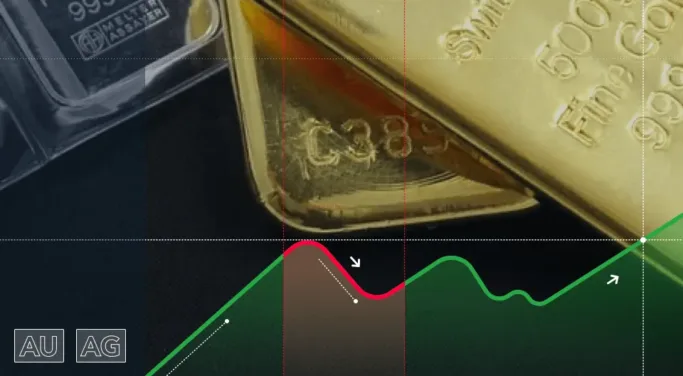

Gold Outlook

After a great month for gold in March, during which the price surged from around $1,820 an ounce to above $2,000 at times, the question for April is how much of those gains can the precious metal cling on to?

The collapse and near collapse of four US banks and one major European one saw a rush to gold in March as investors sought out its safe haven qualities and its lack of counterparty risk at a time when holders of deposits in those failed banks were worried how much of their money they’d get back.

The gold price surged to its highest level in a year, even though March saw interest rate increases from a whole host of central banks, including the Federal Reserve.

Gold surges despite Fed hikes

The direction of interest rates will once again have a key role to play in determining the direction of the gold price, so in the absence of a Fed interest rate decision in April, the minutes from the March meeting, released on April 12th, will be scrutinised in even more detail than usual.

The Fed’s decision to increase its benchmark rate by a further 25 basis points in March came at a tricky time for the US central bank as it had to balance the risk of adding more pressure to already stressed bank balance sheets against the need to keep a lid on inflation that remains stubbornly high.

Given that gold typically struggles at times of rising interest rates, the fact that it was able to largely shrug off the Fed’s March hike illustrated the strength of support for the ultimate haven asset at a time of serious jitters for the banking sector.

Gold remains a beneficiary during the banking crisis

How well that banking crisis proves to be contained will be another key determinant of where gold goes in April with the early signs pointing to markets being sufficiently calmed that a 2008 financial crash isn’t on the cards this time. However, market confidence remains very low and it will take a lot longer yet for the risk-averse investment strategies to be completely unwound, with gold the most obvious beneficiary of the current environment.

With the risk-off approach likely to remain in place for much of April, the other key data to drive markets will be the latest inflation figures, with the US ones due out earlier on the same day as the March FOMC minutes. Given that high inflation was the main reason why the Fed persisted with its latest hike, the release of the March figures takes on added importance.

Expectations of falling inflation in March

The expectation is that these will show a further decline in the pace at which consumer prices are rising, but a figure of around 5.5% is still way above the Fed’s 2% target and shows there is plenty of work still to be done to well and truly curb inflation.

If the March inflation figure doesn’t fall as much as currently expected or even shows inflation rising again then gold is likely to come under pressure as it would raise the prospect of the Fed being forced into another interest hike as well as potentially keeping its rates higher for longer.

Central banks increase their gold holdings

The final element to consider will be how much the central banks have continued adding to their gold holdings in 2023 after the likes of China, Turkey and India showed a healthy appetite last year. This demand source is likely to keep gold’s downside well supported and avoid a return to gold dropping below $1,900 an ounce in the near term.

Overall, April looks set to be a healthy month for gold with the risk-averse investor likely to keep the price supported. With the peak of the banking crisis looking to have passed, a return to above $2,000 an ounce looks unlikely given the reality of high-interest rates. Still, gold is unlikely to dip far below $1,950 until market confidence is significantly picked up.

Silver Outlook

Silver’s fortunes picked up in March after a difficult start to the year with the collapse of a series of US banks sparking demand for the precious metal and pushing its price up above $23 an ounce.

It is interesting to note that while gold’s recent surge saw it trade at its highest level for a year, the equivalent rally on silver only saw it return to levels it was trading at in February, illustrating both gold’s more proven haven appeal as well as the extent to which silver collapsed in February as investors altered their view on how much longer the Federal Reserve would keep hiking rates for.

Investors hope silver’s recovery will continue

Silver investors will be hoping that the metal’s recovery continues into April. Certainly, there is plenty of scope for it to do so given it remains well off the price it was trading at the start of the year and its fundamental outlook remains very healthy.

The energy transition requires vast amounts of silver with the metal used for its conductive qualities on photovoltaics in solar energy and in batteries for electric vehicles. Therefore seeing as this move away from fossil fuels towards renewable energy sources is going to continue irrespective of the macroeconomic picture, silver should be protected against any demand dip should the recent bank crisis spark a recession.

However, despite this healthy demand outlook, silver has struggled to gain the attention it perhaps deserves with the Fed’s hawkish monetary policy, in which it looks set to hike interest rates to 5%, instead of proving the dominant driving force. The fact that silver made healthy gains in March even with the Fed implementing another 25 basis point increase in the month hints that the negative impact of high-interest rates on silver is now largely priced in.

Will silver’s strong fundamental case be heard?

April should prove to be the month in which silver’s outlook becomes a lot clearer after a fairly volatile opening quarter. If silver’s strong fundamental case finally gets its chance to be fully heard then silver can continue climbing up towards $26 an ounce, the level it was trading at a year ago before the Fed adopted its aggressive stance.

However, a month in which it holds onto its gains in March is perhaps the more realistic outcome with silver having so far failed to convince investors of its long-term value and may continue to drift sideways until the Fed presses pause on its interest rate hikes.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.