This article will explore the historical relationship between presidential elections in the United States and fluctuations in the price of gold. This includes patterns and trends in the gold price observed during presidential election cycles and how factors such as political uncertainty, economic policies and investor sentiment surrounding elections might affect the gold price.

Gold and the Election Connection

The relationship between presidential elections and the price of gold is multifaceted, driven by a confluence of economic, political, and psychological factors. Understanding this interplay could give investors an edge in navigating the volatility of financial markets and investing or trading gold and silver during election cycles.

Historical precedent suggests that gold prices may exhibit a degree of sensitivity to the perceived policy preferences of presidential candidates. Proposals advocating for fiscal stimulus and accommodative monetary policy tend to buoy gold prices, while pledges of fiscal austerity or tighter monetary reins may exert downward pressure on gold.

To comprehend the impact of presidential elections on the price of gold, one must first delve into history. Throughout history, gold has served as a barometer of political uncertainty and a refuge in times of crisis. In the context of presidential elections, gold often experiences heightened volatility as investors grapple with the uncertainties surrounding potential policy shifts and their ramifications for the economy. This volatility stems from a combination of factors, including fiscal and monetary policy proposals put forth by candidates, geopolitical tensions, and broader market sentiment.

Economic Policies: Shaping Gold’s Path in Elections

Presidential candidates frequently espouse divergent economic policies, ranging from fiscal stimulus measures to taxation and regulatory reforms. These policy proposals can exert a profound influence on investor sentiment and, by extension, the price of gold.

For instance, promises of expansive fiscal spending and loose monetary policy tend to buoy gold prices, as investors anticipate a debasement of fiat currencies and seek refuge in tangible assets. Conversely, proposals for fiscal austerity or tighter monetary policy may dampen gold’s appeal, as investors pivot towards riskier assets in search of higher yields.

Furthermore, the rhetoric and campaign promises of presidential candidates can shape market sentiment, influencing investor perceptions of future economic conditions. Uncertainty surrounding the outcome of the election and its potential implications for economic policy can fuel volatility in financial markets, prompting investors to flock to safe-haven assets like gold.

Investor Sentiment: A Key Player in Gold Prices

The perceived instability stemming from geopolitical uncertainty prompts investors to seek refuge in assets perceived as immune to geopolitical upheavals. Gold, with its intrinsic value and status as a universally accepted form of currency, often emerges as the preferred safe haven during times of geopolitical turmoil.

Beyond the realm of economic fundamentals and geopolitical developments, the price of gold is also influenced by psychological factors such as fear, uncertainty, and market psychology. Presidential elections, with their inherent unpredictability and potential for regime-changing outcomes, exacerbate these psychological drivers.

The mere prospect of a change in leadership can sow seeds of doubt and apprehension among investors, prompting them to adopt a defensive posture and allocate capital towards safe-haven assets like gold. This flight to safety reflects not only concerns over potential policy shifts but also a broader sense of unease surrounding the direction of the economy and financial markets.

Moreover, the media circus surrounding presidential elections amplifies emotions and stokes investor anxiety, leading to heightened volatility in asset prices. In such an environment, gold often serves as a psychological refuge, offering investors a sense of security amidst the turbulence of electoral politics.

