I have been looking for a price correction in the precious metals sector since late January/early February.

I’m usually early in calling for corrections and I’m usually early in calling rallies. The sector threw off fantastic returns from late September 2022 to early April 2023, but the sector also became technically “overbought” and the sentiment had become a bit “bubbly.”

What the data shows

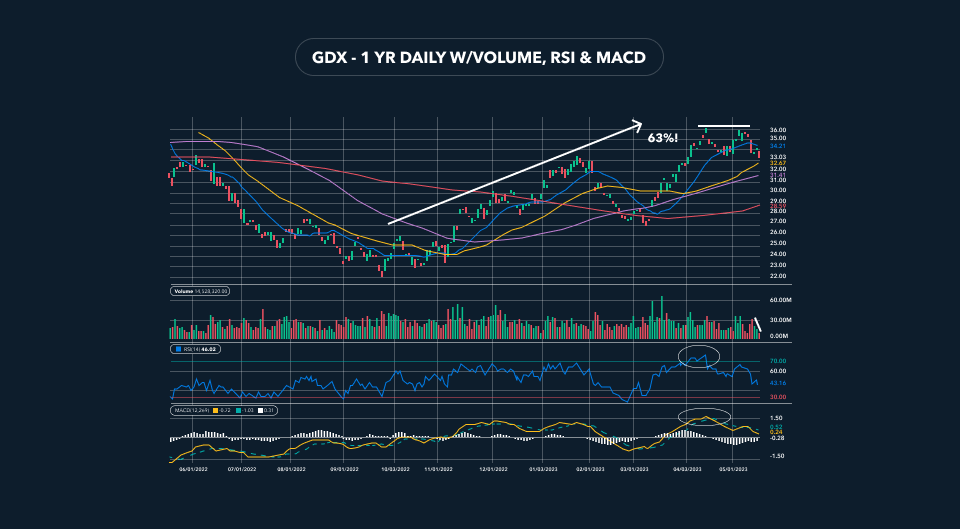

The chart above is a one-year daily of GDX. The charts for gold (GLD) and silver (SLV) look similar. From late September 2022 through early April 2023, GDX returned 63%, by far outperforming the rally in the three major stock indices (Dow, SPX, Nasdaq).

In the process, the RSI (middle panel) and the MACD (bottom panel) became technically overbought. It would be unreasonable to assume that after a 63% run-up in GDX, the precious metals sector was not going to experience a pullback/correction.

Unfortunately, the junior micro-cap early-stage development stocks did not participate, for the most part, in the big rally staged by the mid-cap and large-cap producers. The good news is that if the current bull cycle plays out like the one from 2001-2011, the junior micro-caps will eventually outperform the producers by a wide margin. 300-500% gains will be standard; 10x gains will not be uncommon, assuming that the precious metals sector is in the middle of an extended bull cycle.

Looking forward

It took longer to develop than I expected, but it looks like what up to this point has been a mild correction in the precious metals sector, may get nasty as it enters a final stage in which the banks force a violent technical price decline in an effort to coerce CTAs and hedge funds to disgorge themselves of their large long position in Comex paper gold and silver contracts.

Here’s what that looks like:

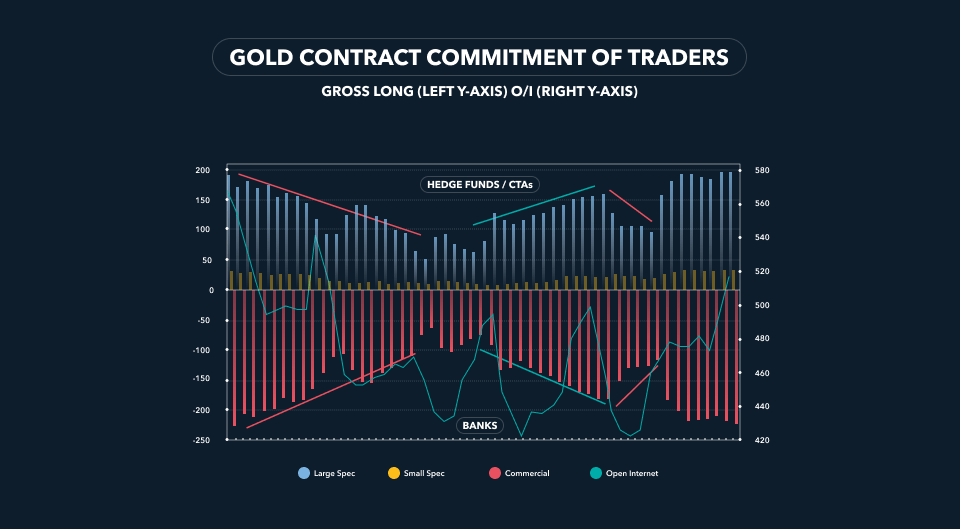

The chart above shows the weekly gross long positions (left y-axis) for the large specs, small specs and commercials plus total open interest from the CFTC’s Commitment of Traders report (weekly on Fridays). Large specs are predominantly hedge funds and CTAs; commercial is primarily the banks; and the small specs are retail traders, largely irrelevant to directional moves.

The COT open interest run-up and run-off cycle is a recurring event. Moves higher in gold and silver are accompanied by a large increase in open interest driven by hedge funds and CTAs buying contracts as they chase the price momentum higher. The banks print paper contracts and feed them out to the funds. At a certain point, when the hedge fund’s long position and the bank’s short position become extreme, the cycle reverses.

When the prices of gold and silver go into a price correction or downtrend, the large specs, with “help” from the banks, unload their long position while the banks use the price decline and large spec selling to cover their shorts and book profits. This process is punctuated with the sharp, abrupt price declines that look like a “cliff dive” in the intraday charts.

This is caused by the banks dumping enough contracts to trigger the stop-losses set by the hedge funds, which forces an “avalanche” of selling. You can see this on 15-minute intra-day charts for gold and silver the past two Fridays as well as on Wednesday and Thursday this week. Typically the “cliff dive” happens around the time the Comex opens at 8:20 a.m. EST. This cycle has been repetitive for over two decades.

The bottom line

The bottom line is that there may be some more pain, accompanied by the “cliff-dive” sell-offs in gold and silver while the open interest and long/short position structure cycles through a period of sharp contraction.

In my opinion, the fundamentals supporting much higher valuation levels for gold and silver, particularly measured in U.S. dollars – and thereby the mining stocks – continues to strengthen by the day.

In terms of timing, it’s anyone’s guess but on the outside, I would say this correction cycle and recovery process will not go beyond July or August. The move higher that I believe will follow this correction, in my opinion, will be worth the wait.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.