Silver investing gets nowhere near the same level of attention as investing in gold, despite the fact that they share many qualities and, like with gold, demand for silver goes back hundreds of years.

You can trace the trading performance of silver over centuries as proof of its long-lasting value to investors. In fact, gold and silver investing share a lot in common. They hold their value over the long term and investors see both precious metals as hedges against inflation.

There are two powerful arguments for investing in silver. First, it has proven to be a key haven asset in investor’s portfolios. Investors should consider having silver in their portfolios to protect themselves during times of crisis. Second, unlike gold, there’s significant industrial demand for silver, particularly from tech companies. Firms use silver in everything from photovoltaic cells for solar energy panels to drive trains or Tesla cars.

If you’re debating whether your next investment should be a silver or gold investment, what are the arguments for choosing silver? How has it performed against other asset classes?

More importantly, is getting into silver a good idea now? If you do, should you invest in silver for the long term?

Silver performance vs. stock market

Both the stock market and silver are prone to periods of high volatility, which can result in sharp gains and losses over short periods.

Silver is generally more volatile than gold. Part of the reason is that, compared to gold, trading volumes in silver are much lower. Gold is one of the most traded commodities in the world.

These low volumes result in much greater swings in the price of silver in both directions. In contrast, the gold performance is much steadier.

Buying and selling silver has many of the same volatility considerations as buying and selling equities (shares). Quite often, they act countercyclically. Factors driving the stock market down can drive the price of silver up and vice versa. This can make the precious metal a valuable diversification asset in any portfolio.

Let’s take US equities as an example. If the dollar falls in value, this reduces companies’ buying power in the export market. However, because companies buy silver with the US dollar, a weaker greenback often helps boost the metal’s price.

At the same time, a crisis in equity markets can be beneficial for silver because of silver’s perceived role as a haven asset.

Sometimes, equities and silver can move in tandem. If the industrial outlook is getting better, silver benefits because the companies that make up the stock market buy more silver.

History has shown how gold and silver move in close correlation. When they do break out of step, it’s often because of the industrial appeal that drives the silver price.

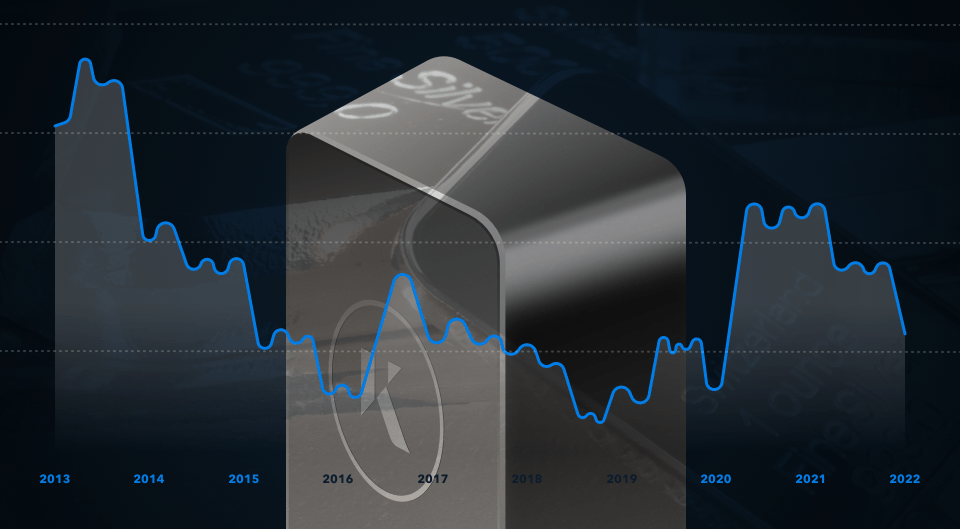

Silver performance in the last 10 years

Silver has a well-earned reputation as being a store of value over time. In the past ten years, prices have ranged between $13 and $48, an all-time high. At the time of writing (September 2023), you would be up on a 10-year investment by a small amount.

