Silver prices held steady on Friday, showing little change from the previous day’s levels.

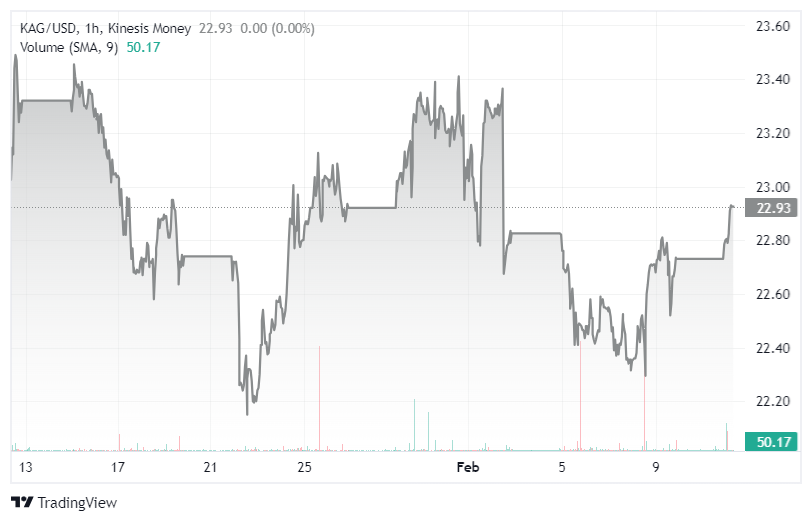

Prices did show significant within-day movement, briefly rising as high as $22.72 an ounce before falling as low as $22.38 an ounce. However, silver finished the day trading at around $22.60, more or less level with Thursday’s close.

Friday’s action means silver capped the week in strong form, having tested the downside at just above $22.15 on Thursday.

Silver’s bullish performance at the end of the week contrasted with gold prices, which came under pressure towards the end of the week as the market mulled the risk of interest rates staying higher for longer.

On the demand side, China added a record 216 GW of solar power capacity in 2023 alone, equal to 14% of the world’s total installed capacity, S&P Global Commodity Insights reported on February 8. This is significant, as solar energy is one of the major demand sources of silver in the industrial sector, with silver set to benefit over the long term as declining uses of the metal, such as photographic film, are replaced with surging demand from clean energy as the low carbon energy transition powers ahead.

Looking ahead, Monday will see the release of Indian industrial and manufacturing production figures for December, offering a fresh take on industrial demand in the world’s largest consumer of silver.

Further ahead, Tuesday will see the release of US inflation figures, offering another indicator for monetary policy direction by the US Fed.

Frank’s experience covering the commodities markets spans 22 years, with a particular specialism in metals, carbon and energy markets. He has worked as a senior editor for S&P Global Commodity Insights (formerly Platts) and before this, at ICIS-LOR, a part of Reed Business Information (Reed Elsevier), where he covered the petrochemicals markets from 2003 to 2005.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.