Kinesis Money Macroeconomic Analysis

The hawkish mode, shown by Jerome Powell in his congressional testimony, has not generated massive movements on the Forex market, with modest greenback gains. The EUR/USD is currently traded just below 1.13, while the U.S. Dollar index is still in the region of 96. Despite this, growing tapering expectations generated some decline in stock and gold yesterday.

Indeed, investors seem less worried about Omicron complications – even if they could be significant, potentially – but at the same time, they seem to wonder whether their portfolios’ recalibrations are needed.

After the positive ADP figures on Wednesday, investors’ eyes are on the non-farm payrolls that will be released later today. Analysts forecasted an increment of 550,000 units.

It is clear that the next major event for the markets is the FOMC meeting, scheduled for the 14th and 15th December. Investors wonder if the Fed will accelerate the tapering process and are awaiting further guidance for 2022 and 2023 interest rates.

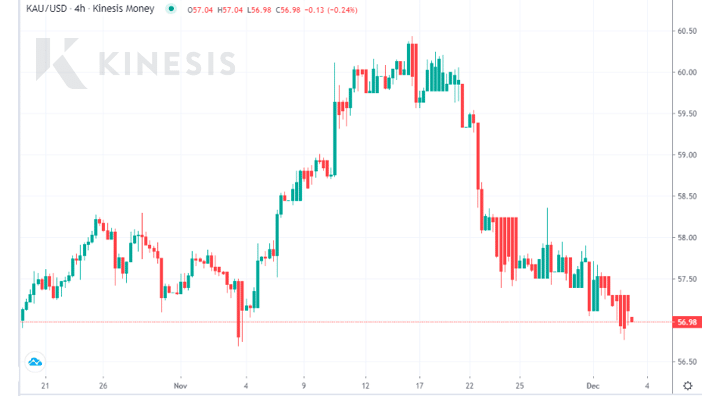

Kinesis Money Gold Analysis

Gold is traded in the region of $1,770. Growing expectations for the increase of tapering speed, have been a negative catalyst for bullion. The price of gold remains above the support zone of $1,750/ 1,760, showing some resilience, despite a short-term adverse scenario.

Any NFP and labour data above expectations could further strengthen the U.S. Dollar, testing (and possibly, breaking down) this support area. Similarly, if the U.S. data won’t meet expectations, investors will see less imminent hawkish Fed decisions, which could be positive for the gold price.

From a technical perspective, we will have a first strong positive signal only if the gold price returns above $1,800.

Kinesis Money Silver Analysis

The silver price is down 4% this week, having suffered from both Omicron variant news and the prospects of the Federal Reserve’s restrictive monetary policies.

Silver has approached and tested the support zone of $22.1-22.2 and is showing some shy rebound attempts, which have not yet been able to fully change the bearish trend of the last two weeks. In case of declines below these key levels, the next target of this downward movement could be seen in the region of 21.5, with the bottom reached at the end of October. A strength signal will come

Find out more about what Kinesis has to offer

Carlo Alberto De Casa is an external Market Analyst for Kinesis Money.

He also writes as a technical analyst for the Italian newspaper La Stampa.

Carlo Alberto provides regular commentary for UK outlets including the BBC, Telegraph, the Independent Bloomberg & Reuters. He is also a commentator for CNBC Italy. He worked for Bloomberg as their Equity Research Fundamental Analyst before joining brokerage ActivTrades in 2011 to specialize in currency markets and commodities. In 2014 he published a book on gold and the gold market, followed by a new updated edition in 2018.

This report is not an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance.