For most of the last 20 years, the effects of inflation have largely gone unnoticed, however, this is less so today as we go through the often-termed “cost of living crisis”.

Inflation rates are at levels last seen in 2009, during the aftermath of the financial crisis.

Disruptions, such as COVID-19 and other factors, caused inflation to shoot up around the world. Food and energy bills went through the roof. Governments ended up having to borrow billions to continue funding areas like state pensions and healthcare.

UK inflation has been particularly stubborn, peaking at over 10%. US inflation peaked at 9.1% in 2022 but fell faster than in Britain.

To beat inflation, central banks hiked up interest rates sharply around the world. That meant that banks forced homeowners to contend with big rate rises on their mortgages.

They weren’t as keen to pass on rate rises to savers, though. They’ve been waiting for over a decade to get a high yield on their savings accounts. They were therefore disappointed when their rates didn’t go up that much. As a result, the value of their cash savings would continue to erode.

Many are now seeking investment alternatives to offset the damaging effects of inflation. Some have turned to cryptocurrencies like Bitcoin instead of leaving their money in the bank.

The problem is that cryptocurrencies may not be the best store of value, due to their high price volatility.

Many investors want an alternative to fiat currencies and their vulnerability against inflation. In this article, we’ll show you 10 investment and wealth management strategies to protect your savings from inflation.

What is inflation?

Inflation is the loss of purchasing power over time. Rising inflation means that goods and services cost more than they did in the past.

Many economists believe a low rate of inflation to be beneficial for the economy. When inflation is too high though, people lose money year on year because their wages often don’t keep up with price rises.

Consumers and businesses have to dip into emergency funds they’ve built up over the years to get by day to day.

There are many different causes of inflation but a number of ways to manage your wealth during periods of high inflation.

10 ways to protect your money from inflation

1. Gold

Throughout history, gold has been the asset class to successfully hedge against inflation. It has proven to be the safest store of economic value for centuries.

Gold has increased in value by 500% in the past 20 years. This is in contrast to other precious metals which have sometimes struggled during periods of high inflation.

In the 1970s gold performed strongly in comparison to fiat currencies. In the 1980s, gold delivered a negative return.

It often outperforms the stock markets during times of high volatility, even when there’s a bear market. This may now be one of those times.

One drawback of gold for many is that it doesn’t pay a yield. Kinesis’s gold-backed cryptocurrency breaks new ground as investors do earn a yield on it.

You get the dual benefits of owning gold and a competitively high annual return on your money.

2. Cryptocurrency

The combined value of all cryptocurrencies surpassed $3 trillion in November 2021. Some currencies have appreciated in value 10,000 times over, easily enough to outperform all other asset classes.

Investors view crypto as a hedge against inflation because there is a limited, or finite, supply of it. There’ll never be more than 21 million Bitcoins. If supply stays the same and demand for Bitcoins goes up, the price goes up too.

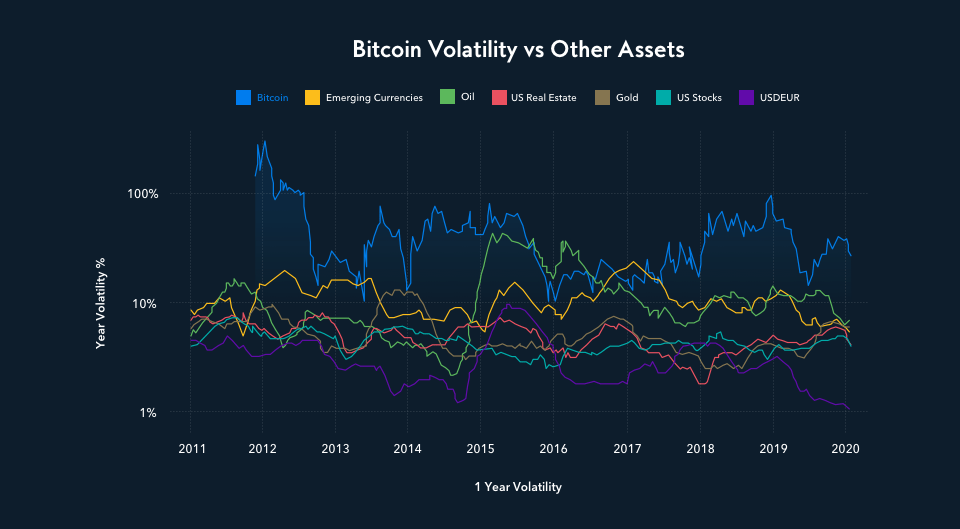

The biggest disadvantage of Bitcoin and other cryptocurrencies is their extremely high volatility.

As a result, crypto’s performance compared to fiat currency is mixed. But, over a long enough time frame, the value of Bitcoin has increased in comparison to fiat.

3. Real Estate

Many consider investing in real estate as a good hedge against inflation. The figures back them up. But gold has easily beaten property over the last 20 years as an investment.

Property has some major disadvantages. In comparison to other investments, property is illiquid. It’s hard to dip in and out of and requires extensive ongoing management and investment from the property owner.

If you rent out property, you can offset some of the effects of inflation by raising rents year on year. When inflation spirals out of control as it did in 2021 and beyond, this may not be possible. Your tenants may not be able to afford an increase.

