Key Takeaways

- Gold is the largest asset in terms of market cap, surpassing $15 trillion, illustrating its unparalleled stature in the financial landscape.

- The market cap of bullion significantly overshadows that of US tech behemoths such as Microsoft, Amazon, and Apple. It is tenfold larger than that of Bitcoin, showcasing its vast economic footprint.

- Silver commands a prominent position with a market cap exceeding $1.5 trillion, underscoring its importance alongside gold in the hierarchy of valuable assets.

Gold Market Cap

Gold is by far the biggest asset in terms of market capitalisation. But what does this mean for investors, and how does it influence their decisions? This article will explain what market cap is, how it is calculated and how investors can use this metric to evaluate stocks and commodities such as gold and silver.

What is Market Cap?

Market capitalisation, often referred to as ‘market cap’, is an essential metric for ranking and evaluating companies and may be particularly useful for novice investors. It indicates company size, providing insights into an investment’s stability and risk profile. Typically, larger companies, with their higher market caps, are perceived as more stable and capable of weathering market volatility. This stability is often attributed to their substantial financial reserves and more efficient access to credit markets, enabling them to manage fluctuations more effectively than their smaller counterparts.

When comparing investment options, such as gold, versus the largest stocks by market cap, it becomes evident that bullion has unique advantages. However, as we delve deeper, the role of market capitalisation in shaping investment strategies and risk assessment becomes clear, illustrating why it’s a crucial consideration for investors.

How do you calculate Gold and Silver Market Capitalisation?

Let’s begin with the fundamentals: how do you determine the market caps of gold and silver? Typically, the market cap of gold is calculated by multiplying the current spot price of gold with the total amount of the precious metal mined throughout history.

According to figures released by the World Gold Council, gold reserves above ground are around 210,000 tonnes, equal to more than 6,700,000,000 ounces.

If we multiply this number by $2,300 (spot price of gold per ounce), we obtain a gold market cap above $15 trillion.

A similar procedure calculates the current silver market cap above $1.5 trillion (10% of gold’s market cap).

Gold vs NASDAQ Mega-Cap

Have you ever wondered how gold compares to the world’s largest stocks, such as Microsoft, Amazon and Apple, which are the giants of NASDAQ? When we look at their market capitalisation, the answer is clear – gold wins hands down, even against the mega-caps of Wall Street. The market cap of Microsoft, which is currently the biggest company in the world, is only slightly above $3 trillion, which is 80% less than the market cap of gold (around $15 trillion). To match the market cap of gold, we need to imagine an impossible merger between the seven largest companies in the world by market capitalisation, namely Microsoft, Apple, Nvidia, Saudi Aramco, Alphabet, Amazon and Meta Platforms.

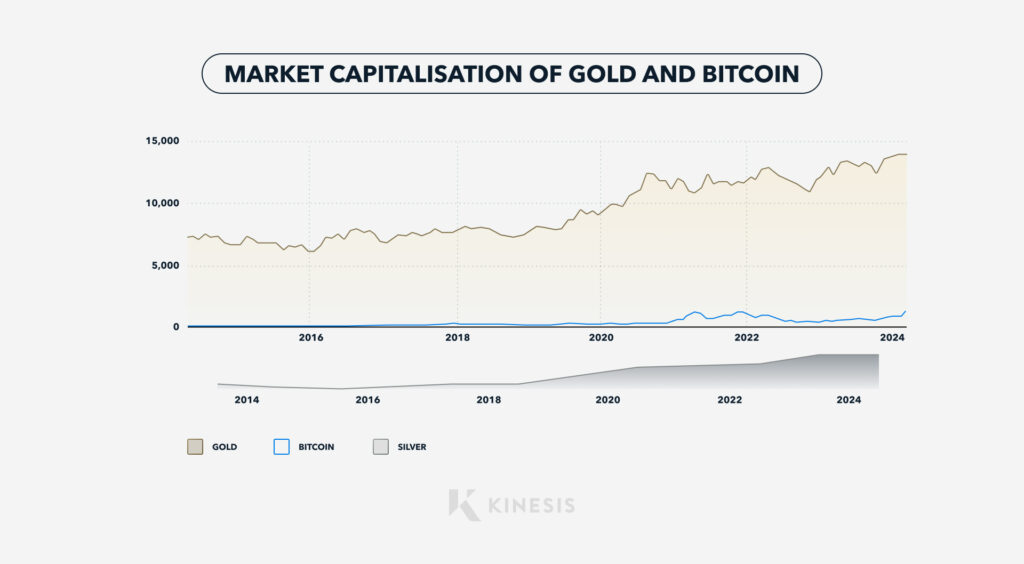

Gold and Bitcoin Market Cap

In the last few years, bitcoin has massively increased its nominal value to over $70,000. Despite this, its market cap is still more than ten times smaller than gold’s, at around $1.4 trillion.

In other words, for the cryptocurrency to reach the market cap of gold, its price would need to be around $700,000, assuming the gold price remains constant.

What Does Market Cap Mean for Bullion?

A market cap above $15 trillion indicates the solidity of gold as an asset that has been crucial for millennia. Gold is primarily used in jewellery, industry and the financial sector, but it also represents a growing percentage of central bank reserves (particularly for emerging markets).

According to the World Gold Council, “Jewellery makes up almost half of the above-ground stocks, while gold in investment form accounts for almost a quarter”.

It is also interesting to note that the physical financial gold market – made up of bars, coins, gold ETFs and central bank reserves – is worth more than $5 trillion (around 35% of the total).

The Role of Gold

Investors often look to gold as a hedge against inflation or market turmoil. Historically, gold has demonstrated an ability to maintain its value, or even appreciate, when stocks decline, thereby enhancing its market capitalisation during downturns in the stock market or economic recessions.

When considering the benefits of gold, it’s also important to highlight its unique attribute: unlike government-issued currencies, gold cannot be produced at will by central banks. This limitation contributes to gold’s price stability, as the annual increase in gold supply from mining is slow, growing by less than 2% each year. This controlled supply growth helps preserve gold’s value over time.

Silver Market Cap

The market cap of silver stands at approximately $1.5 trillion, placing it among the top ten largest assets worldwide. Despite being more abundantly mined throughout history than gold, silver’s lower value – about 1/88th that of gold – results in a smaller market cap. Nonetheless, the market cap of silver is notably significant. It surpasses the combined market caps of Novo Nordisk (the biggest European company by market cap) and Tesla combined. For further perspective, silver’s market cap exceeds Meta Platforms’ and is about 20% higher than the total value of Bitcoin. This highlights silver’s substantial presence in the global asset market.

Market Caps as an indicator for Gold and Silver Investment

When it comes to utilising market capitalisation as a specific indicator for investing in gold and silver, there aren’t targeted strategies unique to these metals. Instead, investors might find it more straightforward to rely on the spot price or comparative ratios, such as the gold – silver ratio, to determine if one asset appears overvalued relative to the other. The principles for analysing market cap movements remain largely consistent across different assets.

However, gold’s substantial market cap reminds us of its enduring value and stability. This characteristic underscores why gold is often considered a crucial component of diversified financial portfolios, reflecting its reputation for reliability and potential to safeguard value over time.

Mike is a market strategist and media commentator with 30 years of experience analysing precious metals markets. He developed his expertise working as an investment banker in emerging markets such as South Africa, Russia and Chile. His focus on precious metals was extended through subsequent work within private wealth management and his own research consultancy. During this time, he covered the gold, silver, platinum and palladium markets.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.

Read our Editorial Guidelines here.