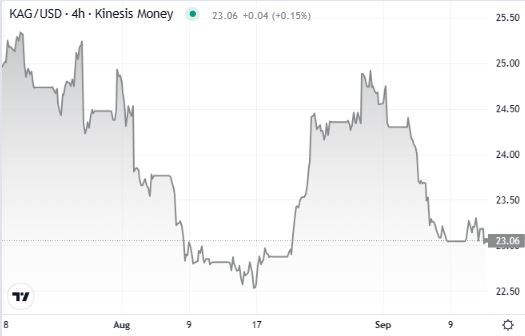

Silver has fallen below $23 an ounce as the precious metal finds itself out of favour in the current trading cycle.

The main headwind for silver is the prospect of global interest rates staying higher for longer, which would make physical silver, with its lack of yield, less attractive than interest-bearing asset classes.

Yet one of the main reasons that central banks look set to keep interest rates around 5% for the foreseeable future is the increasing confidence that economies are able to sustain these higher levels without tipping into recession. Given silver’s industrial exposure in sectors such as solar energy and electrical applications more broadly, a healthy global economy is important for the metal’s physical demand.

So while silver may be out of favour in the short-term, the outstanding fundamental case for the metal should soon see it climbing again with the current price not reflective of physical demand that continues to outpace mined supply. For those investors willing to endure more short-term pain, the current slide represents another opportunity to top up holdings or gain exposure to an asset that will surely rise in the medium-term.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.