offers silver as a digital currency in the form of silver KAG, fit for modern times. For every silver KAG, there is one ounce of physical silver held in fully audited vaults in the name of the buyer – you – at all times.

You can use silver KAG as currency with the Kinesis Virtual Card and be rewarded with a yield paid in silver every month. Kinesis pays out a proportional amount of precious metals through a usage-based yield model at the end of the month.

Discover the full range of silver bullion available at the Kinesis Bullion store.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.