Historical Trends: What the Data Reveals

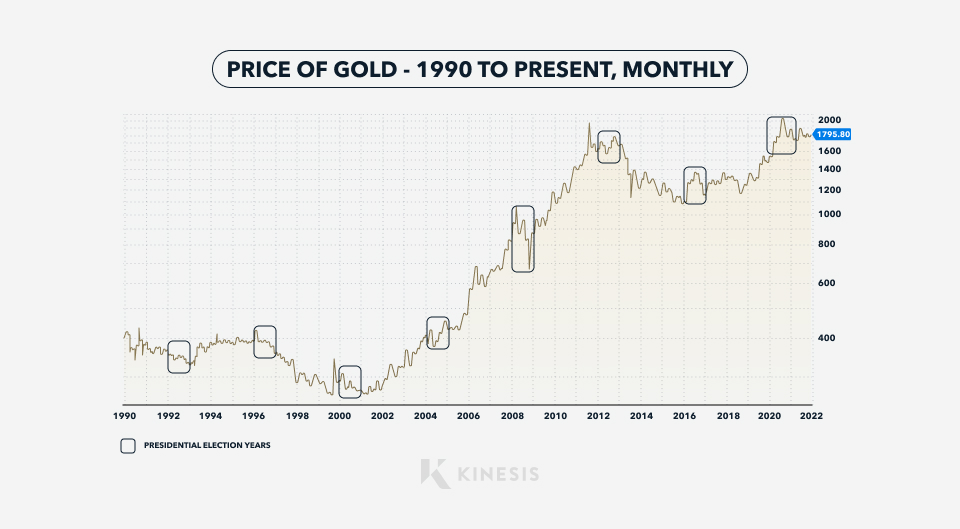

The chart below shows the price of gold from 1990 to present on a monthly basis. The Presidential election years are marked by the boxes:

Note that from 1990 to through the 2000 election, the gold price was still in its 20-year secular bear market that commenced in 1980. In two of the election years, the price declined (1992 & 2000) and in the 1994 election year the price was flat. For the election years from 2004 to 2020, the gold price rose in two of the years (2004, 2016 & 2020) and declined in the two other election years (2008 & 2012). Also note that the precious metals have been in a secular bull market since 2001.

I would thus argue that, at least for the last 34 years in which there were seven presidential election years, it is inclusive as to whether or not the election-year cycle materially or was the predominant factor that influenced the price of gold (and silver).

While presidential election cycles increase the level of price volatility for gold and silver, in my view it’s more important to follow the money: watch what the Fed is doing with systemic liquidity. It’s understood that the Fed propagates loose financial conditions ahead of a presidential election year.

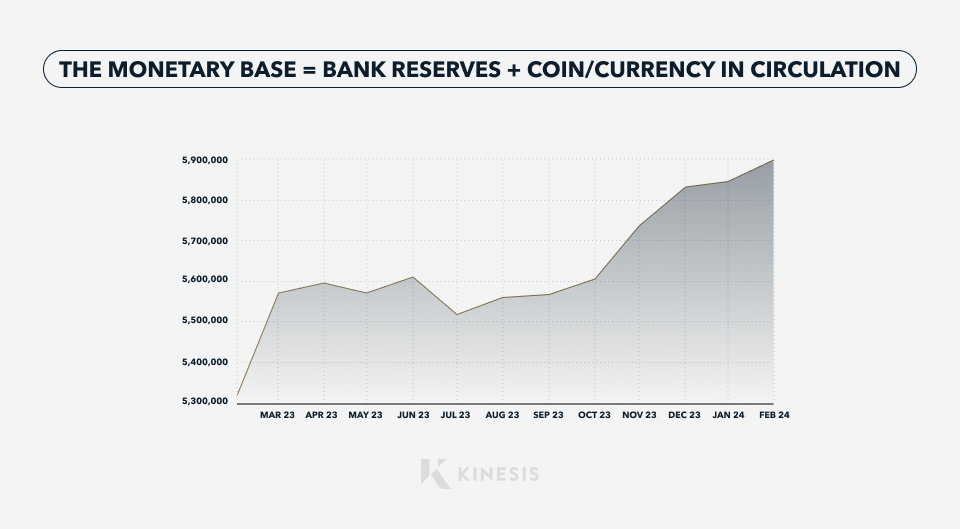

As an example, the U.S. Monetary Base has jumped nearly 10% since March 2023.

The Monetary Base consists of bank reserves plus coin/currency in circulation. It is considered the most powerful form of money supply. The increase in the Monetary Base along with the considerable easing of financial conditions over the last year explains why the S&P 500 is up 35% and gold is up 20% since early March 2023.

Thus, in my opinion and based on my interpretation of the data, the movement in gold and silver that occurs during a presidential election year is attributable to whether the precious metals are in a secular bull or bear market and to the actions taken by the Fed, more so than the election cycle itself.

In that regard, and given that the primary motive for investing in gold and silver is to protect wealth from the ravages of fiat currency devaluation, the most effective strategy for buying and accumulating the precious metals is to buy measured amounts on a regular basis and plan to hold your metal for a long time.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.

Read our Editorial Guidelines here.