The Growing Importance of Silver in the Solar Industry

As the best electrical conductor of all metals, silver has a close-knit relationship with the solar industry where the metal is a key component of the photovoltaic cells that make up solar panels.

With the solar industry experiencing huge growth, so has the demand for silver, with the metal’s use in photovoltaics increasing to 140.3 million ounces last year, according to the Silver Institute.

Understanding the Role of Silver in the Solar Industry

Silver’s excellent conductivity means the metal is turned into a paste and added to contacts within the solar panels so that the converted solar energy from the silicon panels can be carried away as electricity to be used immediately or stored within batteries for later use.

Although each photovoltaic cell only uses a few milligrams of silver, so great has been the rollout of solar technology in recent years that current projections of future demand have raised concerns over whether supplies of silver will be able to keep up with demand.

The Demand for Silver in the Solar Industry

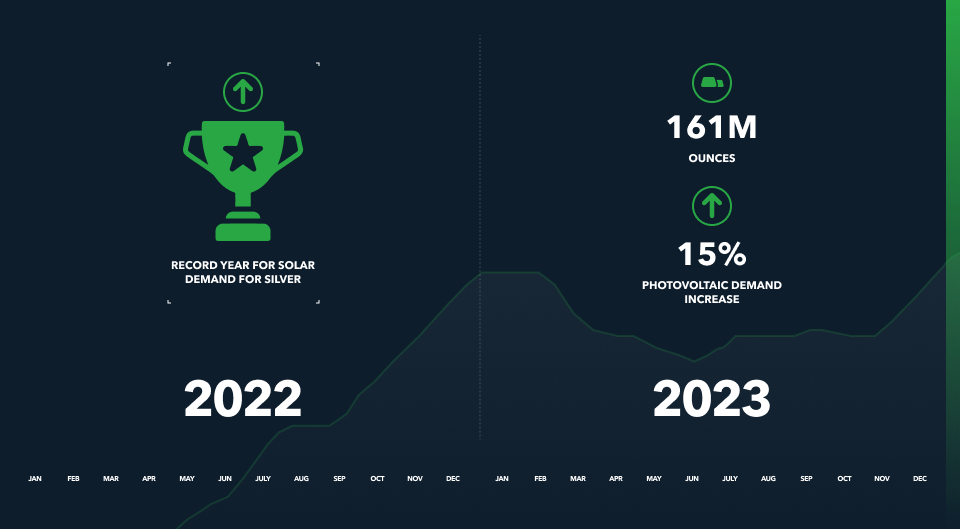

The solar industry has grown so rapidly in the last decade or so that the sector has become the single biggest source of industrial demand for silver. With 2022 already a record year for solar demand for silver, 2023 is set to be even higher with the Silver Institute forecasting photovoltaic demand to increase by 15% to 161 million ounces.

And this trend is likely to persist for many years yet given solar’s crucial role in the energy transition. According to the most recent figures from the International Energy Agency, solar PV generation increased by a record 179 Terrawatt hours (TWh) in 2021 to exceed 1,000 TWh for the first time. As the cost of manufacturing solar panels has fallen considerably in recent years, utility scale solar has now become the lowest-cost option for new electricity generation for many countries.

So bullish are solar’s growth prospects that by 2027, it is set to overtake coal as the world’s largest source of power with the total amount of new capacity being installed increasing for at least the next five years, according to the IEA.

While solar is in hot demand all over the world, recent developments in the US, the world’s largest economy are likely to supercharge solar investment, and with it the need for ever larger quantities of silver.

Last year’s signing of the US Inflation Reduction Act will spur a huge increase in investment in solar technologies with President Biden’s bill including $370 billion of spending dedicated to renewables and climate resilience. According to a study carried out by researchers from Princeton University, Dartmouth College, Evolved Energy Research, and Climate Impact Consulting, US solar investment could reach $321 billion by 2030 compared with $177 billion before the bill’s signing with the annual deployment of solar increasing by more than ten times its level in 2020 to surpass 100GW by 2030.

Investing in Silver: Opportunities and Risks in the Solar Industry

So with such bullish prospects for the solar industry and silver’s crucial role in its global deployment, how best can an investor position themselves to benefit?

The most obvious way to gain exposure is by buying the metal itself. This can be done either in physical form, via reputable sellers of silver, or in digital forms, such as via Silver KAG, which is a digital currency backed by physical silver.

Each KAG is backed on a 1:1 basis with a comparable amount of silver, offering the protection of a physically-backed product with the flexibility of a digital currency that can be used for everyday transactions. As well as benefiting from any price gains in the underlying value of the silver, holders of KAG also receive a monthly yield based on their spending or holding of the currency.