Another complicating factor is that residential properties are already overvalued in most countries. For example, in Hong Kong, the house price to the average annual income ratio is 18.8.

4. Commodities

Commodities have proven themselves to be one of the best assets for hedging against inflation. A study by Vanguard, for example, showed that for each 1% increase in inflation, commodities’ value increased between 6% and 9%.

When we are talking about commodities we usually think about oil, agricultural crops, and livestock.

Other factors affect commodities though. For example, we’re starting to see oil lose ground to photovoltaic technology as part of the drive for net zero. Think about the future prospects of a commodity before investing long-term in one.

Commodities perform well in specific situations but, most of the time, other assets like stocks outperform them.

5. Equities

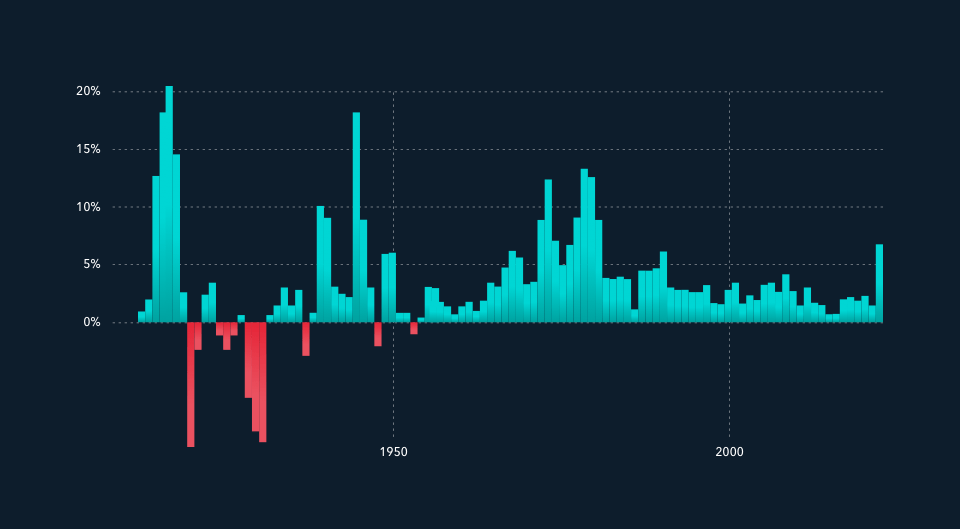

In the past, the value of stocks outpaced inflation by around 7% on a yearly basis. This is why many investors feature stocks so prominently in their portfolios.

Investing in equities is a long-term game because, during periods of increased inflation, equities do less well. That’s because, as prices rise, expenses increase. This hits profit and affects growth opportunities which their share prices reflect.

Investing in a single stock can be a risky investment strategy. To protect yourself, consider your short, medium, and long-term risk appetite.

6. Dividend-paying stocks

Many companies listed on the stock market pay dividends. Investing in dividend-paying stocks is another approach to fighting inflation. Some companies have increased the dividends that they pay out each year like 3M and IBM.

Cryptocurrencies can also pay dividends and offer another option for investors.

Investors get these crypto dividends when they finish tasks related to a currency or exchange like through staking.

However, be careful because, in return for dividends, there may be terms attached like “lock-in periods”. If this is the case, you won’t be able to access your investment for a pre-defined length of time.

7. Inflation-protected annuity

An annuity is a guaranteed payment from an insurance company that many people use for their retirement. The amount of money that you get is usually lower in comparison to other asset classes, but the risk is also lower.

There is also a possibility to add inflation protection to your policy. In these cases, the level of the CPI index affects how much money you receive.

8. Short-term bonds

Short-term bonds are highly liquid and have a maturity of between 1 and 4 years. Investors consider them as a safe haven when inflation is high, especially in comparison to equities.

Usually, when inflation goes up, so do interest rates.

For example, the two-year U.S. Treasury yield rose by more than 10 percentage points in less than a year, from 6.2% in October 1979 to 16.3% in September 1980. This was to fight double-digit inflation.

However, gold has beaten bolds over the past 20+ years as an investment vehicle.

9. Fixed-rate loan

Another option is taking a fixed-rate mortgage loan for 20-30 years with low interest. This means that your rate stays the same even if central banks raise interest rates.

However, please be aware that all debt obligations carry a certain level of risk.

10. TIPS

Treasury Inflation-Protected Securities (TIPS) are bonds issued by the US government. They rise together with inflation since it’s measured by the CPI, Consumer Price Index.

When the rate on TIPS increases, the interest you get increases as well. This protects investors during uncertain times of higher inflation.

Coping with high inflation

Investors should always prepare for inflation when building their portfolios. Stuffing your money “under the mattress” is never the answer. Instead, investing in various asset classes that hold, or better, increase in value over time is generally preferred.

When inflation does go up, that’s a good time to review your portfolio and investment decisions. No one wants their hard-earned cash to lose value but it will unless you protect it.

To protect against inflation, start preparing now. Look at ways to maximize the value of your investments. Do your analysis and due diligence before diversifying your portfolio. One way you can do this is with Kinesis, by investing in Kinesis gold and Kinesis silver, which harness safe haven qualities through offering tangible yielding rewards paid out in physical gold and silver. To learn more about Kinesis, you can check out more from the Kinesis blog.

Want to protect your money in gold?

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.