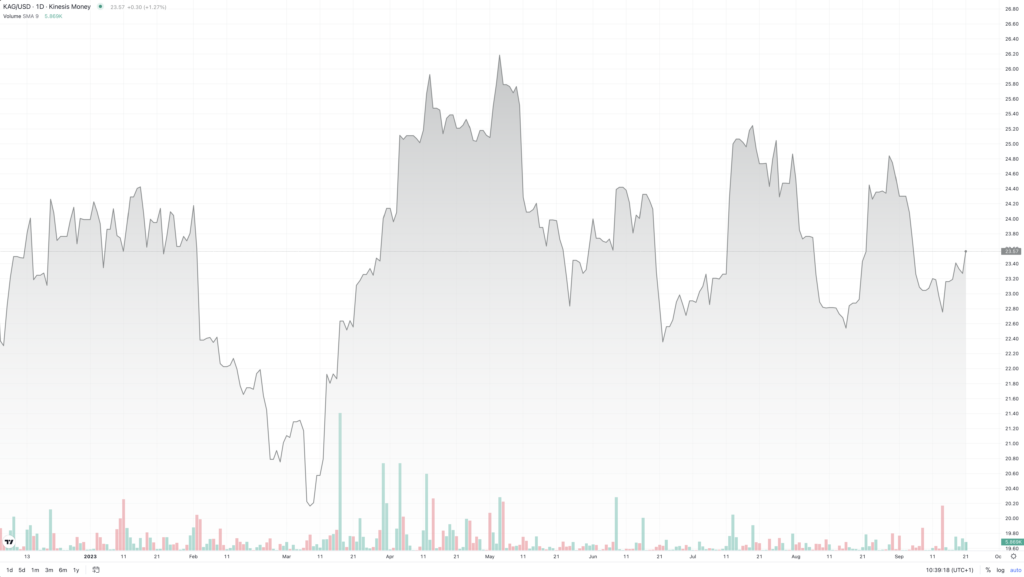

Silver has continued adding to gains above $23 per ounce, extending a price recovery seen over the last week.

This recovery has come, despite a more hawkish tone from the US Federal Reserve suggesting rates are going to be higher for longer than previously expected.

While dollar silver pricing is somewhat exposed to rising interest rates as a non-yielding asset and technically impacted by resulting dollar strength, this is not typically to the same extent as that seen in gold.

The point of differentiation comes primarily from the fact that silver, unlike gold, see significantly greater industrial use (c 45-50% vs. c 7-9%), so is more directly exposed to economic growth prospects. Economies have been more resilient than expected and the markets seem increasingly confident of a ‘soft landing’ going forward.

In addition to cyclical economic support, silver mining supply remains constrained in the face of rising secular demand from new industrial applications supporting the green energy transition in the fields of photovoltaics, power grid development and advanced battery technologies.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.