In my opinion, the best time to buy is, simply put, any time. Some investors buy into gold as a speculative wealth-generating investment. Most, however, choose to invest in gold as a hedge against inflation. That’s because the wealth preservation attributes of gold are well-known and stretch back over centuries.

The best month to buy gold

Monetary inflation happens when the supply of fiat currency increases faster than systemic wealth output. This imbalance guarantees that the value, or purchasing power, of fiat currency declines.

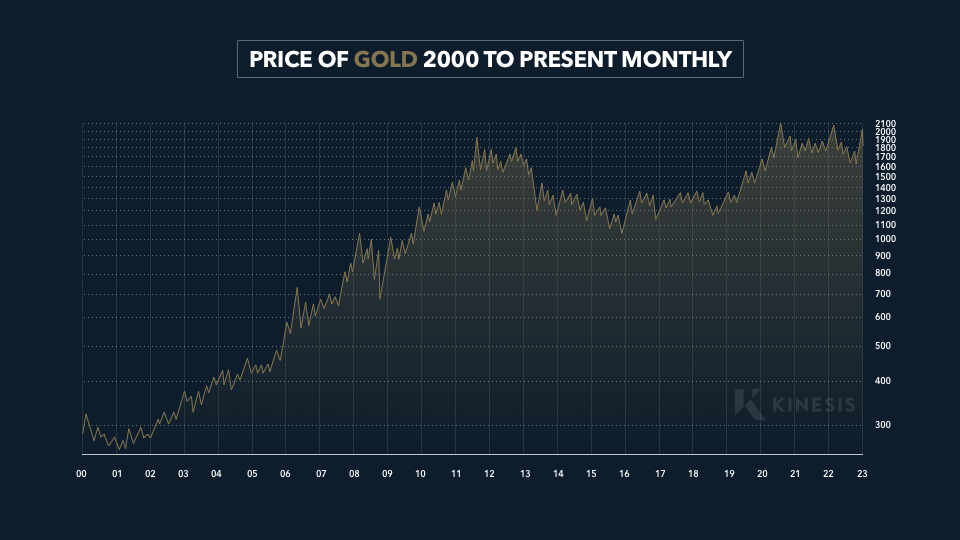

The last 20+ years have seen money creation at rates rarely witnessed in history. Meanwhile, gold has stood the test of time as a wealth-preservation asset.

That said, it is my belief that gold is currently undervalued as an asset and offers both speculative positive rates of return and wealth preservation qualities. If you are looking to generate positive investment returns on your gold purchases, it is worth looking at the price seasonality of gold.

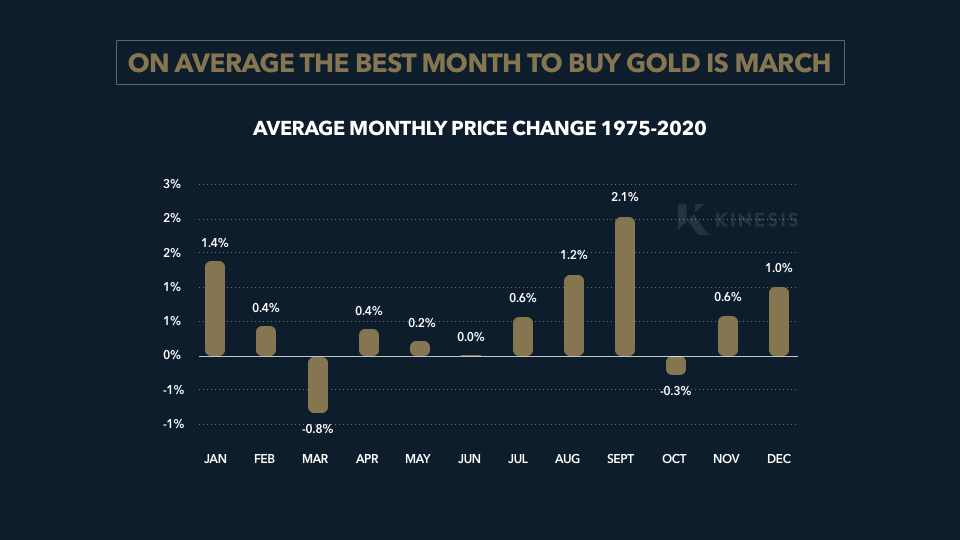

As it turns out, there are certain months of the year in which gold throws off a better rate of return. I started researching and investing in the precious metals sector in 2001. It did not take long to figure out that gold’s best seasonal rate of return is late August through January.

What events affect the price of gold?

