Analysts have studied the relationship between gold and inflation for centuries.

While the price of gold is subjected to short-term volatility swings, an examination of the data over a longer period suggests that gold is not only correlated with inflation, it acts as a hedge against inflation. Many investors also use silver for inflation hedging.

What is inflation?

The term “inflation” is commonly used in reference to rising prices as measured by the Consumer Price Index. Technically, this isn’t correct and it’s not the definition used by economists. They define inflation as the rate of increase in the money supply surplus to the rate of increase in economic wealth output.

As the economist Milton Friedman once said:

“Inflation is always and everywhere a monetary phenomenon. This is in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

His quote sums up the attitude towards wealth output taken by central banks after the Great Financial Crisis of 2008. The Federal Reserve adopted a policy of money printing that carried on for the best part of a decade, also known as “quantitative easing”.

Although printing more fiat money can appear to be a quick resolve if the supply of cash runs low like during the 2008 bank runs, there are limits to its usefulness.

In general, but not always, inflation in the money supply causes prices to rise and the purchasing power of money to fall. When the money supply increases at a rate in excess of wealth output, there are more currency units relative to the supply of “wealth units”. Wealth units represent the number of goods and services supplied by an economic system.

This ends up in a situation where more money is chasing fewer goods and services. The law of supply and demand kicks in at this point meaning that the price of those wealth units goes up.

How does inflation affect gold & silver prices?

Let’s take a look at the data.

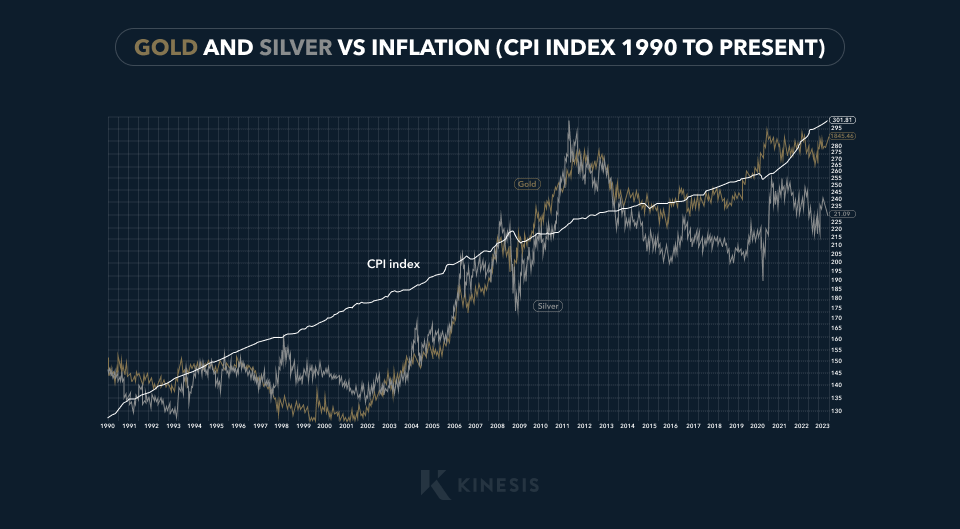

The chart below shows the prices of gold and silver vs. the CPI 1990. Previous records going back to 1971 would be better but the Fed removed the price of gold from its historic St. Louis Fed’s FRED database:

The chart above shows that, over the last 32+ years, gold has been well correlated with the CPI index (the rate of inflation). There was a bull market in precious metals between 1980 and late 2000. The graph shows however that, between 1995 and 2001, gold and silver underperformed the CPI index. But from 2001 to mid-2011, both metals significantly outperformed the CPI. Over the entire period, the price of gold and silver rose in lock-step with inflation.

Though silver somewhat underperformed inflation during that time I believe that silver will play “catch up” with both gold and inflation, making it attractive as both an inflation hedge and a total rate of return investment.

Further supporting this finding, Reuters published a study by the World Gold Council earlier this year which looked at gold as a hedge against inflation. The findings are supportive of the above: “Gold is a proven long-term hedge against inflation but its performance in the short term is less convincing.”

Why is buying gold considered a hedge against rising inflation?

In investing, there is a factor called the “volatility attribute”. It applies to all assets including commodities like gold and silver.

The volatility attribute is a measure of the fluctuation in an asset’s price over time. Investors use this to assess the level of risk and potential reward associated with their investment.

In other words, investing in gold might not be the perfect hedge against inflation in the short run. This was the case between 1995 and 2001. However, it works well in the long-term hedge against fiat currency price inflation caused by money printing.

