This article will define physical and digital gold, outline the respective benefits of each and explore their potential as investment avenues. It also looks at the reality of investing in gold in the 2023 market.

Gold has often acted as an insurance policy during times of economic crisis, proving itself time and time again as a safe haven for investors. As technology advances, new forms of gold investment have arisen to provide gold bugs with alternatives to traditional physical ownership, including digital gold.

What is Digital Gold Investment?

Digital gold – or digital gold currency (DGC) – offers investors the ability to own physical gold, with the added benefit of lower costs, and wider accessibility to the everyday investor. Previously, gold was largely inaccessible to the majority of investors, due to its costly storage fees and the complexity of having to physically withdraw the asset from a storage facility, broker, or bank.

Investing in digital gold is beneficial for many as, in many cases, there are no additional storage or insurance fees associated with the investment. Moreover, it is predominantly a case of practicality. As digital gold can be transacted across the world, with the vaulting of the underlying metals handled by the trading company.

Through regular auditing, investors have the assurance that each unit of digital gold is based 1:1 on physical gold bullion, at all times. If an investor decides to sell, the legal title of the underlying gold bullion is removed from the holder.

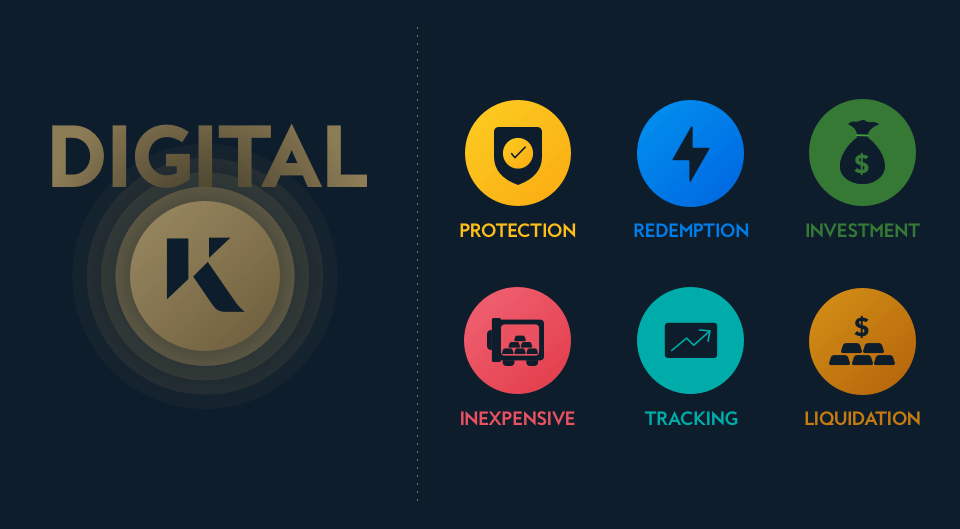

Benefits of Investing in Digital Gold

Some of the benefits of investing in digital gold are:

Invest at any level

With digital gold, investors can invest as much or as little as they want. There are no restrictions for minimum or maximum investment. Moreover, investors can purchase any quantity of physical gold – starting from just 0.01 gram with Kinesis – and receive a monthly passive yield on their holdings.

Liquidate in seconds

With digital gold, investors are offered the ability to instantly liquidate their gold, removing the costly and time-consuming process of accessing and selling gold, which investors face with traditional gold investment. With digital gold, it is always possible to spend your gold in a manner that has a utility equal to that of fiat currency – with the added financial security that gold historically maintains value over time.

Inexpensive

Investment in digital gold can be a cost-effective and efficient way of investing in gold. With no storage fees charged, investors are able to securely store physical gold without the primary expensive of traditional gold investment.

Easy Redemption

With all reputable providers, the gold bullion bars underpinning digital gold can easily and quickly be redeemed and delivered to the holder.

Safe and Secure Investment

The physical gold bars underpinning digital gold assets, are often insured and safely secured in vaulted facilities. For example, Kinesis securely stores the gold bars behind Kinesis gold in 13 world-class, fully insured vaults across 9 countries.

Tracking of Investment

Buying online gives you transparency of market prices and how much gold is on offer. This means investors can also get a better insight into real-time rates so they can take advantage of price movements. With digital gold, exchanges can be utilised to place market orders that line up with their preferred price for gold, allowing for greater tracking of fluctuations.

What is Physical Gold Investment?

