Precious metals are stores of value in times of economic shifts and geopolitical uncertainty, but metals such as gold and silver also have various industrial uses, leaving prices tied directly, at least to some extent, to global manufacturing activity.

It’s essential that investors track key data, like leading indicator the Purchasing Managers’ Index (PMI) for a steer on upcoming trends in the world’s major economies.

Keeping on top of these trends is critical, especially with the energy transition era set to change the face of manufacturing beyond all recognition in coming years.

Understanding PMI

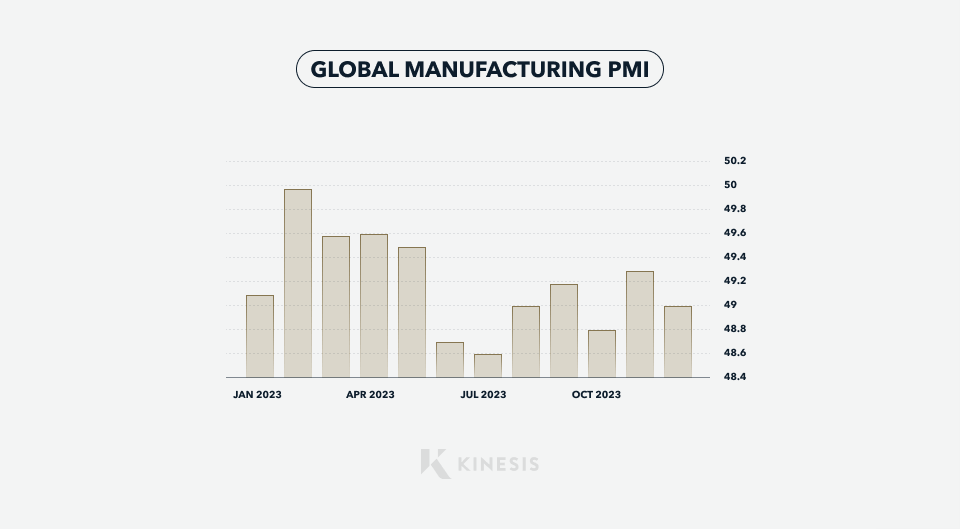

The Purchasing Managers Index (PMI) is the most important leading economic indicator measuring manufacturing activity and services. It acts as a gauge of future economic health and prospects.

PMIs for the major economies, namely the United States, China, and the Eurozone are particularly important and are followed closely by investors and analysts for potentially significant turning points in other key economic indicators such as industrial output, GDP, and employment.

The State of Global Manufacturing

The latest data indicates that global manufacturing remains at a relatively low ebb. Weakness characterised the global economy at the end of last year and, despite financial markets taking heart from signs of an end to interest rate hikes, that tone looks set to continue into the early part of 2024.

In December, eurozone factory activity fell for the 18th month in a row, and with the region’s GDP contracting slightly in the third quarter, a further decline in the final three months of 2024 will signal a technical recession.

Meanwhile, manufacturing activity in China, the world’s second-largest economy, has remained fitful and despite signs of improvement, with the Caixin PMI showing a pick-up in December, the official PMI painted a less optimistic picture recording a third successive month of contraction.

The Caixin PMI comprises a smaller survey focusing more on private companies and exporters, while the official survey from the National Bureau of Statistics (NBS) is much broader and includes large state-owned companies.

Economic Drivers: How Manufacturing Impacts Precious Metals

While precious metals largely are considered a store of value, price moves are still tied to the state of the economy, be that perhaps from overheating or cooling. In addition, all have at least some industrial uses. Platinum and palladium are found in catalytic converters, and though around half of the annual gold demand is taken up by jewellery, its use in consumer electronics and automotive applications is still significant.

Meanwhile, industrial uses account for around half of silver demand and span a broad range of sectors, including solar panels, electrical switches, and chemical-producing catalysts. As such, global manufacturing activity directly affects precious metals demand, and by extension their prices.

But also in an uncertain economic climate, gold’s haven status comes to the fore in a diversified, balanced investment portfolio.

According to Dave Kranzler, gold and silver are “the most effective ways to protect your income and wealth against inflation over long periods”.

Purchasing Managers’ Index (PMI) in Focus

PMIs, published at a country and global level by S&P are designed to give an insight into business conditions and manufacturing activity, with private companies responding to several questions such as the state of their new orders, employment, costs, and factory output.

An overall PMI reading above 50 indicates expansion while anything below that level points to contraction. The company also publishes services PMI, while separately in the United States, the Institute of Supply Management (ISM) releases a monthly non-manufacturing PMI.

Trends in Manufacturing Activities

Trends in manufacturing activities must be closely monitored since they are likely to undergo significant change as part of the energy transition.

In the short term, as 2024 gets underway, the outlook for manufacturing activity remains weak, but PMIs will be important to watch for the first signs of an anticipated upturn as the year progresses.

Data-Driven Insights

For the best overview, investors should track a broad spectrum of data, including forward-looking PMIs, as well as GDP, industrial production, employment, interest rates, and inflation. Currency trends, particularly in the US dollar, are also important to keep on top of your portfolio.

How Manufacturing Influences Precious Metal Demand

Aside from their use in jewellery, coins and as haven assets in investment portfolios, precious metals also have industrial applications, which means prices are susceptible to the vagaries of manufacturing activity and changing trends.

For instance, platinum and palladium demand is tied in part to the automotive sector, with its use in catalytic converters for internal combustion engine (ICE) vehicles. Around half of silver’s demand, meanwhile, stems from the industrial sector, including solar power, electronics, and medical applications, making it more susceptible to industrial demand than gold.

Navigating Manufacturing Trends in Metals

Clearly, whether from the perspective of precious metals’ store of value in turbulent times or simply for their industrial uses, investors should use all tools available to them to navigate trends in manufacturing activity to maximise portfolio performance.

Citations

- https://www.silverinstitute.org/silver-supply-demand/

- https://www.silverinstitute.org/silver-in-industry/

- https://www.gold.org/about-gold/gold-demand/by-sector

- https://www.reuters.com/markets/global-economy-global-factory-activity-ended-2023-soft-note-2024-01-02/

Karen has a distinguished career spanning over three decades in the precious metals industry. She dedicated 11 years of her career as an analyst at the globally acclaimed precious metals consultancy, GFMS, a subsidiary of the London Stock Exchange Group.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.