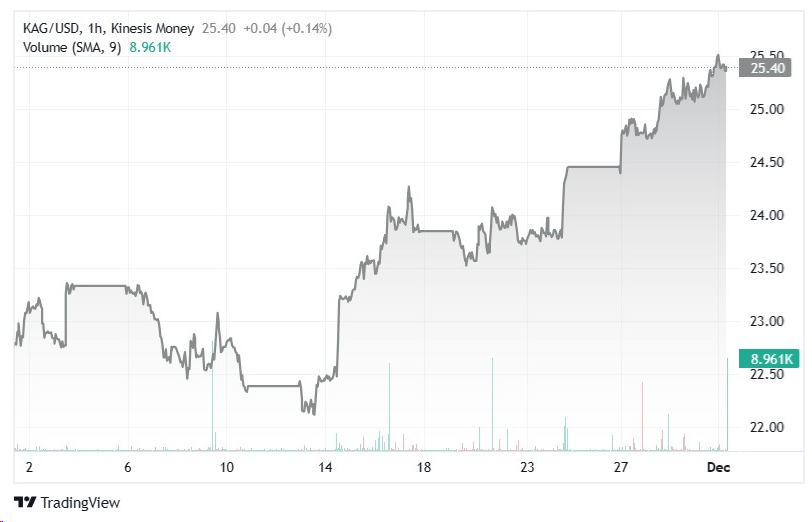

Silver prices continued to push higher Thursday, rising as high as $25.33 an ounce – their highest price since early September. The latest gains put silver within striking distance of its highs of over $26.00 an ounce seen in April.

Bullish moves in gold have provided recent support for silver prices, with both precious metals taking a lift from a weakening of the US dollar. However, silver bucked the intraday trend Thursday, continuing to post gains even with gold prices pulling back from recent highs.

Data on market fundamentals continue to point to a supportive environment for silver prices. Estimates suggest the global market will face a supply deficit of approximately 140 million ounces in 2023, and this coming on the back of two previous years of supply shortfall.

The current environment for monetary policy is also providing a stimulus for silver prices. During times of stable interest rates, when central banks believe they have inflation under control, the silver price could be expected to pay more attention to underlying supply and demand fundamentals.

However, when central banks are taking decisive action to raise or lower interest rates, as seen in 2022 and 2023, this can become a dominant factor driving silver prices. The prospect of potentially lower interest rates in 2024 is a supportive element for the grey metal as it reduces the opportunity cost of holding non-interest-bearing assets.

On the economic data side, Friday will see the release of US ISM Manufacturing PMI data, providing clues on the state of US industrial activity in November.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.