The recent banking crisis prompted a rush to gold from safe-haven-seeking investors and saw the price of gold climb above $2,000 an ounce.

But for those individuals now contemplating buying gold for the first time, it is important to consider how you are going to store your golden asset and which form of gold best fits your investment strategy and access requirements.

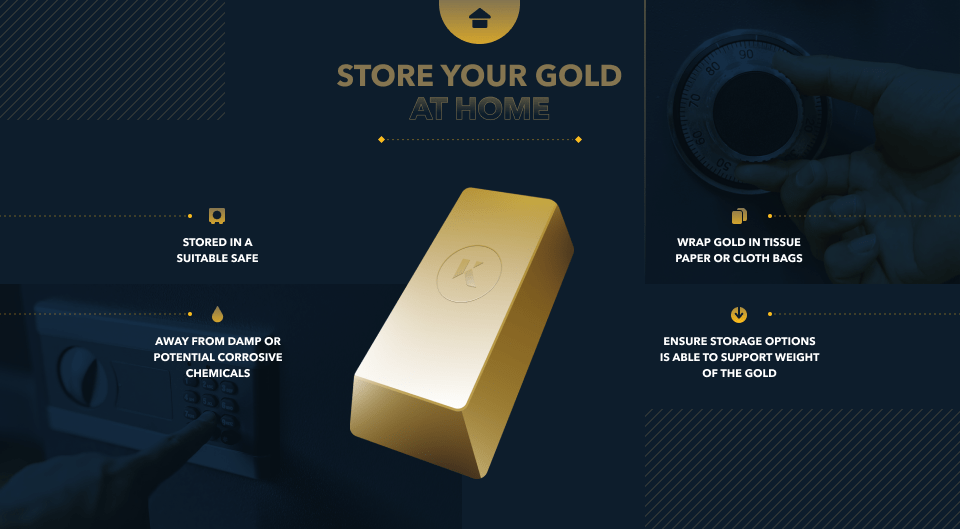

How to store your gold at home

One of the attractions of gold is its lack of counterparty risk with an individual able to buy and sell the metal without the need for an intermediary. A small holding of gold bars or coins can be stored at home, providing the holder with immediate access as and when needed but this does come with its own risks.

Any gold should be stored in a suitable safe and located in a stable environment away from the damp or any potentially corrosive chemicals. While gold is largely inert and retains its shine well, it is worth providing that extra layer of protection by placing jewellery, coins or bars in plastic coin cases or wrapping items in tissue paper or cloth bags. This will also protect the gold from dents or scratches that could potentially devalue the items.

It is also worth considering the weight of any collection and ensuring the storage option is sufficiently strong to support gold’s dense quality which means a considerable amount of weight can be packed into a relatively small-sized object.

While storing gold at home provides ease of access, it does carry the highest risk of theft with no protection if the items were to be stolen. There is also the transit risk of carrying gold from home to a dealer and vice versa.

Storage in a bank deposit box

As a result of these added security risks of home storage, many people choose to store their gold in safety deposit boxes at banks. This can be a low-cost alternative that should provide peace of mind that an individual’s gold is safely stored.

However, this peace of mind comes at the expense of accessibility with an individual beholden to the bank’s opening hours to take out their gold. It is also worth confirming that the gold held in these boxes lies outside of the bank’s assets so that in the event of the bank collapsing, any items held in its deposit boxes aren’t considered collateral to pay off those debts. Given the high-profile recent failures of three US banks, this element should be foremost in any investor’s mind.

For an added layer of security, gold can be stored in vaults. However, this extra protection comes at a cost, making it less viable for small holders of the metal.

How to store your gold in a digital format

For today’s investors, gold is now available in a digitalised format via exchange-traded funds or other physically-backed assets such as Kinesis’s groundbreaking KAU gold-backed digital currency. These options eliminate the need for paying for expensive storage or worrying about the effectiveness of home security but not all digital offerings are equal.

Exchange-traded funds, or ETFs, have proven a very popular, low-cost option for gold-seeking investors. However, in contrast to physical ownership, these funds track the price of gold rather than providing ownership of the underlying asset. For an investor seeking diversification away from the financial system to provide protection in the event of a market crash, an ETF is arguably just another product of the same financial system so doesn’t match up to the physical assurance provided by physical ownership. For a more detailed comparison of physical gold versus Gold ETFs, check out this article here.

Bridging the divide between the time-honoured physical gold ownership that has endured through millennia and the modern digital take, KAU provides the best of both worlds. Each ounce of KAU is backed on a 1:1 basis by an ounce of gold securely stored in one of Allocated Bullion Exchange’s insured vaults in locations around the world. The gold stored is fully audited and redeemable so that an individual can claim their individual holding.

The holder of KAU holds the full legal title of the underlying quantity of physical gold and silver. At no point, will the bullion behind Kinesis’ digital currencies ever appear on the balance sheet of Kinesis or Allocated Bullion Exchange (ABX). Resultantly, neither Kinesis nor ABX has any direct claim on the metals, they simply safeguard the metals within their vaults, on the holder’s behalf, free of charge.

As well as providing all the security and protection of physical ownership, KAU provides the added benefit of delivering a monthly yield to its holders as well as their utility as money for purchasing everyday items – something that physical gold lacks. KAU is truly the gold storage option fit for modern investors – flexible, safe and accessible.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.