This article will explore the relationship between the prices of gold and silver and the U.S. dollar. Since the price of gold and silver are highly correlated, any reference to gold also includes silver.

The commonly accepted view is that gold and the U.S. dollar move inversely, as mentioned in this article published on what drives the gold price:

“Gold is generally a dollar-denominated asset, meaning the value of gold is priced in U.S. dollars. Dollar-denominated assets typically have an inverse relationship with the value of the U.S. dollar. Therefore, if the value of the dollar decreases, the value of gold will increase and vice versa.”

However, the evidence over the last fifteen years contradicts the common perception of the relationship between gold and the U.S. dollar.

While it holds up over certain time-frames, the evidence shows that, since 2008, both the price of gold and the U.S. dollar have moved higher and have generally been positively correlated.

Historical Data Analysis

In 1971, the U.S. government ended the ability of foreign investors to redeem their Treasury holdings into gold held by the Federal Reserve, thereby completely disconnecting the world’s monetary from a Gold Standard.

Since then, the U.S. dollar has lost 98.2% of its value against gold. In 1971, before the Fed closed the gold window, the price of gold was fixed at $35 per ounce. Along with the removal of the convertibility of gold into dollars, the price of gold was allowed to be set by the market.

The most commonly referenced value for the U.S. dollar is the U.S. dollar index. This index is comprised of varying weightings of the Euro, Yen, British pound, Canadian dollar, Swiss franc and Swedish krona. This index started in 1973 with a base value of 100.

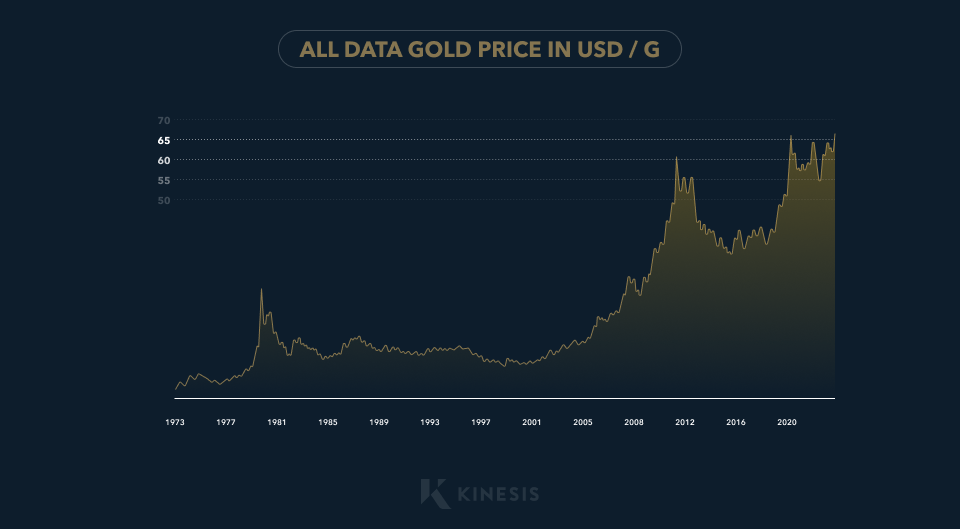

At the time of writing, the dollar index today is 102. Yet, the price of gold since 1973 has risen from an average price of $97 to $2,045 (as of December 20, 2023). Over these fifty years, the price of gold has risen 2100% whereas the value of the dollar index has gone up by just 2%.

During this time, there have been periodic intervals when gold and the dollar moved inversely and, similarly, there have been intervals when both assets were positively correlated. The only definitive assertion that can be said about the relationship between gold and the dollar is that the dollar has lost over 98% of its value relative to gold since 1971.

