This year has seen inflation-dominant headlines with consumer prices rising at levels not seen for 40 years.

This has caused central banks across the world to implement a series of aggressive interest rate hikes to try and bring inflation back under control and become the dominant macroeconomic narrative of 2022.

But what impact does inflation have on our money and our investments? And what are the best strategies to adopt to protect our portfolios at times of high inflation?

How inflation affects asset value

Inflation is widely measured by the CPI (Consumer Price Index) or the price of a basket of consumer items selected to represent the purchases that a typical consumer would make. The prices of the items in the basket are tracked over time to calculate the CPI, which is used to measure the rate of inflation in a given country or region.

While the current rates of inflation experienced on both sides of the Atlantic are detrimental to the economy, as it reduces consumers’ buying power, a little bit of inflation is actively encouraged by central banks. For example, both the Bank of England and the Federal Reserve in the US have a target figure of achieving an annual rate of 2% inflation for their respective economies.

The opposite of inflation is deflation, a situation where prices are likely to be lower in the future. In such a scenario, consumers will typically hold off spending, causing a detrimental impact on economic growth and ultimately on employment. Therefore it is important to note that while the current high rates of inflation seen globally are hurting economies, inflation in and of itself is not necessarily a bad thing.

The asset classes most affected at times of high inflation are those with fixed returns such as government bonds. If the rate of inflation exceeds the amount of interest a fixed-rate asset is yielding then in real terms that investment is losing money. Assets with the longest fixed-term duration are therefore the most exposed to the fluctuations of inflation.

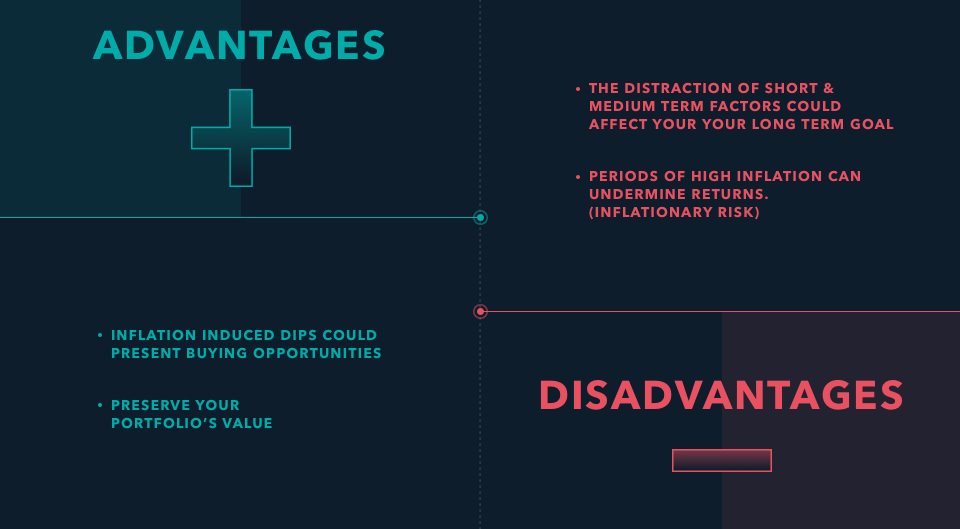

Advantages and disadvantages of investing during inflation

As ever when it comes to investing, it is important to keep focused on your long-term goal for your investment portfolio and not let short and medium-term factors distract too much from those. Therefore while inflation is certainly a dominant theme on the minds of investors this year, it is unlikely to remain as high as it has been for years into the future.

So while it is wise to ensure any investment portfolio has exposure to asset classes that can still perform well during periods of high inflation, it is equally important to not gear investments to solely protect against the current macroeconomic situation and miss out on possible gains elsewhere when the outlook changes.

This year’s stock market plunges have highlighted the risk involved in investing in equities markets yet while 2022 looks set to be a down year, historically over time global stock markets have been shown to outperform other asset classes. Therefore this year’s inflation-induced dips could represent a buying opportunity.

How does inflation affect my investments?

Inflation can impact your investments in a variety of ways. This year has seen tech and other growth stocks particularly hit by the actions of central banks in response to high inflation. Rising interest rates have made companies whose values are based more on future sales projections rather than what they are currently delivering less attractive, as it increases their borrowing costs needed to fund that projected growth.

In contrast, investments in property or in established brands that can pass on the cost of inflation through index-linked contracts or higher prices for their products have been much less affected.

