Gold has been relatively steady in the first part of this week, with the spot price holding above $1,900, and little volatility.

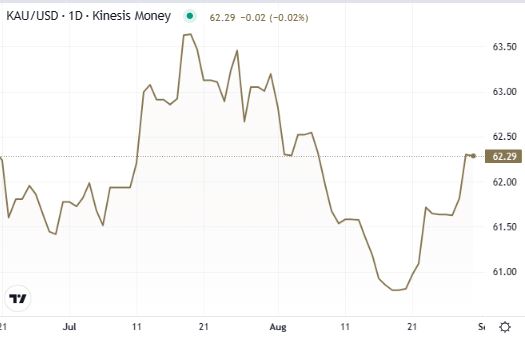

The outlook changed however. It has further improved yesterday after the release of the first significant macroeconomic figures of the week. Both the Job Openings and Labor Turnover (JOLTS) and consumer confidence have been softer than forecast. The precious metal jumped to $1,935 as a consequence while the US yields and the dollar declined, as the weaker data makes new interest rate hikes less likely.

As we mentioned in a recent comment published by Reuters, gold holding its ground above $1,900 was a signal of strength for the precious metal, especially in the challenging context of a more hawkish Federal Reserve last week at the Jackson Hole Summit.

The situation has now improved from a technical point of view too, as the price has surpassed the resistance placed at $1,930 and is looking towards the next potential target in the region of $1,950.

Today the macroeconomic agenda is relatively busy. The German CPI data is expected to be releases at 12:00 GMT. Analysts put the number at +6.0% on an annual basis while the monthly data should remain steady at +0.3%. Just fifteen minutes later, at 12:15 GMT, will be the turn of the ADP Non-Farm employment change. Those numbers could trigger some volatility ahead of the release of the closely watched Non-Farm Payroll data of Friday. Indeed, the Federal Reserve is expected to keep a data-driven approach when it takes its next decisions on interest rates, and inflation and labour data will be the most relevant data points to keep track of, for the US central bank.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.