For most of recorded history, gold has been used as money or as a method of exchanging goods and services from seller to buyer without bartering.

The classic gold standard was adopted in the 1870s and involved backing paper currency with the value of the gold held by the sovereign issuers of currency.

This article looks at the history of the gold price as measured in U.S. dollars going back to 1879 when the United States adopted the gold standard.

Gold price explained

Under a formal Gold Standard, the amount of currency issued by a country was tied to the value of the gold owned by the Government. The gold price was based on a fixed exchange rate by which paper currency was freely exchangeable for gold at that fixed rate. In 1879 the U.S. set the exchange rate for dollars at $20.67 per ounce of gold.

In 1934, U.S. President, Franklin Delano Roosevelt, signed the Gold Reserve Act of 1934 which revalued the price of gold higher by 75% to $35 per ounce. This dollar devaluation against gold was an effort to jump-start the U.S. economy during the Great Depression. It was also a way to increase the value of the gold held by the U.S. Treasury.

It’s interesting to note, however, that the market price of gold traded in New York City had risen to over $24 per ounce or 20% above the official fixed rate of exchange before the exchange rate was reset to $35. This was likely influential in the Government’s decision to revalue the gold price to prevent a massive rush to exchange dollars for gold at the banks.

In 1971 the U.S. “closed the gold window,” removing the world’s reserve currency from the gold standard. Gold was allowed to trade free of an exchange ratio mandate. Interestingly, starting in late 1968, the market price for gold traded in New York City began to diverge from the $35 fixed exchange ratio. Between 1968 and 1971, leading up to the United States’ closure of the gold window, the market price of gold rose from $35 per ounce to over $41 per ounce.

What has driven changes in the price of gold?

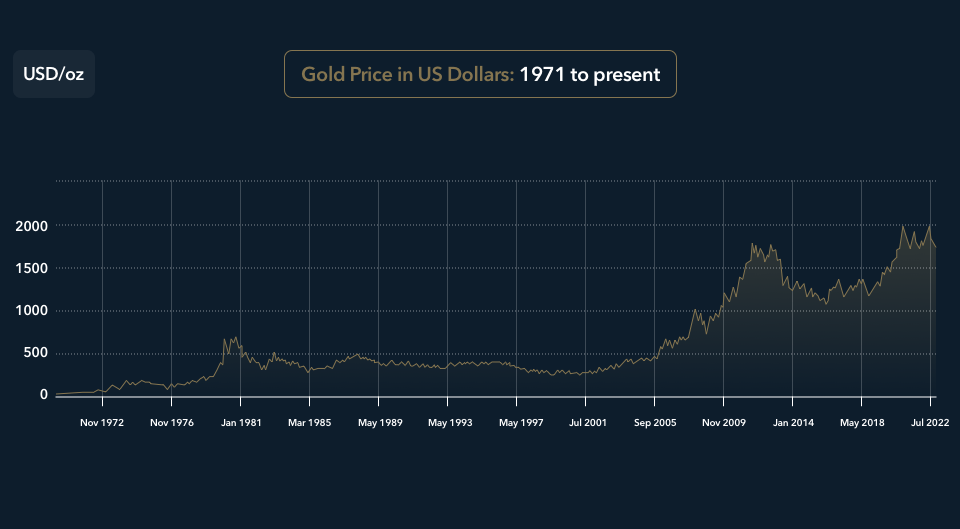

After the U.S. Government removed the dollar from its official gold backing, the market price of gold traded in New York began to rise rapidly. Between 1971 and January 1980, the price of gold ran from $35 to as high as $850. The easily observable catalyst for the move higher in gold was rampant price inflation plus economic and geopolitical instability, globally.

The underlying cause of the price inflation was a sudden increase in the supply of dollars, as the U.S. Government took advantage of its pure fiat currency and began printing currency. Between 1971 and 1980, the M3 measure of the U.S. money supply nearly tripled. The spectacular rise in the price of gold during the 1970s was not so much an increase in the value of gold but, rather, a decrease in the value of dollars used to purchase gold. In other words, price inflation comes primarily from the devaluation of fiat currency via money printing. This is why gold is seen as an effective hedge against inflation.

Since Nixon closed the gold window in 1971, the price of gold has risen from $35 to as high as $2,100 and is currently just below $1,700 versus the U.S. dollar. It has risen even more against most other major fiat currencies.

Price of gold vs inflation

It’s worth showing the effectiveness of gold as a price hedge with a real-world example.

Between 1971 and 2022, the average home price in the U.S. increased nearly 14-fold from $25,200 to $348,000. However, the price of gold increased over 51-fold. In fact, in terms of the purchasing power to buy a home, the price of gold outperformed as an inflation hedge. In 1971 it took 720 ounces of gold to buy an average home. But in 2022 it takes just 193 ounces of gold to buy the average home.

Inflation is the single most important factor that drives the price of gold. But not “price inflation,” per se. Rather, it’s the economic definition of “inflation” as it applies to the supply of fiat currency more than wealth output. Inflation occurs when the currency supply increases at a rate above the marginal increase in wealth output. Rising prices for goods and services are evidence that the currency supply has been excessively increased relative to the supply of goods and services.