This central bank tool of increasing interest rates to curb inflation has increased the yield that newly-issued government or corporate bonds are paying but for those fixed-term assets taken out in the years before this year’s inflationary spike, the level of interest they are returning is likely to be way below the current rate of inflation. It is worth noting, also, the notion stated by Kinesis Money Director, Andrew Maguire, that keeping capital in fiat money ‘is an investment choice’.

So not only does inflation affect the varying asset classes in different ways, but it can also have a different impact within the same asset class.

Where to consider investing when there is a surge in inflation

When there is a surge in inflation, consider which asset classes or companies will be best placed to pass on these rising prices. Brand powerhouses such as Unilever and Diageo are good examples, as are Mcdonald’s and Coca-Cola. So well established are their names that consumers are likely to continue paying up for their products even if the price rises.

But before rushing in, consider how balanced a portfolio you have as rushing to act for short-term gains can lead to longer-term pains. A well-balanced portfolio should have a blend of assets that can offer some protection against inflation while not being solely focused on this single factor so that it continues to perform when the pace of consumer price rises starts to slow.

What investments are good for inflation?

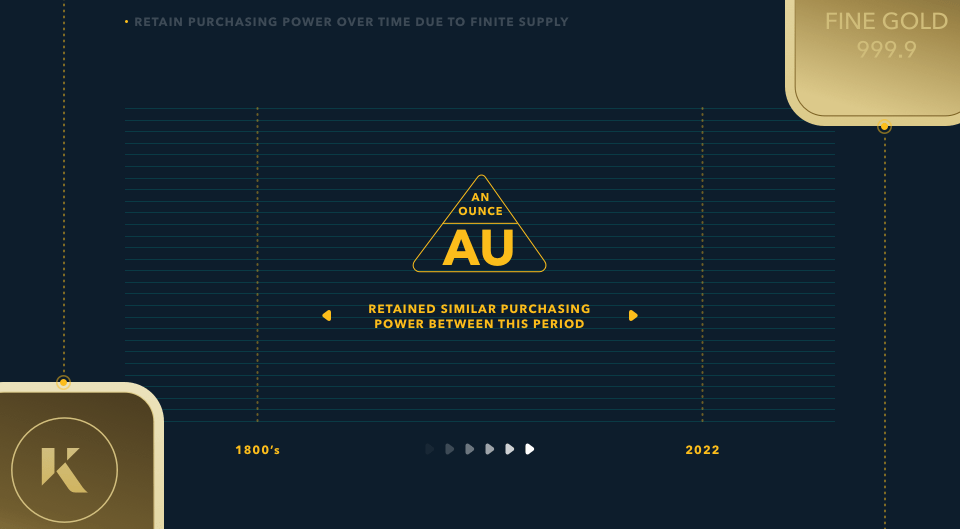

The asset that immediately springs to mind as a hedge against inflation is gold. The value of an ounce of the precious metal in the 1800s has retained similar purchasing power to what it can achieve today. It is worth noting, however, that gold has struggled for much of 2022 as central banks hiking interest rates has dulled the allure of this non-yield-bearing asset. Nonetheless, it has still done better than the S&P 500 Index for example so could still be argued to have offered some protection.

A key quality that gold has that enables it to retain its purchasing power over time is its finite supply. This is something shared by the commodities sector more broadly and makes other commodities such as oil and metals likely to be good investments at times of high inflation. This year this has particularly been true of oil with the global energy crisis both a key cause of inflation as well as a driver for higher oil and gas prices.

Stocks paying dividends can also protect against inflation but so high has inflation soared this year that it will be nigh on impossible to find a stock paying a 10% dividend that can be sustained.

All this leads to the products offered by Kinesis, who have combined the safe haven attraction that gold offers with a product paying a yield to all holders. Kinesis’ two digital currencies, KAU and KAG, have updated gold and silver into currencies fit for modern times.

Each KAU is backed by 1 gram of physical gold bullion, and KAG by 1 ounce of physical silver that is held in fully audited vaults. These currencies are then able to be used to buy everyday items around the world with the Kinesis Virtual card. Every time users spend gold or silver with the card, Kinesis pays users a proportional amount of gold and/or silver at the end of the month through their usage-based yield model.

Could KAU, a yield-bearing digital gold, be the ideal product for these highly inflationary times?

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.