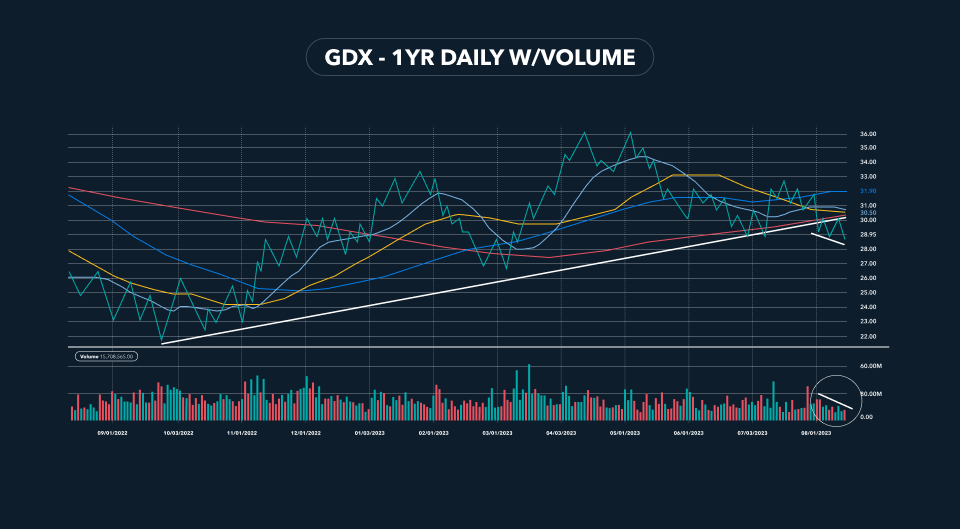

The large-cap mining stocks per the GDX have been in an uptrend since the end of September 2023.

At the beginning of August, GDX traded below the uptrend line from late September. However, the month of August is typically one of the lowest trading volume months of the year, particularly in the precious metals sector.

The big decline in volume highlighted in the chart below reflects a considerable lack of investor and trading interest in mining stocks, which is consistent with seasonality. Although, it also means that there’s less capital to “soak up” any motivated selling.

The drop in GDX below the uptrend line appears to be a “fake-out” move of sorts. I am currently allocating more capital systemically to both physical gold and silver, as well as to junior mining stocks.

Is a larger cyclical bull market move coming?

One of the reasons I believe the move in GDX since September is the beginning of a larger cyclical bull move in the sector is that the junior micro-cap project development stocks have not yet participated in this move.

This is a good thing – I’ll explain in a moment.

The move in large caps has been somewhat “stealth” – meaning no one has been paying attention. This is despite the fact that we’re ten months into this uptrend, which gives it the potential for sustainability and scale.

Recall in 2016 and 2020, the two previous big rallies in the sector that were sharp and short. These both lasted just seven months and five months, respectively. The junior explorers were by far the best performers. This reflects the fact that both of those rallies were driven primarily by momentum-chasing hedge funds and drooling retail speculators. As such, they were “low-quality” moves, which is why they fizzled out so quickly.

In comparison, the current uptrend in the sector has not been pockmarked with speculation and momentum-chasing.

A good comparison is the cyclical move from late 2008 to mid-2011. It started off climbing the proverbial wall of worry, starting in late October that year. The juniors lagged, reflecting scepticism toward an emerging massive bull run in the sector. After the large-cap miners screamed higher, with GDX more than doubling in the last two months of 2008, the juniors started to get a bid that eventually led to massive gains in the entire sector.

These characteristics in the mining stock, since the large/mid-caps began that uptrend in Q4 last year while the risky, speculative mining stocks have languished, is thus why I believe this current uptrend in the sector has a chance to become a sustained, cyclical bull move.

Geopolitical impact

In support of the upcoming move higher, Russia announced at the end of June that the Moscow Exchange will soon roll out trading in perpetual gold futures.

This follows from the launch of quarterly settled gold futures on June 28th. The contracts settle for physical gold in rubles. The lot size is 1 gram and the strike price is tied to an index of the price of gold priced in rubles. The contracts settle in September, December, March and June.

In mid-June, Saudi Arabia announced that it wants to build its own gold refinery. The UAE is already established as a gold trading and refining hub in the Middle East. In fact, over the last 20 years, Dubai has become one of the biggest gold-trading hubs in the world, with the UAE being one of the largest gold-importing countries in the world.

From West to East

I do not believe that these developments will present any immediate threat to the price-setting hegemony of the LBMA and Comex. However, it’s another indication that the physical gold market is shifting from the West to the East. Keep in mind that these countries take physical possession of the gold they accumulate rather than leaving it for “safekeeping” in London vaults.

Eventually, I believe that the physically settled gold and silver contracts now trading in Russia and China, along with the physical gold trading already established in Dubai, will put upward pressure on the global price of gold and silver.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.