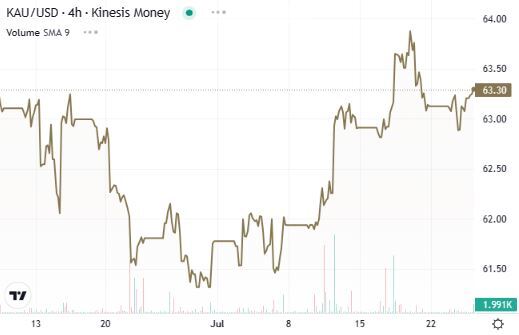

Gold has remained firm at the start of a week that will be dominated by central bank decisions.

Indeed, bullion has moved in a tiny 1% range, between $1,950 and $1,970, which are now the very first levels to monitor. The following support zone is $1,920/1,922, while the psychological threshold of $2,000 represents the next key resistance area. From a technical point of view, the scenario remains supportive, even if it is clear that markets are awaiting new catalysts, which can arrive with the FOMC later today or with the ECB meeting tomorrow.

But overall, what is the current economic scenario, and what should we expect from central banks? The Federal Reserve and ECB will probably raise rates to 5.50% and 4.25%, respectively. There is very little room for more hikes, particularly for the Fed.

In the last few months, overall data has shown significant resilience in parts of the economy, in some cases even strength. The scenario has recently slightly changed, with the US labour market showing some signs of slowing down, while inflation continues to decline.

Looking at the most recent figures, a series of macroeconomic data was published on Monday, most of which fell below expectations. These included data from France, Spain, Germany, the EU, and the US Purchasing Managers’ Index (PMI), a survey-based indicator offering insights into business conditions. A release below expectations indicates an increased likelihood of economic slowdown, which the Federal Reserve and other central banks will consider when deciding on rates.

In light of these developments, a sense of optimism prevails in the gold markets, with most investors anticipating that gold will profit from the end of the central banks’ tightening process.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq. This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.