As a commodity, gold is one of the most popular investments in its asset class worldwide, and enjoys a rich history spanning thousands of years as both money and an investment store of value.

Historically, gold has performed well, often appreciating in value above the inflation rate of various fiat currencies and as such, it is a highly sought-after precious metal today as investors seek to hedge against the high inflation the world is currently experiencing.

A consequence of gold’s popularity as an investment is that several common myths have arisen about it that we will dispel today. When it comes to investing, it is important to do your own research and come to your own conclusions, we only intend to provide more information so that you can make an informed decision.

Myth 1: Gold is a risky and volatile investment

Gold has a number of useful characteristics that mean it is typically not seen as a risky or volatile investment:

- Intrinsic value thanks to its worth and utility

- Store of value over time – gold holds its value in the long-term

- Industrial & retail use cases see gold as a useful material both as jewellery and in other use cases

Despite this, it is not safe from macroeconomic events negatively impacting its price, as we will see when we cover Myth 4.

Myth 2: You need to be wealthy to invest in gold

This myth is pretty surprising the more you think about it: people have invested in tiny amounts of gold throughout history! Think of a gold earring. How much would one cost you today, ten years ago, or 100 years ago?

Investing in gold is easy, quick and affordable if you find the right provider: look for one that doesn’t charge high fees.

Whilst purchasing an entire bar of bullion would indeed be costly, it also wouldn’t make sense for your average investor and is more appropriate for institutions. Developments such as the advent of blockchain technology have meant that the tokenisation and fractionalisation of even a gram of gold is now very easy and convenient for saving, spending, trading, or even earning through yields.

Do your own research when deciding whether to invest in gold and whether the precious metal is right for you and your portfolio but remember, you can start small!

Myth 3: Gold offers no income or yield

Whilst it is true that gold does not yield any interest as an investment, thanks to Kinesis, it is possible to earn a usage-based, debt-free yield in several ways.

The Kinesis Monetary system and the Kinesis Gold KAU tokens that reside within it can unlock many yields that benefit owners for actions as simple as holding it in their account, but there are more too:

- Holder’s Yield rewards those who do not sell their gold

- Velocity Yield rewards those who spend or trade their gold

- Minter’s Yield rewards those who bring new Kinesis gold KAU into the system

- Referral Yield rewards those who bring their friends into the system

- KVT Yield rewards those who buy and hold a Kinesis Velocity Token

Each of these yields pays out monthly in both gold and silver, helping to protect and grow your savings at the same time!

Myth 4: Gold’s Value Always Increases

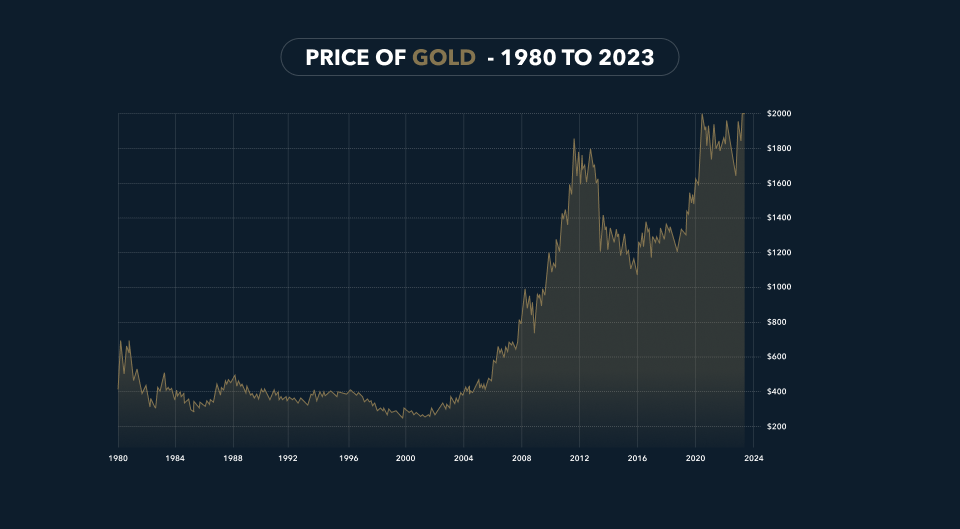

In the interests of transparency, it is worth noting that no investment is ever “up only”, gold included.

The precious metal commodity does go down as well as up. Indeed, it is currently trading around $1900 having regularly traded over $2000 an ounce. Whilst it is not seen as a risky or particularly volatile investment – as discussed in myth 1 – it does not hold a static price. This can actually be seen as a positive sign, as it empowers gold traders to grow their stacks through Ratio Trading and day trading.

Why does gold go up and down? Simple, it is subject to the same law of supply and demand that governs all investments and, as a result, in times of high demand and low supply, prices will rise. Unfortunately, it is also affected by macroeconomic factors such as inflation and financial policy alongside the boon of industrial demand, which often hinders price rallies.

Myth 5: Gold is hard to buy and store

This myth was never true, but is especially untrue after the advent of blockchain technology, which enabled the tokenisation of precious metals like gold and easily unlocked the ability to send, spend or trade physical bullion via digital tokens.

When looking for a gold as money or gold as investment provider, look for one that offers low or no fees and ways to access your gold wealth via, for instance, spending with a card.

Kinesis Gold (KAU) and Silver (KAG) take the pain out of investing in precious metals by removing storage fees and reducing transaction costs through the power of blockchain technology. Each token is backed 1:1 by physical bullion held in Kinesis’ secure vaults around the world, and unlocks yields that allow investors to protect and grow their savings.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.