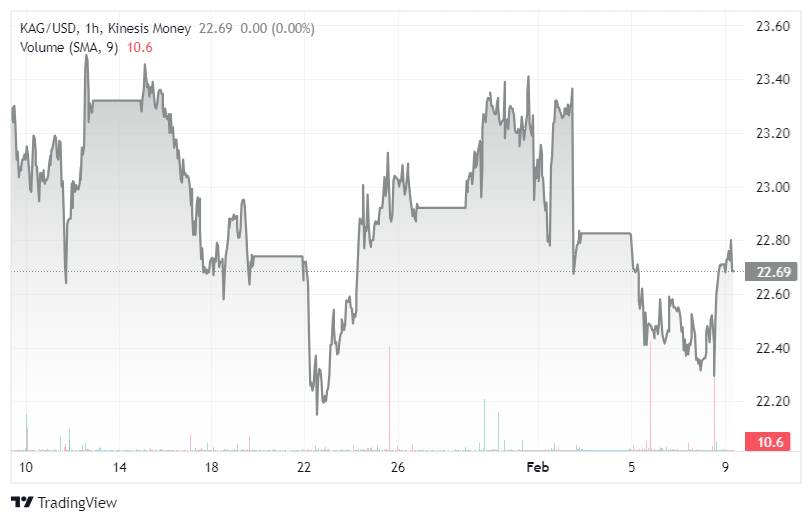

Silver prices put in a strong performance on Thursday, climbing back to levels seen at the start of the week, after seemingly finding support at around $22.20 an ounce.

Prices rallied as high as $22.64 an ounce on Thursday, compared with around $22.20 an ounce late Wednesday. After a rather bearish week overall, silver’s gains took prices back to levels last seen in early trades on Monday.

Earlier in the week, prices fell to a two-week low and spent the rest of the week in consolidation mode, showing little conviction in either direction. This may have been taken as a chance to step in on the buy side among traders with a bullish outlook over the longer term.

Silver’s relative strength on Thursday was at odds with gold prices, which edged slightly lower towards the end of the week.

Looking ahead, Monday next week will see the release of industrial and manufacturing production figures for India in December, providing a fresh update on the country’s industrial activity. India is the world’s largest consumer of silver, and while much of that demand comes from the jewellery and investment sectors, approximately half of global demand comes from the industrial sectors, in applications such as electronics, batteries, solar panels, nuclear energy and medical devices.

Further ahead, Tuesday will see the release of US inflation figures, providing the markets with the latest gauge on the likely direction of monetary policy by the US Fed – a key factor for precious metals prices.

Frank’s experience covering the commodities markets spans 22 years, with a particular specialism in metals, carbon and energy markets. He has worked as a senior editor for S&P Global Commodity Insights (formerly Platts) and before this, at ICIS-LOR, a part of Reed Business Information (Reed Elsevier), where he covered the petrochemicals markets from 2003 to 2005.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.