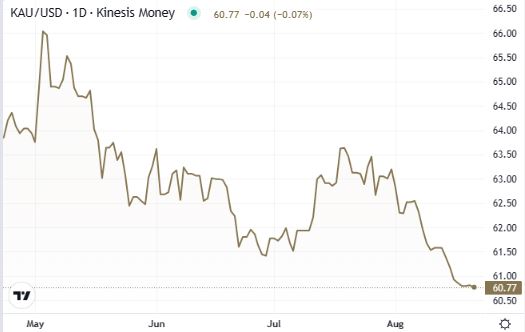

The gold spot price closed last week just below $1,890 per ounce. The early trading this morning has started without big movements, with gold holding above $60 per gram.

Overall the price has declined around 5% from its recent peak of $1,990 in mid-July. So far, the bullion price has not been able to rebound, remaining traded at its lowest level since March, as investors are still digesting the hawkish rhetoric used by the Federal Reserve at its last meeting.

Notably, several board members continue to view inflation as having upside risks. This interpretation implies an increased probability of one (or, less likely, two) additional rate hikes by the Fed.

While the economy continues to demonstrate resilience, inflation remains a primary concern. As such, the short-term outlook for gold is moderately bearish, with expectations of high rates for an extended period and the US dollar’s recovery on the currency market. These factors generally exert downward pressure on gold, although these impacts are likely already incorporated into the current price levels.

The economic scenario faces several elements of uncertainty. Chinese real-estate company Evergrande filed for bankruptcy protection in the US late last week. Now the markets are carefully monitoring the debt levels of fellow Chinese property developer Country Garden. Earlier this morning, the People’s Bank of China cut the 1-year rate by 0.1% (while the forecast was for a decrease of 0.15%) and left unchanged the 5-year benchmark at 4.20%. Investors had been betting on more dovish decisions from the Chinese Central Bank, so the yuan is losing on the FX market.

The troubles of the two leading Chinese real-estate companies could impact the global economy, increasing fears (and risks) of recession. Naturally, this situation is likely to influence the decisions of central banks. Consequently, gold might be well positioned to reclaim its traditional role as a haven asset.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.