Silver prices edged lower Thursday, to trade a few cents either side of $23.70 an ounce, down from a high of $23.95 an ounce Wednesday.

US durable goods orders fell 5.4% in October, according to data released Wednesday – posting the second largest fall since April 2020. The figures included a drop in orders for primary metals, electrical equipment, appliances and components, casting a negative tone for industrial demand for silver in the US.

The financial markets were subdued Thursday due to the US Thanksgiving holiday which was also set to affect markets on Friday with an early close of trading, creating lower than normal liquidity.

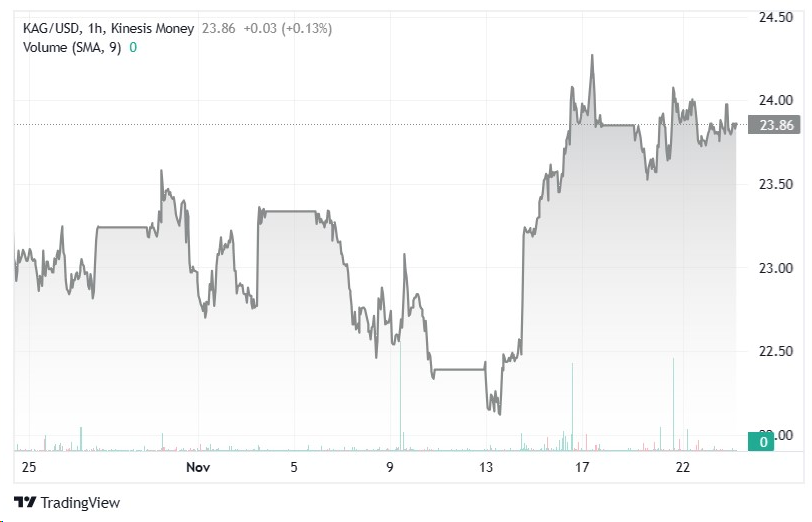

Despite the slight dip on Thursday, silver prices were still trading well above their lows of around $21.90 seen November 13th. Recent signs that interest rates may have already reached a peak have provided support for precious metals, although an extended period of high rates could make it more difficult for prices to push into higher territory.

The slight pull-back in silver prices follows a sharp rally to just above $24.00 on November 17th – a level not seen since early September.

Looking ahead, Friday will see a speech by ECB President Christine Lagarde which may provide further clues on the central bank’s outlook, and also the release of S&P Global Manufacturing PMI flash data, providing a handle on demand from the industrial sectors.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.