The spot price you see on market tickers around the world is the price that you can buy or sell one ounce of gold for at that moment in time.

Gold (and silver) are among the most actively traded commodities in the world. They’re a key part of many personal and corporate investment portfolios. Check out a gold price chart at any time of the day to see just how dynamic and ever-changing this market is.

Many investors consider both gold (and silver) as key asset classes. They believe that the spot price of both are key indicators of the relative health of the global economy.

What is spot gold?

Traders buy and sell physical gold on specific types of financial markets called ‘spot markets’. A spot market is a particular type of market where traders must present whatever it is they’re selling for immediate delivery. Buyers must be ready to pay for their investments too.

Traders settle these transactions ‘on the spot’, hence the name. Activity on the market sets the gold price internationally in US dollars.

When you buy gold bars or gold coins, the spot gold price directly affects how much you pay for them. Unlike most other commodities, sentiment drives the gold price more than supply and demand imbalances.

When investing in gold, you should factor in the following:

- General risk appetite: Traders’ risk appetites can significantly influence gold’s price over time. When there is a low-risk appetite among market participants, the gold price normally heads higher.

- Central bank demand for gold: This is a very positive price signal. Central banks hoard gold to hedge against inflation and currency depreciation.

- Reductions in interest rates: They can be actual or anticipated drops in rates but they can lead to upward pressure on gold prices.

- Weakening of the U.S. dollar: A drop in the greenback can signal a favourable market for gold price rises.

- Industry demand: This is also a key factor. Manufacturers monitor the price of gold to buy it at the optimum time which can lead to a bounce back in the price.

Another key factor is a looming economic downtown, according to Kinesis head of content, Douglas Turner. He states that:

“For thousands of years, people have looked to gold as a sound investment and store of value. When there’s an economic downturn, a volatile stock market or political instability, gold is an attractive investment.”

The gold spot price is usually quoted in US dollars. However, it’s easy to get a live gold price in any of the world’s major currencies. The relative strength or weakness of individual currencies impacts on how high or low the price of gold is to users of those currencies.

This price is also a reflection of what price gold is being exchanged for in over-the-counter (OTC) markets. If there are more buyers than sellers, then the spot price of gold is likely to rise. If there are more sellers than buyers, the price is likely to fall.

How is the gold price calculated for futures?

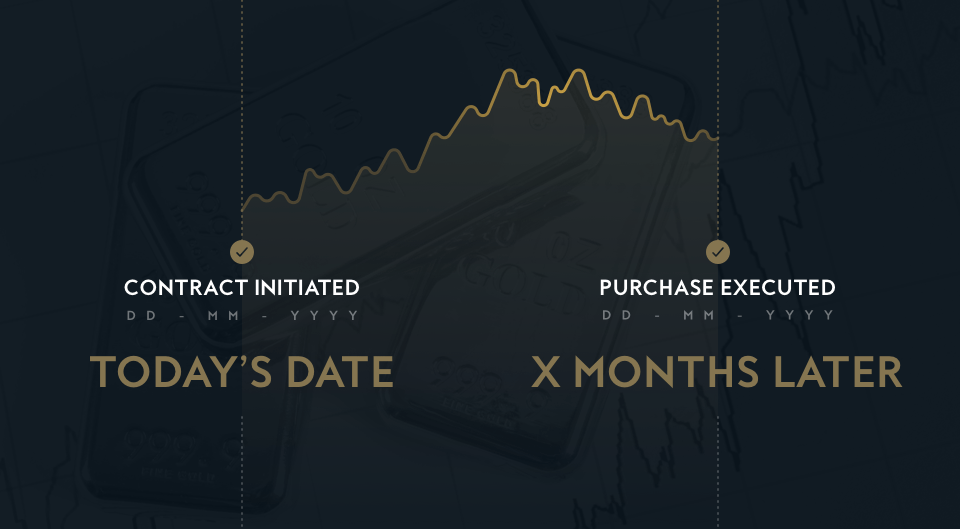

Spot markets determine the buying price of gold now, at this very moment. As well as a spot, or current, price for gold, there’s also an extensive futures market. Instead of buying or selling gold now, you enter into a contract to buy or sell gold at a future date, otherwise referred to as “futures trading”.

These contracts, priced in troy ounces, let you speculate on what the gold price will be in the future. That could be in 24 hours or in 10 years, it’s up to you.

Futures contracts are generally for 100 troy ounces and you can buy them on dedicated, regulated, and highly liquid exchanges like the CME.

Unlike over-the-counter markets, the owner of the gold bullion doesn’t deliver to you when the contract expires. Instead, traders sell off the gold they have “bought” on a futures contract. They buy back any they have “sold”. At this point, they make their actual profit on the trade or have to pay back the losses.

Because you don’t need to pay or deliver the gold when you agree to the contract, traders can build up large positions. These positions can be many times greater than if all trades had to be physically backed up.

The potential gains are much greater if the price of gold moves in the right direction over the timeframe of the contract. Equally, the potential losses are much greater if the price falls.

How is the gold price determined?

As well as spot gold and futures prices, there is also the daily London Bullion Market Association (LBMA) gold price. This is the global benchmark price for physically delivered gold in London, which traders set twice a day.

Originally, this involved four banks meeting twice a day in a room near the Bank of England. They would carry out a verbal auction that would determine the price. Over time, this evolved from an auction over the phone to now being fully electronic. ICE Benchmark Association now administers this. Every day, 16 direct participants contribute towards deciding the price.

This takes place at 10:30 am and 3 pm London time. ICE conducts a series of 30-second auctions until they achieve a balanced price. They publish the price of gold in US dollars and convert the price into sterling and Euros based on the exchange rate at the time.

How to keep track of the gold price

If you want to stay up to date with the gold price and get the latest news on the gold market, you’ve got the following options:

- Websites and digital platforms: Get real-time updates on live gold prices only. Many sites feature gold price charts that track fluctuations in the gold price throughout the day, week, month, or even year.

- Mobile apps: Download one of the many apps that allow you to monitor the gold and silver markets in real time.

- News and financial channels: Most major news networks provide regular updates on gold prices. During market turmoil, they often concentrate on gold as a bellwether for the economy.

- Brokerages and financial advisors: They can also guide you on how the price might affect your investment portfolio.

- Local dealers: Local dealers can be an excellent resource. They can offer insights into both global trends and local market conditions.

You can view the live price of gold with Kinesis. We also have live price charts for tracking spot silver, too.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwashing while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.