I’m starting to warm up to the idea that a sustainable bull move has begun in the precious metals sector. Certainly, the fundamentals support a big move, since the Federal Reserve seems to have lost its appetite for raising the federal funds rate, enough to pull real rates into positive territory.

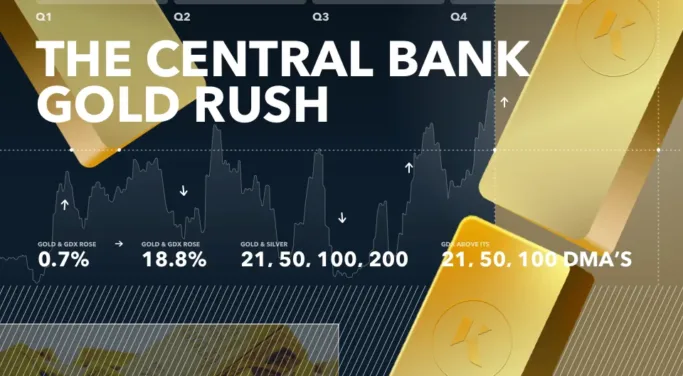

Silver jumped 25.8% in Q4, while gold and GDX rose 9.7% and 18.8%, respectively. These numbers compare to a fourth-quarter move in the SPX of 7%. Gold and silver are now above all four of the key moving averages (21, 50, 100, 200). GDX is above its 21, 50 and 100 DMAs – or displaced moving averages – and is coiling around its 200 DMA, poised to move higher still if gold and silver follow through on their Q4 moves in January.

Reading the so-called tea leaves, I’ve noticed that on several days during the fourth quarter in which the general stock market sells off, the precious metals sector diverges positively and moves sideways or higher. This is an attribute that has historically characterised the beginning of a bull move in the sector, as in late 2005, 2008 and 2015.

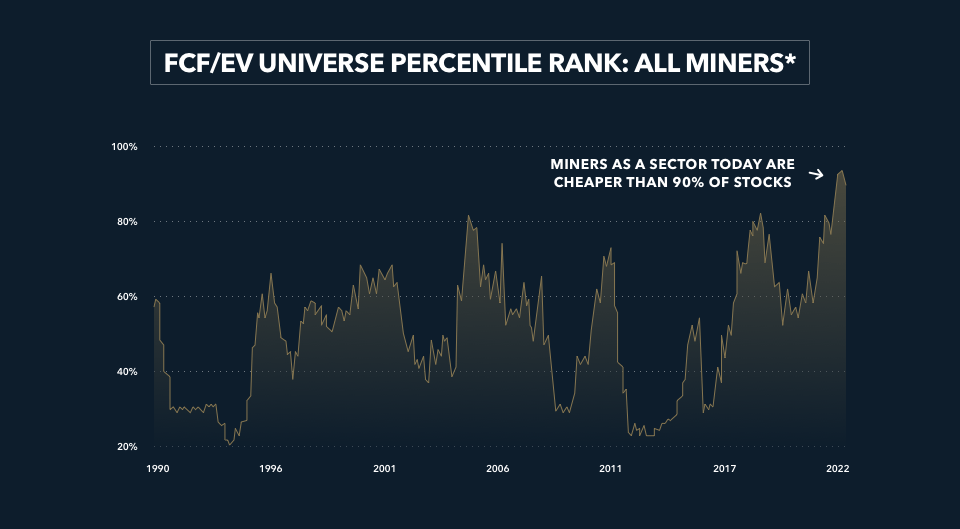

In the chart below, mining stocks are shown as extremely under-allocated in institutional portfolios:

The chart tracks the ratio of free cash flow to enterprise value (free cash flow yield) for mining stocks, relative to stocks. On this basis, mining stocks (producing miners) are cheap relative to 90% of stocks in the stock market.

During the time period shown in the chart, previous peaks since 2000 in the FCF/EV ratio correlate with periods of time when mining stocks diverged positively from the rest of the stock market and transitioned into a sustained bull cycle.

Another fundamental factor at the start of previous bull moves is the demand for physical gold and silver from central banks. Eastern hemisphere central banks bought more gold in the first nine months of 2022 than all annual totals since 1967. Nearly 400 tonnes of gold were purchased in the third quarter, quadrupling the amount purchased in Q3 2021. This move by central banks is intended to fortify their respective currencies and diversify reserves away from the US dollar, with many buyers repatriating their bars from London custodial vaults.

At the root of this appears to be Gresham’s Law at play where “bad” money drives “good” money out of the system. A perfect example would be the 90% silver pre-1965 U.S. minted dimes and quarters. Those coins were removed from general circulation by everyone who understood the difference between the 90% silver coins and their replacement, the copper/nickel alloy dimes. Currently, pre-1965 dimes contain roughly $1.75 worth of silver, whereas the pre-65 quarters contain $4.45 worth of silver.

It’s well documented that, the Peoples Bank of China has been hoarding far more gold than it publicly discloses. Alasdair Macleod has studied the topic in-depth, concluding that China is likely to have accumulated over 20,000 tonnes of gold in its reserves, compared to the 1,980 tonnes the PBoC discloses. While the PBoC uses dollar reserves to pay for their purchases, a recent article in The Asian Times stated that “one of the worst-kept secrets in global central banking is the extent to which Chinese officials are swapping dollars for gold”.

With the support of both strong fundamental and technical factors, the probability that a sustainable bull move in the precious metals sector has started is now higher than at any time since the last bull move from March 2020 – which peaked in August 2020.

With that said, I expect high volatility to accompany the move until a growing number of long-term, fundamentals-based institutional investors decide to allocate capital – or more capital – to the precious metals sector. The market has not seen the latter occur since the 2008-2011 bull move when numerous large “general” macro-oriented mutual funds poured capital into the sector.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The views expressed in this article are those held by Dave Kranzler and not Kinesis.