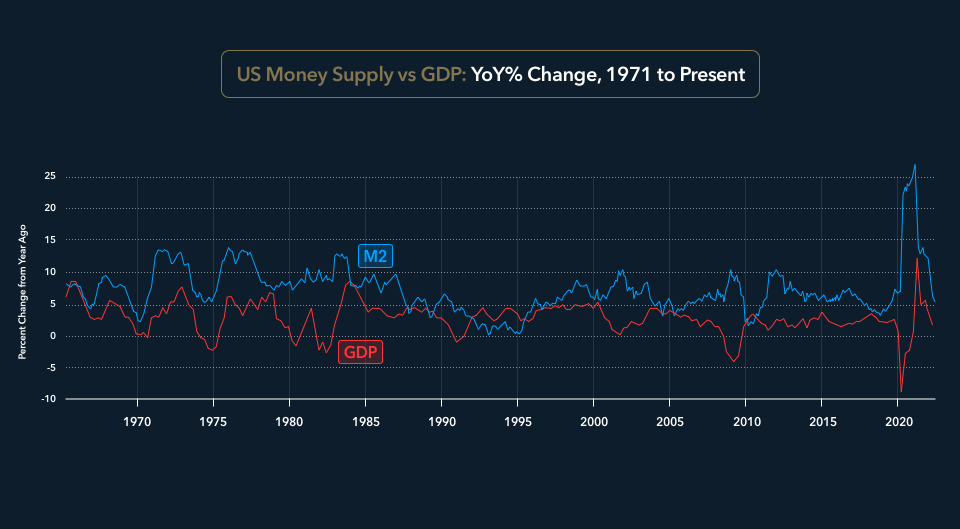

This chart prepared using the St. Louis Federal Reserve FRED database illustrates this point:

The chart shows the US money supply measured by M2 (blue line) vs the US GDP (red line) on a year-over-year percentage basis since 1971. The yellow-shaded areas show the periods of time in which the increase in the money supply exceeds the marginal out of wealth. This is roughly 98% of the time between 1971 and now.

The yellow-shaded areas represent periods in which the dollar is devalued through excess money printing. The effect of this shows up as higher prices for goods, services and, of course, gold. On a relative basis, the prices for these items are not rising, and the value of the fiat currency used to purchase these items is declining. The dollar value relative to gold has declined by 98% since 1971.

The second most important factor that drives the price of gold is negative real interest rates. Real interest rates are calculated by subtracting the inflation rate from the Fed funds rate.

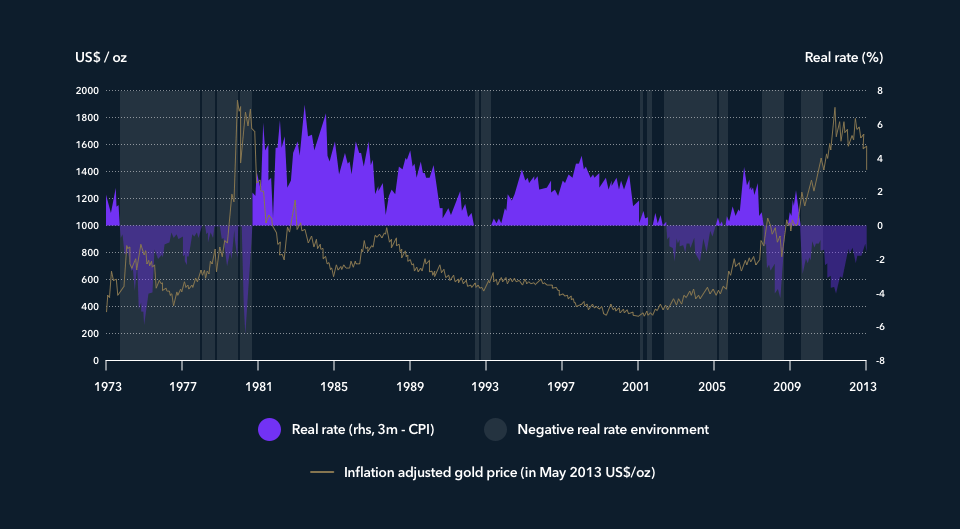

The year-over-year inflation rate measured by the U.S. Government’s CPI index is 8.7%. The Fed funds target rate is 2.75%. This means that real rates are negative by 5.25%. Throughout the fiat currency era, studies have found a strong negative correlation between real interest and the price of gold. This chart demonstrates the relationship:

The chart runs from 1973 to 2013 – the modern fiat currency era. The light purple-shaded areas show periods when real interest rates have been negative. In all three periods, the price of gold rose swiftly. With the real interest rate considerably negative in the United States and the EU, it’s reasonable to expect, if not assume, that at some point in the next few months there will be an upward reset in the gold price of some not insignificant magnitude.

Why should you look at historical gold prices?

Gold has functioned as money throughout most of organized history.

As populations became large and required more forms of organisation, currency was used as a mechanism to use gold as money fungibility. Until 1971, the price of gold was determined by the rate of exchange between an ounce of gold and the currency by which gold was measured.

Since 1971, the price of gold has been set by the global trading market, notwithstanding the constant effort by western Central Banks to suppress the price of gold. At some point, the world will likely reincorporate gold into the global monetary system. When that occurs, it will require a substantial upward revaluation of the gold price, at which point the price will be based again on a fixed rate of exchange.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The views expressed in this article are those held by Dave Kranzler and not Kinesis.