With huge amounts of silver needed for the solar industry over the coming years, investing in the mining companies extracting and processing the metal offers another route for individuals to benefit from the silver surge. Mexican giants, Industrias Penoles and Fresnillo are two options while investors can also buy shares in NYSE-listed Wheaton Precious Metals, Coeur Mining or First Majestic to name a few.

Finally, investors can choose to gain exposure via silver-focused Exchange Traded Funds (ETFs) which aim to deliver a similar return to the price of silver itself or the silver mining companies. Options here include iShares Silver Trust or Global X Silver Miners ETF. It is worth noting however that investors don’t hold any physical silver via these funds with their money instead held within the fund or trust.

Silver vs. Other Metals: A Comparison in the Solar Industry

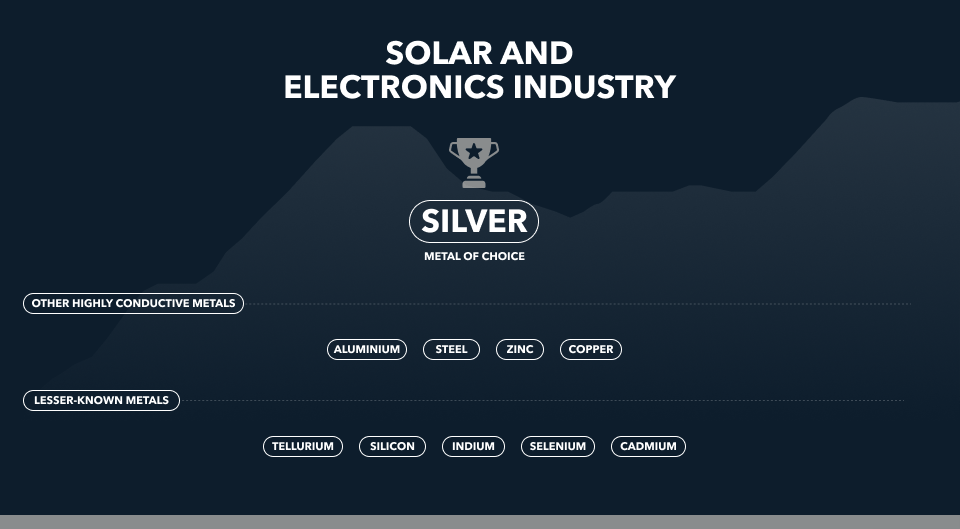

Silver may be the conductor metal of choice within the solar, and indeed the broader electronics, industry but it is far from the only metal required for the manufacturing of solar panels. Aluminium, steel, zinc and that other highly conductive metal, copper, are all needed as are lesser-known metals such as silicon, indium, gallium, selenium, cadmium, and tellurium.

In contrast to most other sectors where silver has a role to play (such as a safe haven asset or in jewellery), solar is a largely gold-free zone. As such, it will be interesting to note the dynamic of the two precious metals over the coming years, with the prospect of the gold/silver ratio narrowing on silver’s bullish fundamental case.

Another trend to follow is the loadings of silver in each photovoltaic cell and the solar industry more broadly. Assuming silver remains in a supply deficit, as it has been for the last five years including the current one, then manufacturers may look to thrift on the amount of metal each panel requires or even contemplate using alternative metals in silver’s place.

The Importance of Staying Informed about the Solar Industry

The solar industry has been one of the key beneficiaries of the energy transition with government policies incentivising the adoption of photovoltaics for businesses and individuals alike. Yet with solar power now price competitive with other energy sources without the need for subsidies, the question is what level of support will the industry continue to receive?

However, given how urgently the world needs to move away from fossil fuel sources, solar looks set for a buoyant future with or without government assistance. Nonetheless, government policies such as the Inflation Reduction Act in the US as well as any developments out of China, where so much of the technology is manufactured, are worth following closely to see if any surges in demand or supply bottlenecks may be created on the back of them.

The Future of Silver in the Solar Industry and Its Impact on Your Investment Portfolio

The sun certainly looks to be shining both on the solar industry and indeed silver’s role within it. Given the bullish growth prospects, the inclusion of silver in an investor’s portfolio makes perfect sense both from the diversification it offers and also by aligning with the single biggest investment story of current times, the energy transition.

So far, silver’s strong fundamental case, driven primarily by the huge rollout of solar technology across the world, has failed to gain full attention with the price instead kept down by macroeconomic factors such as the Federal Reserve’s aggressive interest rate hikes.

As such the metal has failed to climb above $26 an ounce and is currently trading around $24 an ounce. Yet in a few years’ time, the current prices could well look cheap with what manufacturers of 2030 will have to pay to keep pace with the solar surge.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.