The primary driver of my bull thesis for the precious metals sector is the shift in the Fed’s monetary policy. It was only a matter of time before this occurred. The Fed informally “pivoted” away from hiking rates at its November FOMC meeting. The markets immediately began to price several rate cuts in 2024 into stock valuations and bond yields.

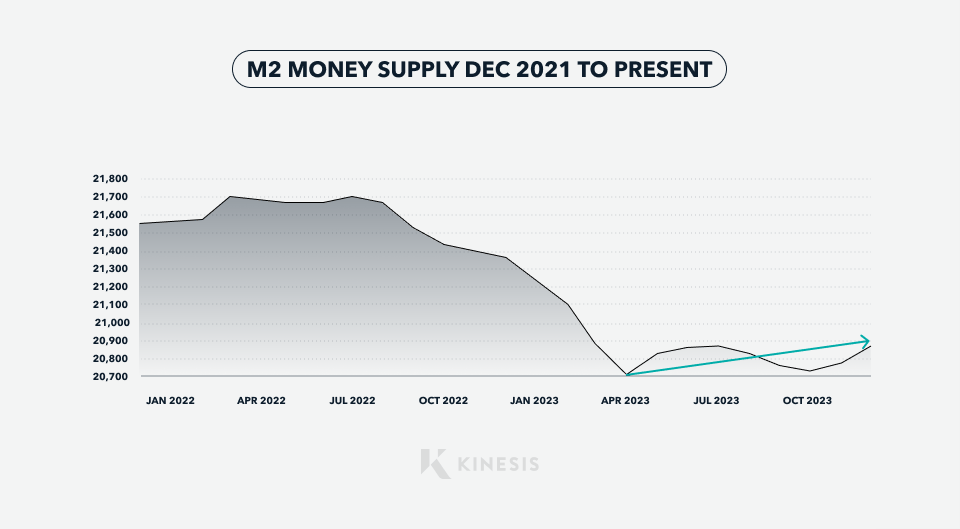

While most observers are watching what the Fed does with interest rates, few have noticed that the Fed stopped shrinking the money supply in response to the regional bank crisis in March 2023. The M2 measure of the money supply has increased slightly since April 2023 (while everyone merely glares at the YoY %-change in M2 that circulates social media):

M2 has increased 0.77% since April 2023. Unfortunately, most observers, without further investigation, only “consume” the YoY percentage change in M2 charts posted on social media which makes it look like M2 is still steeply declining.

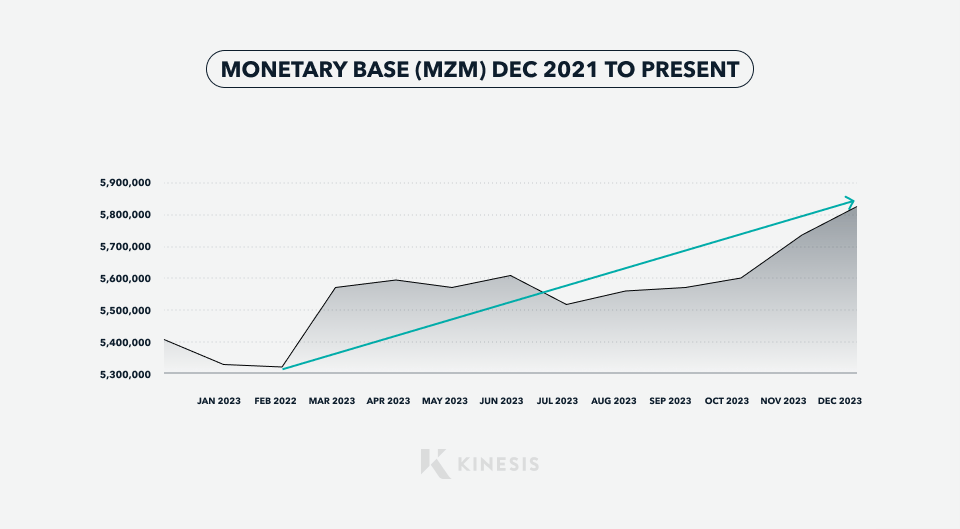

Even more telling is the ‘Monetary Base‘ (MZM), which is the most “powerful” form of money supply because it measures bank reserves plus coin and currency in circulation. I say “most powerful” because this form of “money” can be translated instantaneously into money used for spending or investing as opposed to M2, which includes less readily available forms of money like savings accounts and interest-bearing time deposits.