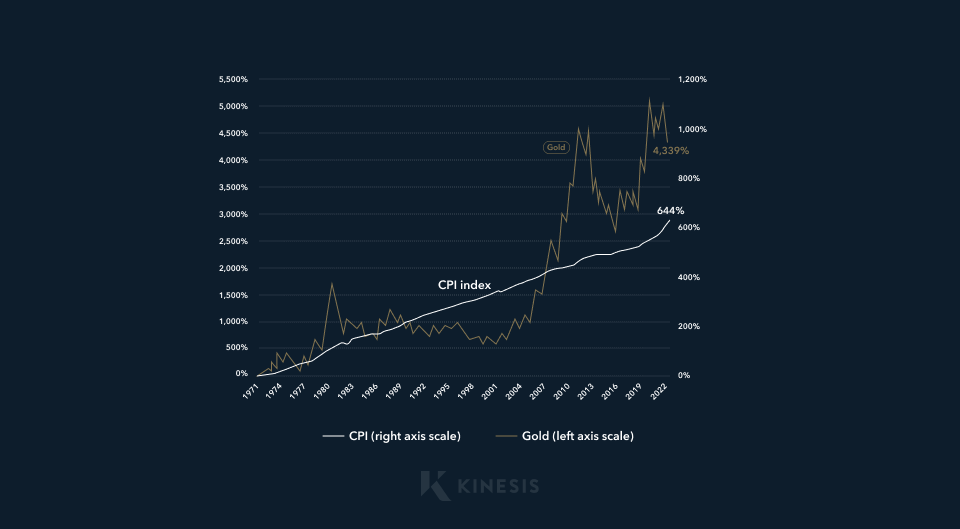

The chart, sourced from December 1, 2022, shows gold vs the CPI index from 1971 to mid-2022:

1971 is a significant benchmark date because that is when the world officially came off the gold standard. This happened after the U.S. government decided to no longer observe the Bretton Woods Agreement, which established the terms of convertibility of sovereign-held dollars into gold. This is what, up until that point, had established the dollar as the world’s reserve currency.

The price of gold, which had been pegged at $35, was allowed to “float” as a market-priced asset.

Over the past 50+ years, the inflation-adjusted gold price has been on an upward trend. It has kept up with rising prices during that time, subject, of course, to the periods where the volatility attribute applied.

Why does inflation increase the gold price?

Why is gold such a good hedge against inflation? And why does investing in gold bullion protect investors?

The principles of economics can be used to explain the correlation between gold and inflation. Over extremely long periods of time – as in centuries – the increase in the supply of gold annually roughly is equal to the long-term growth in global economic

Since 1971, when the U.S. came off the Gold Standard, there’s been no limit to the amount of money they can print. The United States, like all other countries, does not have to balance the level of currency in circulation with the amount of gold it holds any more.

Over a time period of many centuries, both the supply of gold and the rate of economic output increased at approximately 3% annually. Issuing currency in varying units of denomination enables the use of gold as a reserve asset against the issuance of that currency by creating “fungibility” of the central bank gold that backs the currency issued by that bank.

Constraining the growth in the supply of currency to the amount of gold that is produced and can be used to back currency, limits the ability of central banks and governments to “oversupply” currency.

However, since 1971, when the gold-backing of the U.S. dollar as the global reserve currency was completely removed, there have not been any real constraints on currency creation.

Since 1971, periods of price inflation have become problematic and it is during those periods when the price of gold not only has served as an inflation hedge but also has outperformed the rate of inflation.

Because the rate of return on gold has lagged behind the rate of inflation over the last couple of years, it suggests that investing in gold now offers an opportunity to use gold, and silver, as both an inflation hedge and a total rate of return investment asset.

How can you invest in gold & silver?

While I highly recommend investing in physical bullion – like sovereign-minted bullion coins and bars – and keeping the bullion in your physical possession, there are digital platforms like Kinesis that offer not only a good way to invest in physical gold and silver but also the ability to use those funds for consumption.

Kinesis gold and silver investment accounts are backed by physical gold and silver along with the Kinesis Virtual Card which enables you to use your physical gold/silver account as currency.

Alternatively, you can also take delivery and possession of your physical metal. Since I hold plenty of physical gold and silver, I use my Kinesis account as a savings account that I’m highly confident will track inflation and preserve the wealth value of the account.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.

Read our Editorial Guidelines here.