Gold is still just about trading above $1,900 an ounce as the prospect of more interest rate hikes continues to weigh on the precious metal.

Yesterday’s US jobs data showed the world’s largest economy remains in good health, giving the Federal Reserve more breathing space to increase interest rates further if today’s inflation data provides another stubbornly high reading. In a week in which central bankers have spent the week talking up the need for more hikes at their forum in Portugal, it seems that gold is unlikely to benefit from any rate relief any time soon.

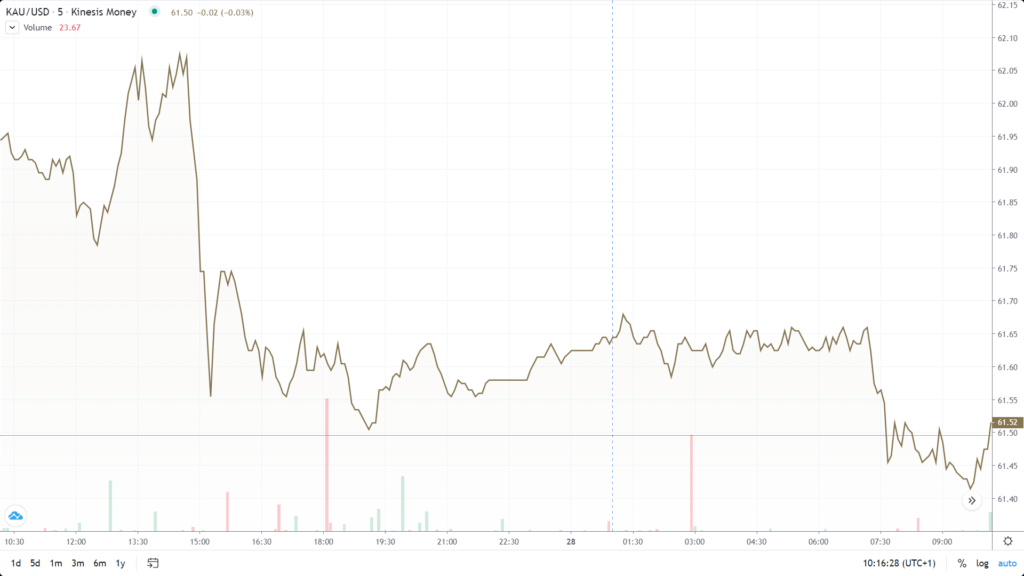

So far gold’s decline has been one of slow drift rather than any sharp plunges during an environment in which interest rates are likely to continue rising, investors are still not convinced of the bull case for equities, especially with some countries potentially already in recession.

As such, while gold’s appeal may have dwindled from the peaks of the US banking crisis earlier in the year and indeed in early May when it seemed that the Fed may have peaked on its interest rate hiking cycle, there remains sufficient support for gold to partially offset the challenging macroeconomic environment it now finds itself in.

Soon gold will be trading below $1,900 an ounce with that slow drift downwards likely to continue for a while yet until there is a fresh catalyst. Yet while $1,900 may be down from the highs seen in early May, it is still a historically high level for gold and a reminder of how much underlying support from central banks and other institutions there is for one of the world’s oldest investment classes.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.