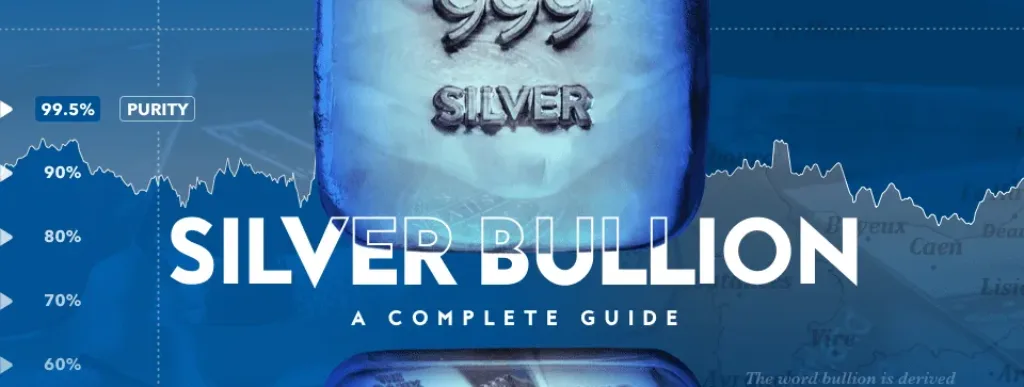

This article provides a guide to understanding silver bullion, exploring the size of the market as well as the different products available to bullion buyers and collectors.

Understanding Bullion

Bullion describes pure metal, usually gold and silver. For a product to qualify as silver bullion it needs to have at least 99.5% purity. The word bullion is derived from an Anglo-Norman French word “bouillon” meaning a melting house, reflecting the melting process silver ore goes through to create the pure silver coin or bar.

Originally, the primary purpose of silver was as a currency with the metal used as the basis for trading across the world. However, the metal was displaced by gold, before it too was replaced by the current fiat system. As such, the attraction in holding silver bullion physically comes from the collector value they provide, as well as them being an investment class.

With bullion therefore ascribed to silver meeting this purity qualification, the difference between silver coins and bars is not the metal they are made of but the different investment approaches they offer. Fundamentally, the weight of the bar or the coin is the predominant driver of the price it will achieve, with the price fluctuating in line with the movements of spot silver.

Bars are a stable asset class, recognized worldwide and easy to trade, offering a direct physical asset that tracks the silver price. Coins too are subject to the fluctuations of silver’s movement on global markets but have the added appeal that certain particularly decorative, historic or rare coins can trade at a significant premium to their underlying weight value.

The Bullion Market

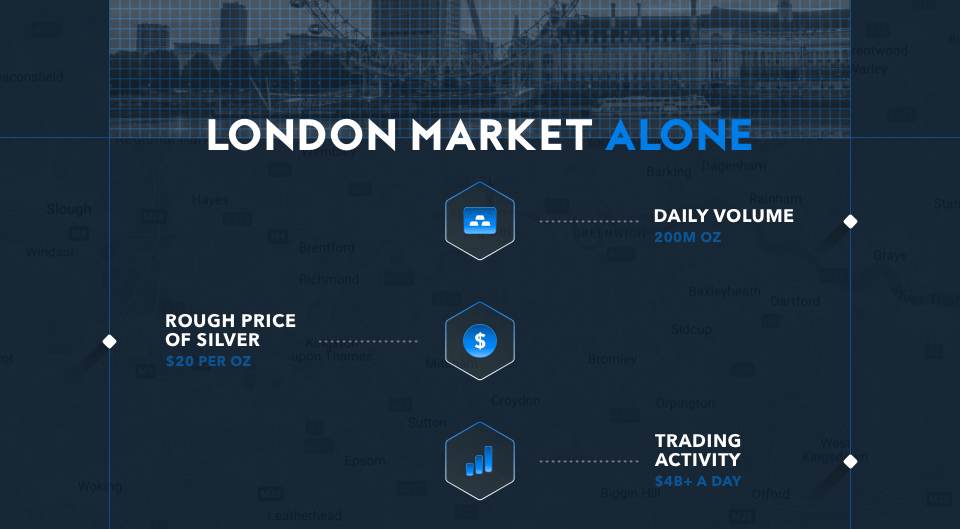

The silver bullion market is enormous with the London market alone generating a daily volume of over 200 million ounces. Assuming a rough price of silver of $20 an ounce, that equates to trading activity of more than $4 billion a day. While this is dwarfed by the size of the gold bullion market, it still provides a hugely liquid market for buyers and sellers to enter and exit easily with a highly transparent price to reference.