The Monetary Base has increased $506 billion, or 9.5%, since February. Currency/coin in circulation has increased by just $36 billion. This means that $470 billion of the increase in the Monetary Base is attributable to the creation of bank reserves, which is also known as Quantitative Easing or QE – also known as “money printing.” This reality goes a long way toward explaining the reflation of the stock bubble, the dramatic decline in rates at the longer end of the Treasury curve (10 years to 30 years), and the stubborn persistence of price inflation.

Changing Monetary Policy

The Fed’s “dual mandate” is to use its monetary policy to promote stable prices and full employment. But in reality, its priority is to prevent the “too big to fail” banks from collapsing as it did in 2008, again in 2020, and again in March 2023. In 2023, in response to the collapse of some big regional banks due outflow of checking and savings account funds from banks into money market funds, the Fed swiftly printed $400 billion and injected it into the banking system. In addition, it made available a “QE-like” facility called the “Bank Term Funding Program” which made funds – money created by the Fed – available to all banks.

Although the Fed removed the $400 billion it printed by late June, the growth in the Monetary Base between March and the end of December (the most recent money supply report) shows that the Fed increased the base money supply by $470 billion. Very little of this is explained by the change in the level of currency/coin in circulation. This means that the Fed used various “back door” liquidity facilities to replace the $400 billion removed plus it added $470 billion, of which only $161 billion is explained by the Bank Term Funding Program. In other words, the Fed is opaquely creating bank reserves (aka “printing money”) to address what I believe is a burgeoning liquidity problem in the banking system.

Treasury Bond Issuance

But the Fed will also have to help fund new Treasury bond issuance at some point this year. Over the next twelve months, an unprecedented $8.2 trillion in Treasury bonds will have to be refinanced. In addition, based on the first quarter of the fiscal year (starting October 1, 2023), the government’s spending deficit on an annualized basis would be over $2 trillion. This $2 trillion – and the spending deficit likely will be significantly larger – represents additional new debt issuance that will have to be funded – a task made more difficult by the fact that our government’s biggest foreign financiers (China, Japan and OPEC) have been reducing their participation in Treasury auctions.

Unless the Fed can find investors large enough to replace the missing foreign investment capital, it will either have to be the buyer of last resort or risk watching Treasury yields soar to a level that might induce foreign capital back to the table at Treasury bond auctions. Because considerably higher interest rates would throw the U.S. into an economic depression, the second motive, in addition to propping up the big banks, for renewed money printing in 2024 will be a requirement for the Fed itself to bridge the gap between the supply and demand for Treasuries.

Quantitative Easing

Money printing – much more so than changes in interest rates – is the fuel that drives precious metals prices higher. While the economy is likely headed into a nasty recession this year (many sectors of the economy, like manufacturing, were already contracting during 2023), the primary factors that dictate Fed policy are the health of the banking system and the monetization of new Treasury bond issuance.

Both factors will need to be addressed, in my opinion, with more money printing.

I strongly believe that the financial and economic fundamentals are set up quite similarly, only much worse, to the conditions in 2008 that led to the Great Financial Crisis. As such, I also believe that the Fed’s response to the next full-blown financial system crisis will be much larger than its responses in 2008 and 2020. This should result in a cyclical bull move that I believe will be bigger than the move from late 2008 to mid-2011.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.

Read our Editorial Guidelines here.