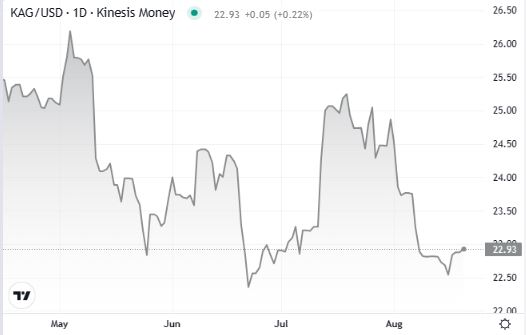

Silver closed last week showing interesting rebounding signals. Despite a challenging macroeconomic scenario – as investors are still fearing further Fed rate hikes – the silver found a solid support zone between $22 and $22.5 per ounce.

The price of the grey metal has declined almost 10% in the last four weeks, outpacing gold, which only lost around 3% in the same period. But we should note that in the last few days, selling pressure has been curbed by the resilience of buyers, with silver finally overperforming gold.

From a technical point of view, the price has yet to offer a clear bullish signal, even if the scenario is improving. A clear surpass of the peak reached last week in the region of $23.00 would open space for a continuation of the recent rebound.

Anticipating potential targets in such a scenario is a challenge. Silver, like gold, remains closely intertwined with the decisions made by the Federal Reserve. Continued rate hikes could impede silver’s recovery efforts, while any dovish indications from the Federal Open Market Committee (FOMC) could act as a bullish catalyst for the precious metals sector.

Analysing silver, it is worth remembering that its price was traded above $25 per ounce in July, while in May, it reached $26.50.

This suggests there’s more scope for recoveries than downside possibilities. The next few days will tell us more about the real strength of this rebound.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.