Silver is sought after as an investment due to its ability to hold its value over time and as a haven asset at times of crisis or uncertainty in equity markets. In contrast to gold, silver has significant exposure to industry with its qualities as an excellent electrical conductor as well as being soft, ductile and malleable. It is seen in sectors ranging from solar energy, photography and batteries.

Purchasing Bullion

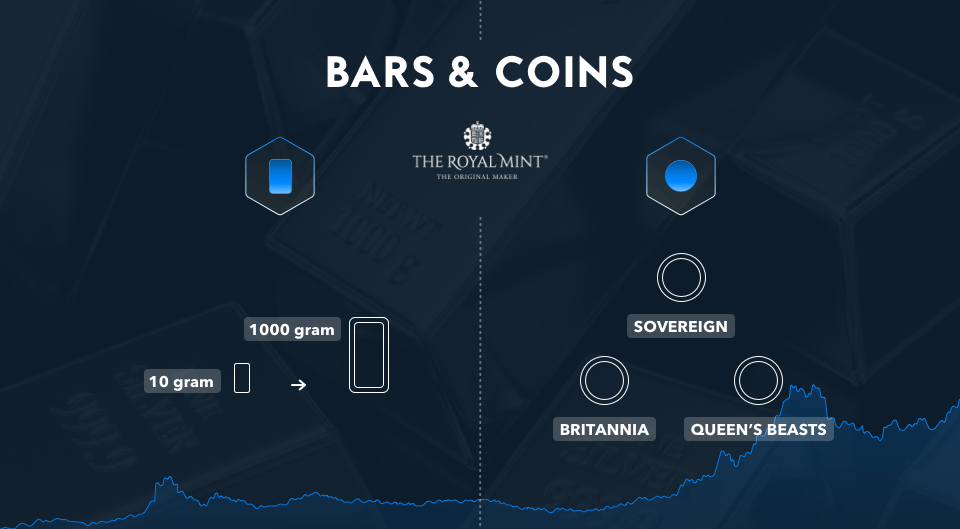

Silver bar and coin bullion are available to buy in a vast range of sizes and with the price of silver significantly lower than the price of gold, investing in silver bullion has a much lower entry point than for gold.

The most popular coins include those from the Sovereign, Britannia and Queen’s Beasts ranges, with a 1 oz coin available to purchase for little more than $20. In the US, the official silver bullion coin is the American Eagle. At the same time, the Kinesis Bullion store produces and manufactures a range of minted fine bullion coins featuring the Egyptian goddess Ma’at, struck in the highest quality of investment-grade silver (9999) available at competitive prices.

While the many different sizes provide a great range of options for a potential investor, the best prices are available for the largest sizes due to the benefits brought by economies of scale. As such the smallest size bars and coins can often cost many multiples of their underlying weight and are more items for gifting purposes rather than as an investment.

At the other end of the scale are the 1,000-ounce silver bars produced by one of the London Bullion Market Association’s Good Delivery refiners. The daily trading of these is the basis of the spot price quoted on markets with these bars often broken down into smaller lots for sale in industries using silver, such as in photovoltaics for solar energy or in batteries for electric vehicles.

In summary, the silver bullion market is highly liquid, with a low barrier to entry and offers investors the potential to hold an attractive physical asset they can hold for investment and collector purposes.

The Kinesis Bullion store offers wholesale and retail investors industry-leading pricing on independently produced bullion coins and bars, with products from the latest bullion series making for a timeless addition to any physical precious metals collection.

Take a look at the Kinesis Bullion collection

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basi