Investing in the silver market is all about timing, like all investing. If you’d invested at the top in 2011, you’d be nursing losses. If you’d invested at the bottom in March 2020, you’d be 30% up by now – inflation aside.

For example, silver suffered a severe plunge in its price in 2013. It then traded in a broad range of between $14 an ounce to $22 an ounce from 2014 onwards before the start of the coronavirus lockdowns in March 2020. That’s when it hit a low of $13. Silver seemed seriously undervalued at that point.

Silver briefly received significant attention from the Reddit community after the much-documented silver squeeze of early 2021. Interest from retail investors pushed the price of silver above $30 an ounce for the first time since 2013.

The squeeze ended up highlighting silver’s die-hard appeal among many in the trading community. It also spotlighted the metal’s inherent volatility. To experienced investors, it’s hard to imagine gold being affected in such a way.

In early 2022, silver was a beneficiary of the rush to haven assets in the wake of Russia’s invasion of Ukraine in late February. This triggered a steep rise in price to $27 an ounce.

Interest rate rises set by cautious central banks adopting a more hawkish stance punished silver because of its lack of yield. As a result, the metal plunged to below $21 an ounce before recovering in recent weeks to near $22 an ounce.

From the past ten years’ volatility in silver prices, you can see how a wide range of factors affects its value.

The future of silver in the next 10 years

The last 10 years have been a bit of a roller coaster. You can see why many investors would want to buy gold over that time instead of silver. But should you choose silver over investing in another gold bar for your portfolio?

The key to getting the spot price of silver much higher in the coming years depends on demand from the industry. 2022 was a record year for physical demand with increased buying from the electronics sectors. Photovoltaics and other components pushed consumption above 1.24 billion ounces.

Silver’s outlook is bright thanks to its use in key growth industries such as technology, solar energy and electric cars. Manufacturers have tried to reduce the use of silver but there are only so many savings they can make.

Despite that, analysts expect a huge surge in demand for silver from these companies in these sectors.

Industrial demand is not the only drive. The war in Ukraine and successive interest rate hikes will also have an effect. This much current uncertainty in the world makes the next 10 years difficult to forecast. Who could have predicted the rise of meme stocks for example?

Where will silver be in 2033? In truth, no one knows. But, if demand outstrips supply in the next decade, this points to an asset that still has plenty of room to climb higher.

Is silver still a good investment?

Silver has a role to play as at least a small part of an investor’s portfolio. Its performance is different to other asset classes and it offers extra diversification opportunities. Physical silver’s value can’t be whittled away in the same way that a company can if goes bust.

There are different ways to invest in silver:

- Physical silver: This is the most direct form of investment, where you own the metal. You can buy silver in various forms like bars, bullion coins, and silver coins. Storing and insuring physical silver may incur additional costs.

- Shares in silver mining stocks: Investing in stocks of companies that mine silver offers another avenue. You do not own the metal, but you own a piece of the silver mining company. The value of your investment rises and falls in line with the company’s performance and the price of silver.

- Silver ETFs: Silver Exchange-Traded Funds (ETFs) allow you to invest without owning the physical asset. These funds hold either physical silver or shares in silver mining companies so you can diversify your exposure to silver.

- Silver-backed digital assets: You can own allocated physical silver in the form of digital coins that bring added utility to silver investment through the ability to send, trade and spend them, with the ease of any other currency.

We’ve seen how silver investors have had to endure some volatility since 2010. However, its current low entry point with an ounce of silver costing around $25 means it’s cheaper and easier to obtain than gold.

The wide range of uses for silver in cutting-edge industrial sectors is encouraging, since the appeal of silver is not solely restricted to investors and collectors.

Investing in both gold and silver makes sense. That’s the opinion of precious metals analyst Dave Kranzler:

“It’s ideal to invest in both metals. When silver is undervalued relative to gold per the gold-silver ratio, it makes sense to buy silver instead of gold.”

To help with silver investment, you can learn more about Kinesis’ silver-backed tokens, KAG.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwashing while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.