Gold, the quintessential symbol of wealth and prosperity, is a natural resource that has shaped the growth of early civilizations and nations.

Gold is often a popular choice for investors seeking to diversify or stabilise their portfolio, as well as a strategic asset for nations who are searching for similar ‘safe-haven’ qualities that are particularly useful during times of economic downturn.

With the gold industry worth an estimated $12.9 trillion in 2021, we explore how much of this precious metal there is left to find in the world, how much is produced and how its long history of wealth preservation still makes it an incredibly sought-after asset to this day.

Gold’s Journey: From Ground to Vault

So, where is all the world’s gold?

As a visual example: if you emptied all the vaults and safety deposit boxes across the globe, almost 50% of that gold above ground has been turned into jewellery. The role of gold as a symbol of wealth and prosperity prevails in countries such as India in China, which accounted for the majority of gold jewellery demand in 2020.

As Kranzler points out, India also contributes to India’s strongest seasonal gold buying which begins in late September, with wholesalers and dealers already primed and ready in late July to begin stocking gold and jewellery ahead of the Indian festival and wedding season in Autumn.

After jewellery production, the percentage of gold used for private investment (22%) and central bank reserve holdings (17%) makes up a value of nearly $5 trillion dollars worth of physical gold above ground. On paper, the US central bank reportedly holds more than twice the reserves of any other country in the world, after it implemented a gold standard for the world’s reserve currency, the US Dollar, over 50 years ago.

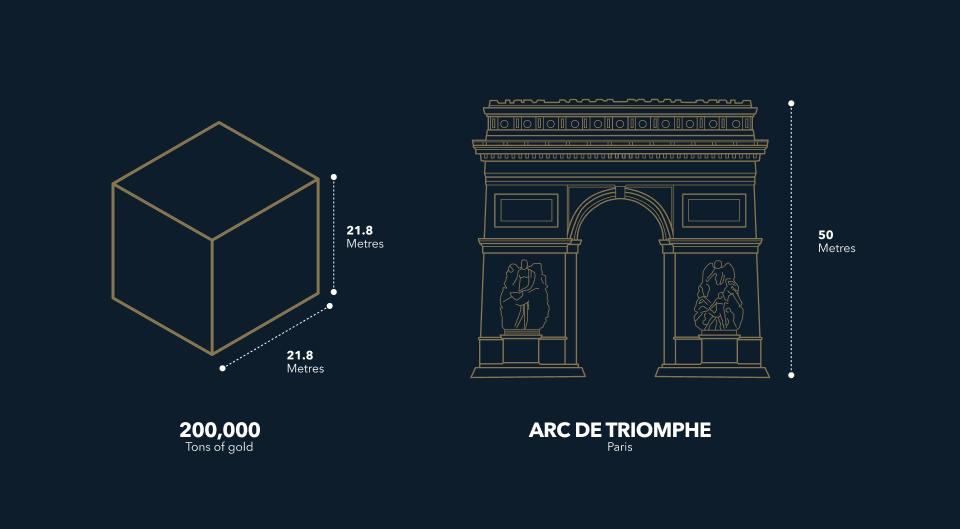

The World Gold Council estimate that just over 200,000 tons of gold have been mined throughout history, with the bulk of that surfacing above ground over the last century. That amount of gold could fit into a cube with dimensions around 20 metres by 20 metres – this is more or less the height of the ‘Arc d Triomphe’ in Paris.

As a physical commodity asset, gold contrasts with fiat currency as its supply cannot be manipulated – or printed – at whim, which allows the precious metal to serve as a natural hedge against inflation. Irrespective of market conditions, the value of gold has always prevailed, which is why many central banks often store the metal as part of their reserves.

Kranzler comments that it is not just Western central banks but rather Eastern central banks, such as China or India that are significantly buying up gold more than is publicly disclosed.

“China is likely to have accumulated over 20,000 tonnes of gold in its reserves, compared to the 1,980 tonnes the PBoC discloses.”

Dave Kranzler, Market Analyst & Author

According to The Asian Times, the People’s Bank of China often uses dollar reserves to pay for their purchases, but the true extent to which Chinese officials may be swapping dollars for gold is unknown.

Where in the world is gold?

The largest reserves of gold can be found in just a handful of nations, deep underground in tightly concentrated yet expansive veins of ore.

In resource-rich regions like California, US, or Victoria, Australia, gold is embedded deep within the earth’s layers, surfacing through geological phenomena like volcanic eruptions, earthquakes or mass water movements.

As of 2020, Australia had the most substantial reported reserves of gold, where the precious metal represents a significant part of the economy. The mine in Kalgoorlie named the “Super Pit” is one of the most notable and has been in operation since 1989.

