Ratio trading is an investment strategy that involves trading two assets against each other to benefit from market strength and positive price action in one of the assets.

This type of trading is based on the ratio between two or more assets, which can be stocks, commodities, fiat currencies or cryptocurrencies. In the precious metals industry, the most popular pairs include gold versus silver, Bitcoin versus gold and Bitcoin versus silver – which are all available on the Kinesis platform.

By carefully monitoring the ratio between the two assets in the pair and trading them against each other, investors can identify any significant deviations in the price and potentially grow their holdings if the trade is successful.

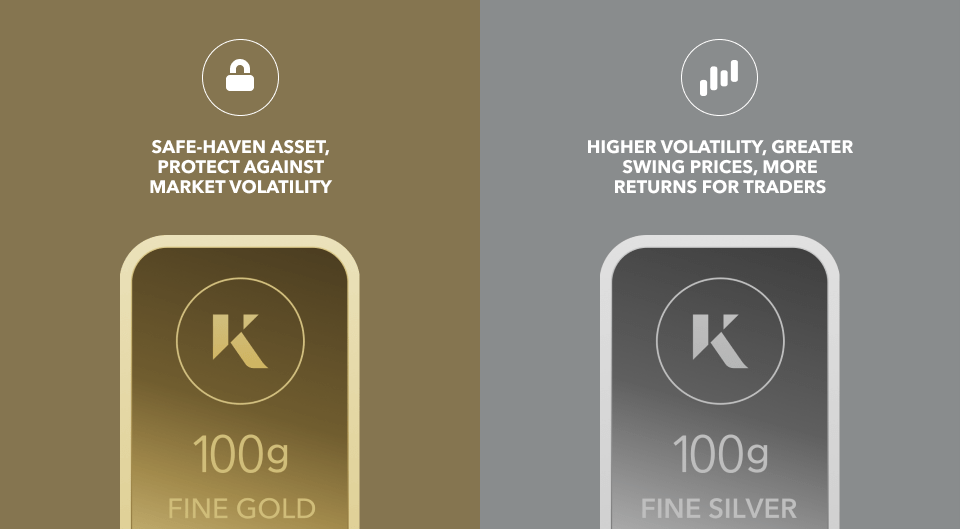

Gold versus Silver

Gold is often used in ratio trading as it is considered a safe-haven asset and can help to protect against market volatility, inflation and the devaluation of fiat currencies like the Dollar. Silver is also often used as it is more volatile than gold, which can result in greater price swings, and therefore more returns for traders.

Bitcoin and other cryptocurrencies, especially when traded against precious metals, are also used in ratio trading as they are highly volatile – although they can present more risk as they can experience more severe price fluctuations.

One of the more popular pairs in the precious metals industry, the gold/silver ratio, refers to the relative spot prices of gold and silver and is calculated by dividing the current price of gold by the current price of silver.

As an example, let’s say the gold/silver ratio stands at 70. This describes how many ounces of silver can be bought with one ounce of gold, or vice versa.

You can trade 70 ounces of silver for one ounce of gold, or you can trade one ounce of gold for 70 ounces of silver.

A higher gold-silver ratio indicates that gold is relatively expensive compared to silver, with a low ratio indicating that silver is expensive compared to gold. The ratio is also used to determine whether one metal is overvalued or undervalued relative to the other, and can be used as a way to determine which metal may offer better investment opportunities.

Historically, the gold-silver ratio has varied greatly, with high-ratio periods indicating a preference for gold from investors alternating with periods of low ratios indicating a preference for silver.

The ratio can also be influenced by external factors such as changes in the supply and demand of each metal, interest rate adjustments and geopolitical events.

Northstar & Badcharts x Kinesis

To help the Kinesis community learn more about ratio trading, Kinesis has partnered with leading technical analysis service, Northstar & Badcharts, to offer users access to their time-tested ratio trading strategy for growing precious metals holdings.

The unique ‘Ratio Tracker‘ feature is available as part of Northstar & Badchart’s Premium and Premium Plus subscriptions, which enable Kinesis users to tap into decades of market experience and make more informed trading decisions.

