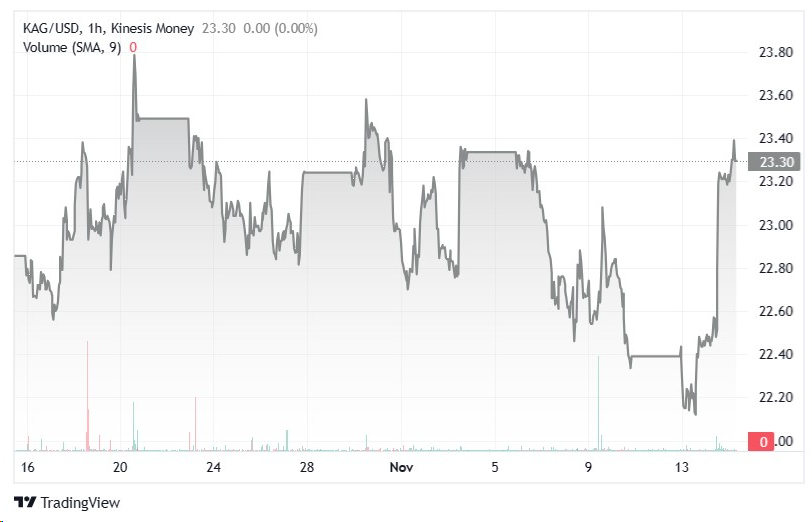

Silver prices surged higher Tuesday on the back of a sharp drop in the US dollar. Prices jumped as high as $23.19 an ounce Tuesday, compared with a low of $21.90 on Monday.

The US dollar index weakened to a two-month low Tuesday and US Treasury yields fell sharply, following news that US inflation in October had come in below expectations, slashing the prospects of further interest rate hikes by the US Fed.

The weaker greenback naturally provided a shot in the arm for dollar-denominated assets like gold and silver. Since the inflation figures were lower than expected, this may have prompted short-covering activity in the silver futures market, lifting prices on the day.

However, the market will be watching closely to see if the latest gains can hold, particularly as each rally over the last few months has failed to surpass the previous one, painting a bearish trend for silver in the medium term. This downward trend has been in evidence since prices hit a high of just over $26.00 an ounce in April.

For short-term direction, eyes will be on Chinese industrial production figures due out Wednesday, followed by Euro Area industrial production and US retail sales figures later in the day.

Silver’s wide range of applications in the industrial sectors make the price sensitive to data highlighting economic conditions in general, and industrial demand in particular.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.