The chart above shows the price of gold from 2000 to 2023, on a monthly basis. The black boxes show that the gold price tends to rise in the last quarter of the year. This is particularly during periods when gold is in a bull cycle. In the last 23 years, there were at least 19 years during which the price of gold rose in at least two of the six months spanning from August to January.

Part of what dictates this seasonal pattern is when people buy and sell gold. There are two dominant players in the gold market; India and China. Every year, India buys more gold bullion than any other country. China is the world’s second-largest purchaser of gold. India imports gold (and silver) every month. The country imports more gold in the fourth quarter of the year than at any other time.

This is because the fourth quarter of the year hosts India’s largest festival and wedding season. Diwali, also known as the Festival of Lights, is one of the most important festivals in Hinduism. It is based on the Hindu calendar month of Ashvin and falls between mid-October and mid-November.

Because of this, gold importers start buying massive quantities of gold in August and September. They do this so they can meet the higher demand from October through to January. This likely explains the outperformance of the gold price in August and September.

This chart quantifies the average monthly rate of return for the price of gold from 1975 to 2020:

The relative price outperformance in August and September is directly correlated with Indian seasonal buying patterns.

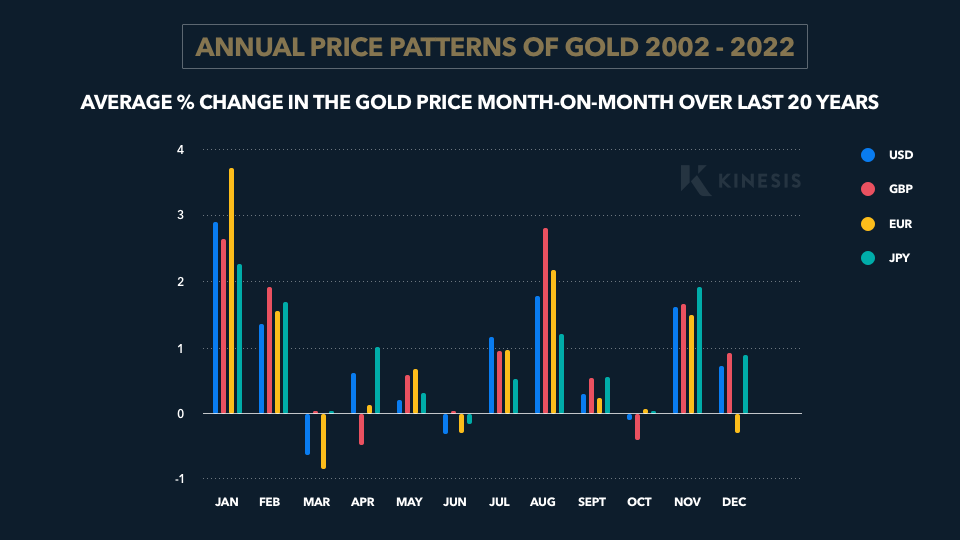

This chart shows a similar pattern:

The chart shows the average percentage change in the price of gold from the previous month in dollars, British pounds, euros and yen from 2002 to 2022. Note that January actually has the best monthly rate of return over the last 20 years. This may be due to those involved in investing and trading gold and silver expanding considerably during the precious metals secular bull market that commenced in 2001, particularly in the West.

In January, the country surpasses India as the largest importer of gold. This is because of the forthcoming Chinese New Year which falls between late January and late February.

Another is likely managers inundated with an influx of investor cash (largely tied to retirement account funding). It’s important to view this as part of the wider context too. There has been a secular bull market, particularly in the West that started in 2001. Many more people have been buying physical gold and gold-related exchange-traded funds (ETF) as a result. This has naturally affected the balance between supply and demand during that period not just in January but across the year.

Buying gold during uncertain times

While I hold the view that timing gold and silver purchases are meant for wealth preservation purposes at regular intervals with the intent of “dollar cost averaging”, the empirical evidence does suggest that there are seasonal patterns that can be traded profitably.

Interestingly, central banks are buying gold bars and bullion at breakneck speed at the moment, according to Bloomberg. Gold is a popular choice for central banks as they look to preserve the value of their investments, just like other market actors.

The easiest, most seamless way to trade gold and silver on a short-term basis is with online precious metals platforms like Kinesis. This allocated gold belongs entirely to the holder and is stored in a secure global vaulting network. Unlike with most allocated gold, you don’t pay vaulting fees for holding Kinesis gold.

KAU lets you trade in and out of gold and silver on a real-time basis – as well as take physical delivery of the underlying gold at any point. You can sign up for the Kinesis platform here.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.

Read our Editorial Guidelines here.