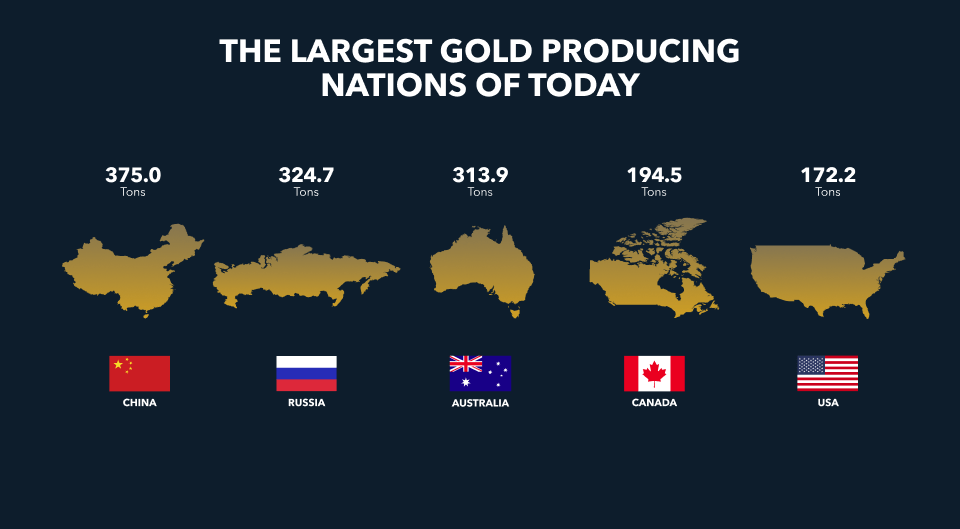

The largest gold-producing nations of today include:

- China (375.0t)

- Russia (324.7t)

- Australia (313.9t)

- Canada (194.5t)

- United States (172.7t)

*As of 31 December 2022, from gold.org

This handful of nations does not encompass all the reserves that are yet to be uncovered, with more reserves uncovered each year. In 2022, major reported gold discoveries in Africa have poised the continent to benefit from the precious metal in the coming years.

Different Ways You Can Invest in Gold

Alongside the investment methods mentioned, there are several ways individuals or private investors can invest in gold.

With the online investment space, the opportunities to invest in gold are now more expansive than ever.

Physical Gold

Purchasing physical gold in the form of bars or coins is a traditional way of investing in this precious metal. It’s a tangible asset that you own outright, and its value moves independently of other assets such as stocks or bonds.

Kinesis Bullion offers US investors the opportunity to invest in bespoke, investment-grade gold and silver bullion bars and coins, at some of the most competitive prices across the precious metals industry.

Gold Mining Stocks

Investing in gold mining stocks is another option. These are investments in the companies that mine gold, where the value of these stocks is influenced by the price of gold but also by the mining company’s performance and other market factors.

Gold ETFs

Gold Exchange-Traded Funds (ETFs) are another option used by trades and investors of gold. These are funds that track the price of gold, and you can buy and sell shares of these funds just like stocks.

However, investors do not necessarily have ownership of the underlying gold that backs their shares, which makes redemption nigh impossible. As a result of this, investors cannot take full advantage of the numerous qualities of gold, including its ability to hedge against inflation or have full control over its transfer or trade.

Gold-backed currencies

With the rise of digital currencies and the advent of blockchain, gold-backed cryptocurrencies have emerged as a favoured way of investing in gold. These digital assets, like the asset-backed gold KAU offered by Kinesis, are backed by physical gold, combining the time-tested value of gold with the convenience and security of a digital currency.

Gold crypto not only provides a hedge against inflation but also enables title ownership and enhanced liquidity. Investors can buy, hold, and sell gold in a secure and cost-effective way, making it a popular choice for those wanting to harness the benefits of gold investment while embracing the digital age.

Is Gold a ‘safe haven’ for investors?

The enduring value of gold and silver, coupled with modern technological advancements, holds significant potential. Kinesis, for instance, allows the transactional efficiency of digital currencies while maintaining the intrinsic safety of gold.

With the addition of a card, people can hold their cash in gold until the precise moment of purchase rather than having to store large amounts of depreciating dollars or pounds in their accounts. The Kinesis Card allows users to hold gold, silver and a range of cryptocurrencies and make everyday purchases with these assets at their local supermarket or coffee shop.

Not only does this approach offer a buffer against economic downturns, but it also facilitates the transactional ease of day-to-day life. The combination of gold with a digital currency could well be the future of a resilient global economic system.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.