Gold and, to a lesser extent, silver have long been ‘stores of value’ in periods of economic turmoil. This has been the case during the recessions that followed the COVID-19 pandemic, the 2007/08 Global Financial Crisis (GFC) and the demise of the dot-com bubble this century.

Investors widely consider precious metals as an inflation hedge and, in a bid to retain their purchasing power, it’s no surprise that gold and silver are used to position against the financial ramifications of looming downturns as well as periods of strong growth.

To assess their utility as wealth preservation assets we will assess the economic data through a broader spectrum encompassing interest rates, currency moves and trade.

Precious metals investors monitor key economic indicators spanning Gross Domestic Product (GDP), manufacturing output and indices through to global trade and employment numbers. The global economic indicators allow them to monitor overall economic health, trends in inflation and forthcoming interest rate hikes or cuts, to assess the opportune time to hold, buy or sell these haven assets.

Historical Correlation with Precious Metals

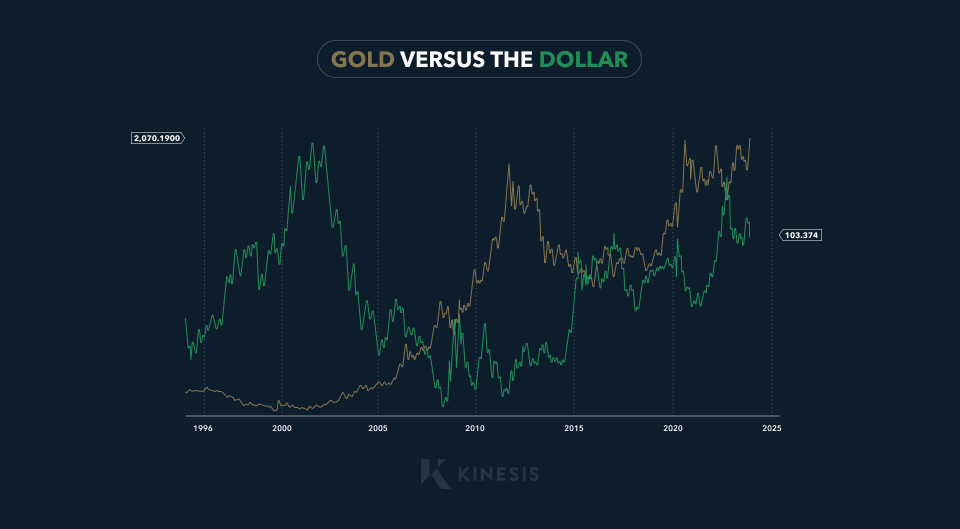

With gold and silver prices denominated in US dollars and correlating inversely to the currency (more metal is bought when the dollar is weaker), investors focus particularly on the US economy and the economic figures that determine directional changes in the greenback.

The chart below demonstrates the inverse relationship between gold and the USD currency, which was especially marked during the recession that followed the GFC. Investment in gold and silver (even though silver is more of an industrial metal) is popular during such periods because, like other commodities, they retain value and are assets with a largely fixed supply.

Inflation and Precious Metals

Gold prices, like other commodities, can be volatile in the short term. However, over the long term, the precious metal holds its value against both price and money supply inflation, acting as a hedge.

Strong numbers for GDP and manufacturing are positive for an economy up until the point of signalling “overheating”, with low and falling unemployment an important inflation indicator.

One of the most anticipated releases each month is the US Non-Farm Payrolls number, used to assess the state of the labour market, and to help determine – by extrapolation – whether interest rates will need to be used to cool an overheating economy.

High employment levels are indicative of rising wages, increasing consumption and higher prices for goods.

Interest Rates and Central Bank Policies

The commonly held view is that rising interest rates, a tool used by central banks to combat inflation, have an inverse relationship with gold. High rates are said to reduce demand for holding and storing metal with investors instead switching from gold into money market funds or T-Bills.

However, while that may be the case in the short term, hedge fund manager, precious metals analyst and author Dave Kranzler explains how “gold performs well as an investment during periods of rising interest rates”.

Experienced gold investors view the yellow metal as “a wealth-preservation asset and not an interest-bearing investment”, he added.

Underscoring this point is the gold price surge by almost 200% in 1973-1974, even while rates peaked at 10%.

Global Trade and Commodity Prices

The US dollar weakened in November and this trend is expected to continue into 2024, underpinned by the Fed projected to commence a wider lowering of interest rates.

US dollar weakness, in turn, is expected to boost trade and prices for precious metals, along with other key commodities, as it becomes cheaper to buy for major consuming nations China and India.

Market Reactions to Economic Data Releases

Market reactions to economic data releases can overstate their overall significance. Taking the example again of US Non-farm Payrolls, there is no strong long-term correlation between the number and the gold price.

However, a near-term significant reaction is possible in precious metals prices if the data surprises in either direction, especially if the backdrop suggests an influence on short-term interest rates.

Future Trends and Economic Indicators

The monitoring of future trends in economic indicators is essential to the pro-active investor, to give a holistic view of market prospects.

Despite the potential for initial knee-jerk reactions, data can shine a light on the outlook for critical influences on precious metals prices, including trends in inflation, interest rates, currency factors and trade.

Implications for Gold & Silver Investors

Despite more hawkish comments from Federal Reserve Chair Jerome Powell, after earlier comments were misconstrued as dovish, precious metals investors are likely to draw comfort from the view that central banks in Europe and the United States are expected to adopt a more dovish approach in 2024. Thus far, high-interest rates have pulled back significant economic growth this year.

In the second half of November, the data certainly pointed to falling inflation and a ‘soft landing’ for the global economy, underpinning a more optimistic view. Gold prices reached an all-time high in early December on heightened expectations of a US rate cut as early as end-Q1. For more insights on the current global economic impacts and their effect on the precious metals markets, read the latest Gold and Silver Price Market Forecast.

Karen has a distinguished career spanning over three decades in the precious metals industry. She dedicated 11 years of her career as an analyst at the globally acclaimed precious metals consultancy, GFMS, a subsidiary of the London Stock Exchange Group.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.