Understanding the Recent Connection Between the Dollar and Gold

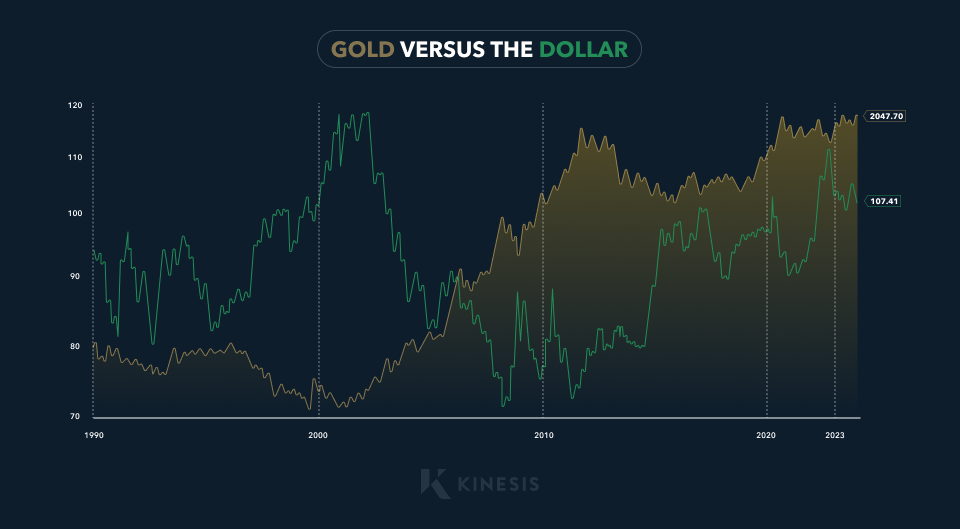

The chart below shows the relationship between the price of gold and the U.S. dollar since 1990 (weekly). Most market aficionados might find this chart surprising because it shows that, since 2008, the price of gold and the dollar have been, in general, rising in tandem and thus positively correlated.

From late 2008 to present, the dollar index has risen from 88 to 102 while the price of gold has risen from $700 to $2,045. To be sure, for brief intervals of time over this fifteen-year period of time the price of gold and the value of the dollar index have moved inversely.

In the whole period, both assets have moved higher in positive correlation.

As per the chart above, the dollar index declined between 2001 and late 2008, while the price of gold rose from under $200 to as high as $1,035. But since late 2008, both gold and the dollar index have moved higher in tandem, notwithstanding brief intervals of time in which the two assets might have moved inversely.

US Dollar and the Price of Silver

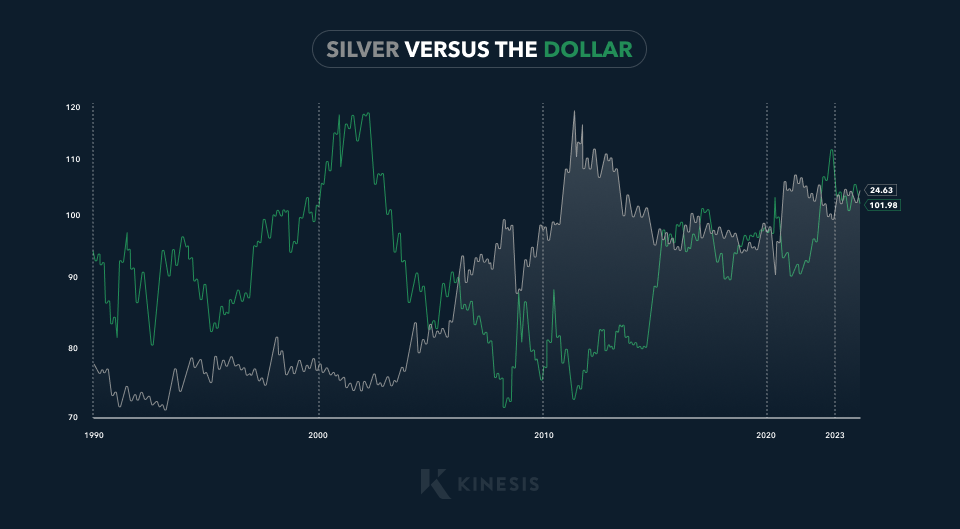

The evidence shows that silver has the same trading relationship as gold with the dollar.

How does USD affect gold and silver prices

Over short term trading intervals, there is a definitive inverse relationship between the prices of gold and silver and the value of the dollar. However, it’s arguable that this is because momentum-based hedge fund and commodity trading pool operators (CTAs) have programmed their trading algorithms to trade based on an inverse movement between gold and the dollar.

The relationship is known in technical market analysis as a self-fulfilling prophecy. But over the entirety of the last 15 years, gold and the dollar have moved higher, together.

The chart below illustrates the dramatic devaluation of the U.S. dollar versus the value of gold ($/g) since 1973 when the U.S. dollar index value was set at 100.

Source: goldprice.org

Since 2008, the global demand for physical gold, particularly from eastern hemisphere Central Banks and investors, has had a stronger influence in determining the price of gold than has the movement in the U.S. dollar over the time period.

Similarly, the demand for physical silver for both industrial and investment purposes has been a much stronger determinant in setting the price of silver than movements in the U.S. dollar.

Furthermore, I expect the price of silver to outperform gold because silver, per the Silver Institute, will be in a supply deficit for the foreseeable future.

In other words, supply and demand for physical gold and silver, regardless of the value of the dollar relative to other major fiat currencies, has been the dominant factor in pushing the price of gold higher.

In support of this, refer back to the gold vs US dollar chart above and note that both assets have moved higher in tandem, notwithstanding short time-frames within that fifteen year period in which gold and the dollar may have moved inversely.

Citations

- Year Average HISTORICAL GOLD PRICES -1833 to Present. (2016). Available at: https://nma.org/wp-content/uploads/2016/09/historic_gold_prices_1833_pres.pdf.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.