Investing in physical gold has been a safety net for centuries as it has historically maintained its value over time, and due to this, demand has increased consistently. Physical gold can be bought in the form of jewellery, gold coins and bars.

Benefits of Physical Gold Investment

Some of the benefits of investing in physical gold are:

You hold it

Some investors, particularly collectors, choose physical gold because it is a tangible asset that they can hold in their hands, or store at home. While this presents certain security risks, some investors still choose this option as a reminder of the literal and symbolic wealth that physical gold still represents.

Immediately accessible

Some investors enjoy the security of having immediately accessible bullion within their homes. In the unlikely event of an economic failure, some investors prefer to keep their personal gold holdings close to hand.

Inheritance

Investors can pass on physical gold to relatives as a way to hold wealth within the family unit. This is particularly the case with luxury jewellery, which makes the precious metal a lucrative investment option.

Benefits of both digital gold and physical gold:

Some of the benefits of investing in physical gold or digital gold are:

Inflation-proof Investment

Gold is considered to be inflation-proof. This means you can buy gold today and sell in 20 years and still have the same relative value. Since the gold price has historically appreciated alongside rising inflation rates, gold investment has proven to protect individuals from the depreciating effect of monetary expansion policies – otherwise known as overprinting of currency.

Due to this, investors often look to buy into gold as a hedge against inflation. Using the example of the US dollar, and contrasting it with gold, the two have often had an inversely correlated relationship. When gold has appreciated, the dollar has consistently depreciated, most notably after the fall of the Bretton Woods Agreement.

Historically appreciating value

Historically, gold has appreciated over time, and the return is based on price appreciation. If we compare the value of £100 worth of gold and £100 worth of British pounds in the 1980s, the purchasing power of that same £100 worth of gold in 2021 would certainly be stronger than the counterpart of £100 British pounds. Despite holding £100 worth of British pounds and £100 worth of gold, you would purchase less with GBP.

Is Digital or Physical Gold the Better Investment?

When comparing physical and digital gold it is important to consider what’s most important to you as an investor. Digital gold offers superior liquidity, value and security, but some investors will always prefer to have their gold within reach. That said, it’s important to consider that investors can take delivery of the underlying bullion behind their digital gold.

As an investor, the Kinesis Monetary System can be used simply to hold gold in storage, meanwhile earning a competitive yield, as well as utilising its fullest capacity as a global, digital currency. In recent years, the Kinesis Holder’s yield figure has competed with and outperformed traditional investment options on the market, such as property, government bonds and dividend-yielding stocks. The Holder’s yield rewards users for holding gold and silver with Kinesis and is paid out monthly in the first week of each following month. Find out more about the Holder’s yield and how to calculate it here.

Investing in gold in 2023

Now you’ve heard about the benefits of investing in digital gold and physical gold, it’s important to look at gold in the context of 2023.

The beginning of the year saw experts and investors concerned about a looming recession, market uncertainty and inflation. This leads many people to assess their finances and consider what the safest investment options are at that moment.

During market turmoil and geopolitical tensions, many invest in gold for stability. When an economy approaches a recession, the stock market follows, and real estate investments often lose value. In times like this, investors can diversify their portfolios by investing in gold. If you fall on hard financial times and need to offload assets for cash to stay afloat, you can cash in on gold quickly and easily, as opposed to other assets such as real estate and bonds.

As previously stated in this article, gold is considered an inflation-proof investment. In the United Kingdom, inflation was recorded at a 41-year high in the year to October 2022, at a staggering 11.1%. In the year to March 2023, it was measured at 10.1%. As inflation remains high, gold stands out as a particularly attractive investment.

The value of gold in 2023

2022 was a challenging year which saw gold remain resilient, disappointing gold investors. However, the start of 2023 proved promising for the value of gold. In the first months of 2023, market uncertainty and geopolitical tensions helped the price of gold rise, as expected. As markets dropped due to worries about the financial sector, the value of gold increased by 9.2% to USD 1,980 per ounce in Q1 of 2023.

If you’re looking to build wealth and beat inflation, both physical gold and digital gold could be a good choice. Many gold bugs choose to divide their holdings between digital and physical gold. It is recommended that gold should take up 10-20% of a healthy investment portfolio to ensure investors are protected against market volatility, currency fluctuations and inflation risks. Take a look at how you can invest in gold today.

* with Kinesis between October 2020 – October 2021. Yields will fluctuate based on transaction volume. Please note that past yield figures are not indicative of future figures.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.