Silver has enjoyed a sharp reversal of its fortunes on the back of the drama playing out in Russia following the aborted rebellion by Yevgeny Prigozhin’s Wagner Group.

Suddenly market attention has moved away from interest rates and onto what is happening in Russia, a key producer of many of the world’s commodities, including silver, but also a nuclear superpower that has been responsible for the first war in Europe for a couple of decades.

The initial market reaction has been clear to see with investors looking to get risk off the table but with Russia sitting outside most people’s portfolios following its invasion of Ukraine last year, the direct impact to investors is much more muted.

However, Russia’s geopolitical importance means that all investors are still impacted by how this direct threat to President Vladimir Putin’s reign resolves itself with money likely to be kept away from riskier assets until there is more clarity. This is likely to keep silver supported in the short-term both from a safe haven appeal perspective but also a potential fundamental perspective if the situation were to impact on supplies and therefore exacerbating the current deficit further still.

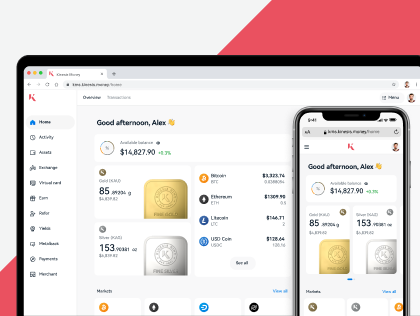

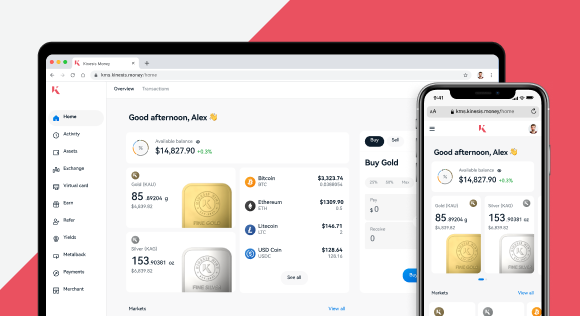

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.