Gold’s long history has demonstrated the precious metal’s appeal to countless investors across the globe over thousands of years but what is its value to modern-day investors and what is the right amount to include in your portfolio?

Why consider gold in your portfolio?

The main attraction for including gold in your portfolio is the diversification it offers with gold often featuring as a standalone asset class that moves in different ways to other sectors such as equities. Gold has also garnered a reputation as a safe haven asset that can offer protection to your portfolio at times of stock market crashes or other financial concerns.

It also carries little counterparty risk, something that has proven particularly alluring in recent months given the US banking crisis, which saw depositors rush to try and get their money out of accounts held with institutions such as Silicon Valley Bank, Signature, and First Republic. As a result, the price of gold climbed to its highest on record in excess of $2,070 an ounce earlier in May.

Gold’s primary role therefore in an investor’s portfolio is a safety play, an asset that is likely to tick over quietly in the background, ready to come to the fore when the rest of the financial community is suffering losses.

What is the recommended amount of gold to have in a portfolio?

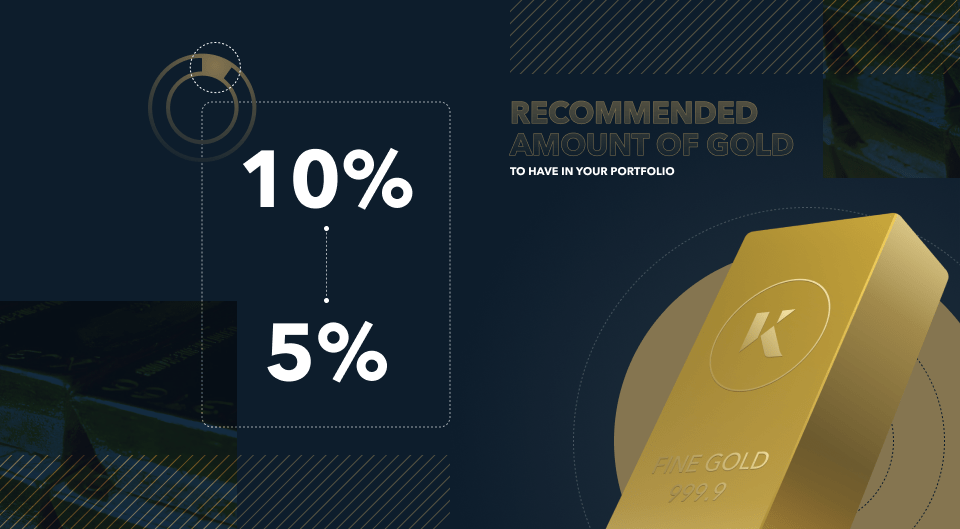

While gold has a vital role to play as a portfolio diversifier, it doesn’t offer the same potential returns as equities and other risk-related assets. Gold may prove useful at a time of crisis but the price is equally prone to fluctuations with the precious metal trading a little above $1,600 an ounce as recently as November last year. It is therefore just as vital to not be overly exposed to gold than it is to any other asset class.

Equally, while gold ownership is a good safety valve, this protection does come at a cost with the physical metal not paying a dividend or yield to holders and often requires payment for safe storage at a bank or similar institution to reduce the risk of an investor’s gold being stolen.

It is worth noting that while physical gold may not produce a yield, Kinesis’ innovative product KAU offers investors the security of a physically-backed asset with the added appeal of paying a monthly dividend to holders based on transactions using the gold-backed currency.

As such, a typical recommendation is for an investor to allocate between 5% and 10% of their total portfolio to gold and other precious metals such as silver.

How to calculate the optimal percentage of gold in your portfolio

The optimal percentage for any investor will depend on their risk approach as well as their long-term investment goals with their portfolio. An investor with a longer time frame and a greater appetite for risk may be willing to have a lesser percentage held in gold with the aim of achieving a higher return on equities and other asset classes over time.

However, an investor nearing retirement or one who is looking to minimise any risk of losses within their portfolio may favour holding more gold. Certainly, given the recent jitters on equity markets, a strategy including a greater percentage of gold will have looked like the smartest approach so far in 2023.

Benefits of investing in gold

The tangibility of gold makes it stand out among other investment options with an investor able to physically hold say a gold bar and immediately understand what they have purchased. This stands in sharp contrast to the recent popularity of cryptocurrencies that have often tried to market themselves as haven assets to rival gold but have proven to be nothing of the sort.

Its physicality also helps gold to retain its buying power over time with it being a finite resource whose supply can’t be artificially increased in the way that fiat currencies can be. It is also an asset that is recognised the world over and can be easily bought and sold around the globe to raise cash for an investor should the situation require it.

Monitoring and adjusting your gold allocation over time

Any investor should review their portfolio on an annual basis to check to see if their holdings are doing the roles they were intended for. It is also worth checking to see if any changes in markets have left any holdings carrying greater or lesser weight than originally intended and therefore needing to be reweighted.

Within this, gold is no different and any investor should check to see that their percentage exposure to the precious metal remains at the level they are comfortable with and is in line with their investment goal. This could, of course, see an investor’s exposure to gold increase over time as they near retirement and potentially look to move away from riskier assets in favour of havens.

Is gold right for your investment strategy?

Investing is ultimately a personal choice so whether gold is right for you can only be answered by the investor themselves. However, a little exposure to an asset has stood the test of time and risen to prominence yet again in recent weeks as the latest crisis engulfs financial markets.

It, therefore, would take a brave investor to completely disregard including gold in their portfolio, there to provide some insurance against stock market gyrations and offer an easily convertible route to cash. The question for most investors is not whether to include gold in their portfolio but instead how much.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.