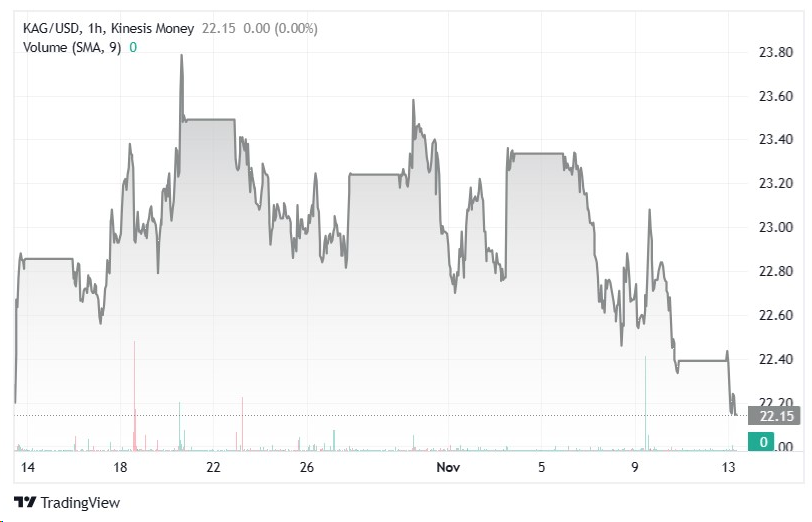

Silver closed last week with a bearish note, declining to $22.2 an ounce. In today’s early trading, this mood has been confirmed, with the spot price continuing to slide in the region of the $22 mark. The (modest) recovery of the greenback and the gains posted by the U.S treasury are pressuring the non-yielding assets, such as silver.

From a technical point of view, in the last 6 months, the price of silver has been posting declining tops and lows, an indicator of bearish trend. This mood has been confirmed in the last few days, when the price has been unable to surpass the resistance zone of $23.5, sliding to the current levels of $22.2.

We should note that the price is currently trading close to a key support zone of $22.2 and it is crucial for silver holding above these levels. Indeed, a hypothetical rebound from this support zone, would increase chances of seeing again the precious metal testing the resistance zone of $23.5-23.7.

Vice versa, a fall below $22.2 would open the doors for new retracements, with a potential target to $20.8-21, the area which has stopped the price of silver last month.

Analysing the scenario on other precious metals, it is interesting pointing out the sharp fall of palladium, which has returned below $1,000 per ounce. The metal, massively used as a catalyst for auto vehicles, has been progressively replaced with the cheaper platinum (now trading at around $860) and analysts are no longer forecasting a deficit in the palladium production for the next few years. From the historical high of $3,440 per ounce, reached just 18 months ago when Russia invaded Ukraine, palladium has lost around 70% of its value.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.