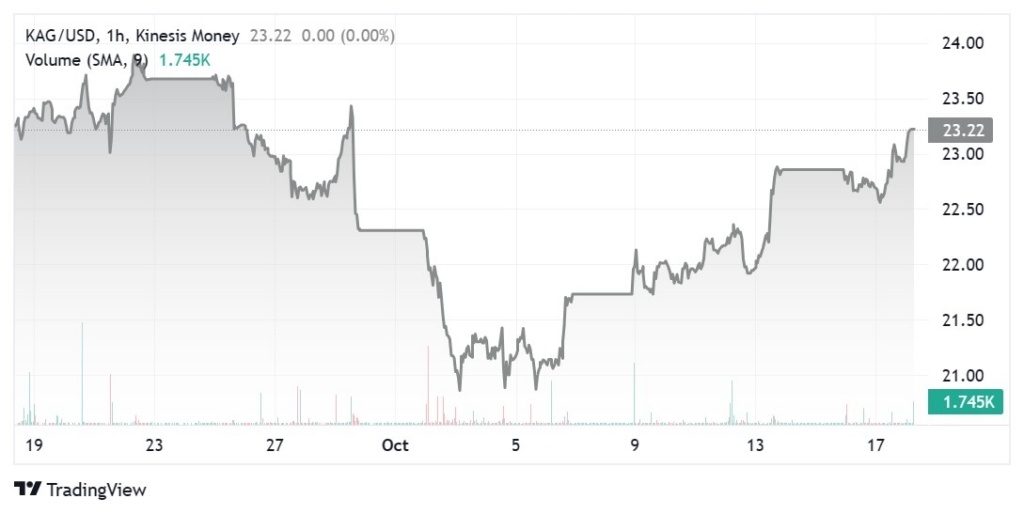

Silver continued to make headway, with a move to $23 per ounce taking the price to levels last seen at the end of September.

Like gold, silver is a non-yielding asset, so recent US data suggesting that US interest rates might remain higher for longer could be considered a headwind to price appreciation as higher rates increase the opportunity cost of holding zero yield assets.

However, Tuesday’s US data also signalled stronger retail sales, industrial production and manufacturing, all of which are broadly supportive of silver demand, c. 45-50% of which is derived from industrial applications.

Moreover, recent global economic data has also become more consistent with a ‘soft landing’ scenario with a firming trend in Asia. The Eurozone remains a laggard, though economic data is now disappointing by a smaller margin. It also seems highly likely that the next move in Eurozone rates will be down.

Thus, silver is currently benefiting from the prospect of both a cyclical pickup in industrial demand and the more secular growth prospects generated by new silver applications such as photovoltaics. A renewed bid for ‘safe haven’ assets, completes the current, supportive, demand dynamic.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.