The Premium and Premium Plus subscriptions are available with an exclusive 50% discount for Kinesis users and contain all the guidance and analysis you need to execute your ratio trading strategy – including regular technical analysis on all major assets, charts, heatmaps and market commentary.

How does the Ratio Tracker work?

Simply holding an asset can leave the investor prone to market fluctuations, and not being hedged can negatively affect your stack.

By trading these fluctuations to your advantage, investors can leverage the Ratio Tracker to trade from one Kinesis asset to another on the Kinesis platform and work in tandem with the market.

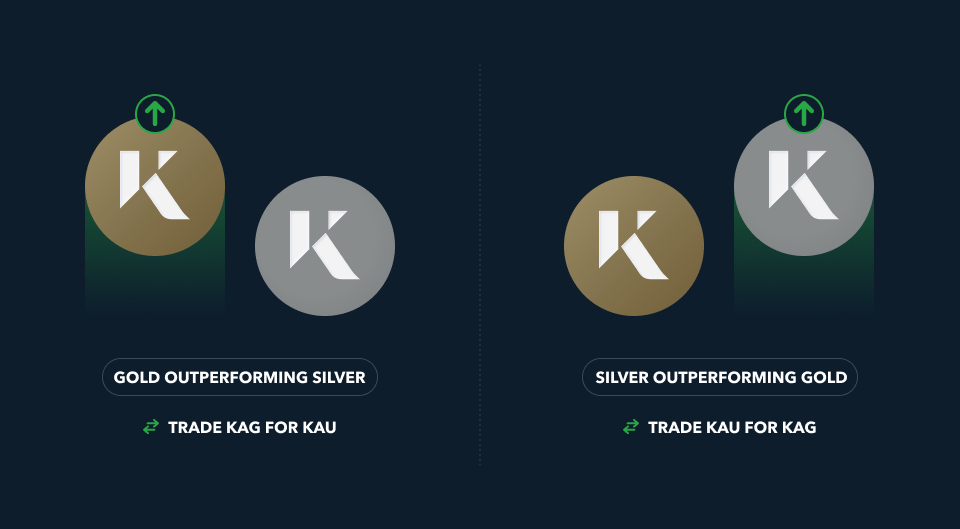

For example, when gold outperforms silver, trade your KAG held on the Kinesis platform for KAU. Then, when silver begins to rally and outperform gold, trade your KAU for KAG.

Over time, this could increase the number of ounces of gold or silver by simply following the ratio tracker.

The premise is simple – when a metal begins to outperform another, a signal will be sent to your inbox with what you need to know.

Using the Kinesis Exchange and Northstar’s & Badchart’s Ratio trading tool, you can make trades directly within the exchange and track the relevant chart straight from the platform.

Kinesis users can benefit from this tracker greatly as they can reallocate their gold into silver, or vice versa, to profit from directional trends on both assets with low fees, spot-physical pricing and non-existent premiums.

It should be noted that ratio trading is a riskier, shorter-term trading strategy, with the overall long-term strategy focused on the accumulation of gold and silver to your stack.

The Kinesis platform, when combined with the Ratio Tracker, gives you everything you need to trade your assets at the right time and take advantage of market movements – growing your stack of gold and silver over time

Start ratio trading

Those wishing to execute their own ratio trading strategy using assets such as gold, silver or Bitcoin can trade using the Kinesis Exchange, which provides low premiums, instant trade execution and high-liquidity pairs.

As always, with any trading and investment strategy, there are risks that need to be taken into consideration such as overleveraging, being too invested in the trade or taking a trade at the wrong time.

Sign up for a Kinesis account to start investing in and trading physical gold and silver more efficiently, with low costs and additional utility such as Yields and spending on the Kinesis Virtual Card.

In addition to legal-title ownership of the physical precious metals in your account, which you can be physically redeemed at any time, the platform offers an easy, low-cost way to reallocate your gold and silver to make a ratio trade.